- United States

- /

- Pharma

- /

- NasdaqGS:CRNX

Crinetics Pharmaceuticals (CRNX): Gauging Valuation Following Wider Third Quarter Losses

Reviewed by Simply Wall St

Crinetics Pharmaceuticals (CRNX) just released its third quarter financials, showing a wider net loss compared to last year. This update is important for investors keeping an eye on the company’s trajectory.

See our latest analysis for Crinetics Pharmaceuticals.

Despite the steeper losses just reported, Crinetics Pharmaceuticals has climbed sharply in recent months, with a 43% share price return over the last quarter. However, momentum has yet to fully recover from longer-term declines because its total shareholder return over the past year remains down 22%.

If today’s earnings shake-up has you looking for new opportunities, take a moment to explore See the full list for free.

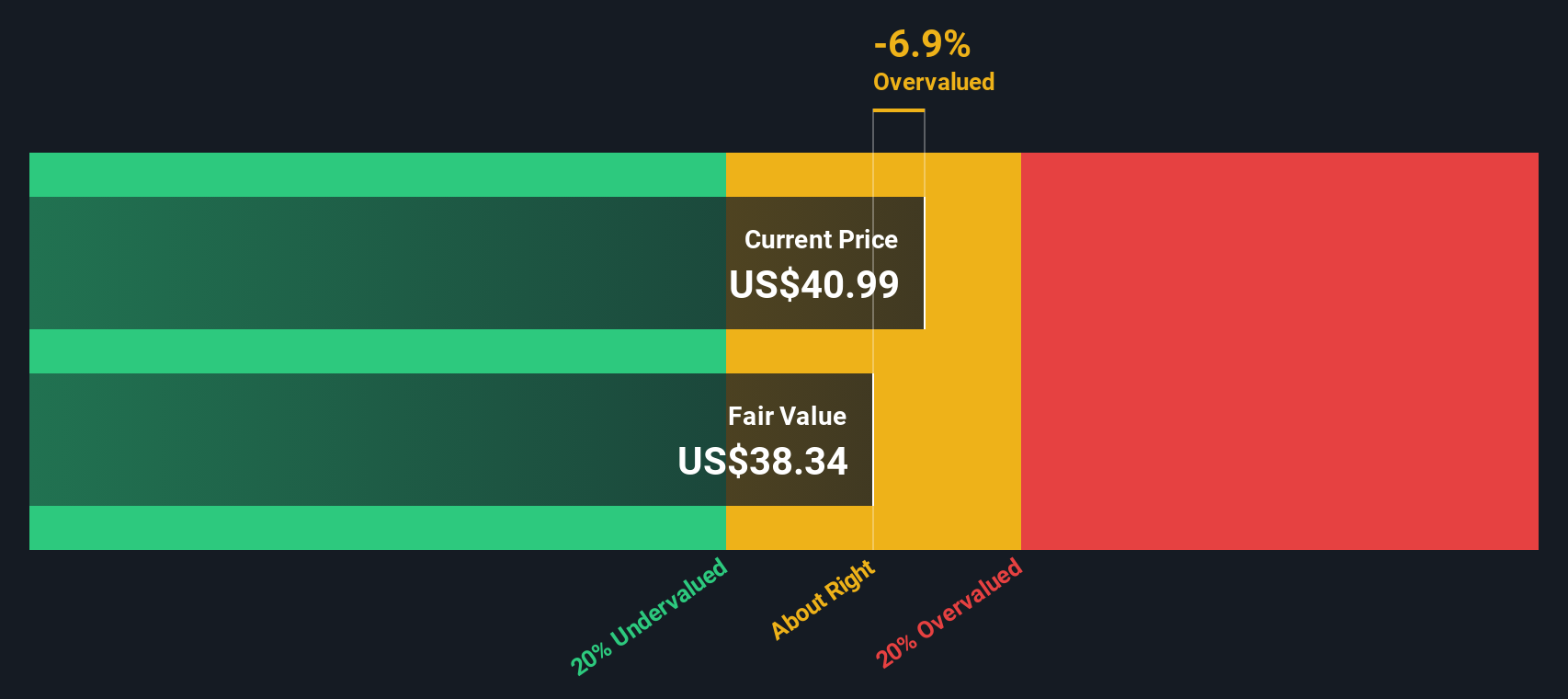

With Crinetics trading well below analyst price targets despite this quarter’s larger loss, investors are left to wonder if the discount signals an overlooked opportunity or if the market is simply factoring in slower growth.

Price-to-Book of 3.8x: Is it justified?

Crinetics Pharmaceuticals is currently trading at a price-to-book ratio of 3.8, which means investors are paying a premium compared to the company’s existing net asset value per share. At $42.67 per share, the last close reflects this elevated multiple within its sector.

The price-to-book ratio compares a company’s market value to its book value and can signal whether investors expect strong future growth or are overestimating the company’s fundamentals. In biotech and pharmaceutical sectors, this metric often captures anticipated pipeline breakthroughs or risk associated with unprofitability.

Right now, Crinetics looks expensive relative to its sector’s average price-to-book ratio of 2.3. While optimism about future revenue may be contributing to the higher multiple, the broader market is attaching a higher price to Crinetics’ assets than most of its US pharmaceutical peers. In contrast, when compared to a broader set of peer companies, Crinetics does look attractively valued at 3.8x versus a peer group average of 5.8x. There is insufficient data to compare the stock’s price-to-book to a statistically derived “fair” ratio, so any market reset could push the valuation quickly in either direction.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 3.8x (OVERVALUED)

However, persistent net losses and potential delays in anticipated revenue growth could challenge the optimism that is currently reflected in Crinetics shares.

Find out about the key risks to this Crinetics Pharmaceuticals narrative.

Another View: Discounted Cash Flow Model

While the price-to-book ratio paints Crinetics as expensive versus peers, the SWS DCF model suggests otherwise. Based on future cash flows, Crinetics is trading at a steep 63% discount to its estimated fair value of $116.34 per share. Could the market be overlooking long-term potential, or are risks still holding the share price back?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Crinetics Pharmaceuticals for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 894 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Crinetics Pharmaceuticals Narrative

If you want to reach your own conclusions or challenge the analysis above, you can explore the numbers and build your own story for Crinetics Pharmaceuticals in just a few minutes. Do it your way

A great starting point for your Crinetics Pharmaceuticals research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors always have a few extra stocks on their radar. If you want a head start on the next opportunity, don't hesitate to act now.

- Tap into high-potential technology by reviewing these 25 AI penny stocks, which are setting new standards in artificial intelligence and automation.

- Unlock hidden value by screening for these 894 undervalued stocks based on cash flows, which the market may be overlooking based on strong cash flow fundamentals.

- Claim your share of future financial growth by checking out these 16 dividend stocks with yields > 3%, which offer robust yields and steady income potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRNX

Crinetics Pharmaceuticals

A clinical-stage pharmaceutical company, focuses on the discovery, development, and commercialization of novel therapeutics for rare endocrine diseases and endocrine-related tumors.

Excellent balance sheet and fair value.

Market Insights

Community Narratives