- United States

- /

- Pharma

- /

- NasdaqGS:CRNX

Crinetics Pharmaceuticals (CRNX): Taking Stock of Valuation After Recent Volatility and Rebound

Reviewed by Simply Wall St

Crinetics Pharmaceuticals (CRNX) has attracted increased attention recently as investors take a closer look at its share performance and underlying business dynamics. The stock has experienced a variety of shifts this month, reflecting changing sentiment.

See our latest analysis for Crinetics Pharmaceuticals.

Crinetics Pharmaceuticals has seen sharp swings lately, but when you zoom out, the story is one of both volatility and potential. After a surge in the past month with a 1-month share price return of nearly 20%, the stock remains down 21.6% year-to-date, and its 1-year total shareholder return stands at -30.8%. Still, anyone who’s held on for a longer stretch has seen significant upside, with a 3-year total shareholder return of 118.4% and an impressive 227.6% over five years. These figures hint at moments of renewed optimism and growth potential amid recent turbulence.

If Crinetics’ recent moves have you thinking bigger about healthcare, check out how other biopharma stocks are performing with our handpicked list: See the full list for free.

With shares rebounding but still well below last year’s highs, the real question is whether Crinetics remains undervalued compared to its growth prospects, or if the market has already accounted for what comes next.

Price-to-Book Ratio of 3.3x: Is it justified?

Crinetics Pharmaceuticals is currently trading at a price-to-book ratio of 3.3 times, which sets it apart from the US Pharmaceuticals industry average and its peer group valuation.

The price-to-book ratio compares a company's market value to its net assets. This metric is commonly used in sectors where profits are still elusive but tangible assets and growth potential are under scrutiny, such as biotechnology and pharmaceuticals. In Crinetics’ case, the elevated ratio signals high investor expectations despite ongoing losses and a lack of profitability.

At 3.3x, Crinetics’ price-to-book is notably higher than the industry average of 2.3x. This suggests that the market is pricing in outsized growth potential or unique assets not captured on the balance sheet. However, compared to peer companies, Crinetics actually appears more attractively valued versus their average of 6.6x, which hints at mixed market sentiment and possible room for sentiment to shift.

Insufficient data is available to calculate a regression-based fair price-to-book ratio at this time, so it remains unclear whether the market might eventually re-rate the company to a different level.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book Ratio of 3.3x (ABOUT RIGHT)

However, continued net losses and an ambitious price target relative to current performance could present challenges to investor confidence in the near term.

Find out about the key risks to this Crinetics Pharmaceuticals narrative.

Another View: What Does Our DCF Model Say?

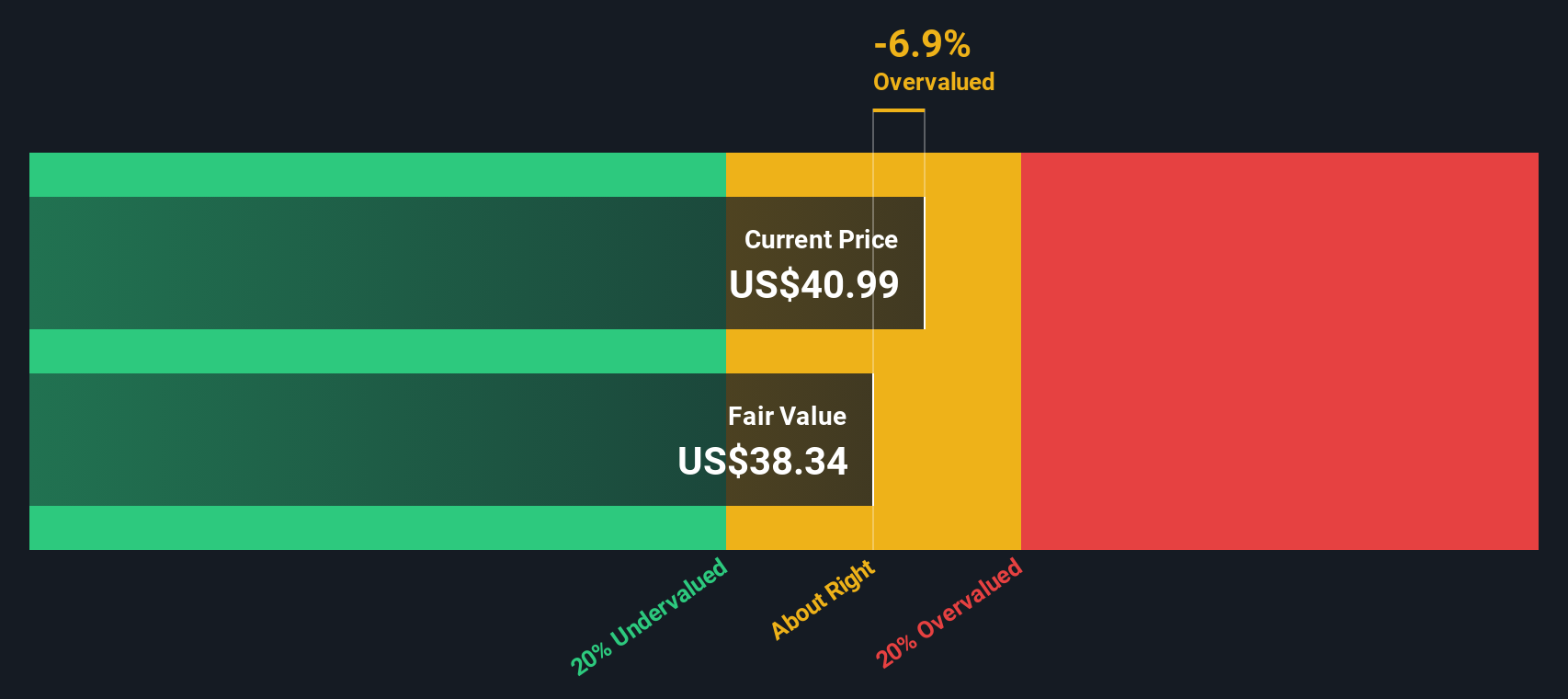

While the price-to-book ratio offers one perspective, our SWS DCF model provides another. According to this approach, Crinetics Pharmaceuticals’ current share price of $40.43 is actually above our fair value estimate of $38.34. This signals the stock may be overvalued based on future cash flows and challenges the outlook offered by traditional multiples. How much weight should investors place on each method?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Crinetics Pharmaceuticals for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Crinetics Pharmaceuticals Narrative

If you’d like to dig into the details yourself and reach your own conclusions, it’s easy to build a personal view in just a few minutes. Do it your way

A great starting point for your Crinetics Pharmaceuticals research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never stick to a single opportunity. Stay ahead of the curve by uncovering unique stocks powering the next big trends with these targeted ideas:

- Maximize your yield and boost income with these 17 dividend stocks with yields > 3% that deliver steady returns above 3%.

- Uncover potential high-flyers early and build your watchlist from these 3573 penny stocks with strong financials showing resilient financials.

- Ride the artificial intelligence wave by tapping into these 100+ AI penny stocks, where companies are transforming industries through tech innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRNX

Crinetics Pharmaceuticals

A clinical-stage pharmaceutical company, focuses on the discovery, development, and commercialization of novel therapeutics for rare endocrine diseases and endocrine-related tumors.

Excellent balance sheet with limited growth.

Market Insights

Community Narratives