- United States

- /

- Pharma

- /

- NasdaqGS:CRNX

Crinetics Pharmaceuticals (CRNX): Evaluating Valuation After Pivotal Phase 3 Milestone for Paltusotine in Carcinoid Syndrome

Reviewed by Simply Wall St

Crinetics Pharmaceuticals (CRNX) kicked off a major new chapter by beginning patient randomization in its Phase 3 CAREFNDR trial, studying oral paltusotine for carcinoid syndrome linked to neuroendocrine tumors. This study could open up new growth avenues for the company.

See our latest analysis for Crinetics Pharmaceuticals.

Crinetics Pharmaceuticals has seen its share price rebound strongly in recent months, climbing over 36% in the last 90 days. However, the one-year total shareholder return stands at -21%. The company’s progress with paltusotine may be fueling renewed optimism. Long-term holders have still enjoyed a substantial 229% total return over five years. This highlights the volatility and growth potential in biotech investing.

If you’re following breakthroughs in pharma, it’s worth taking the next step and exploring other innovators. Check out our dedicated See the full list for free..

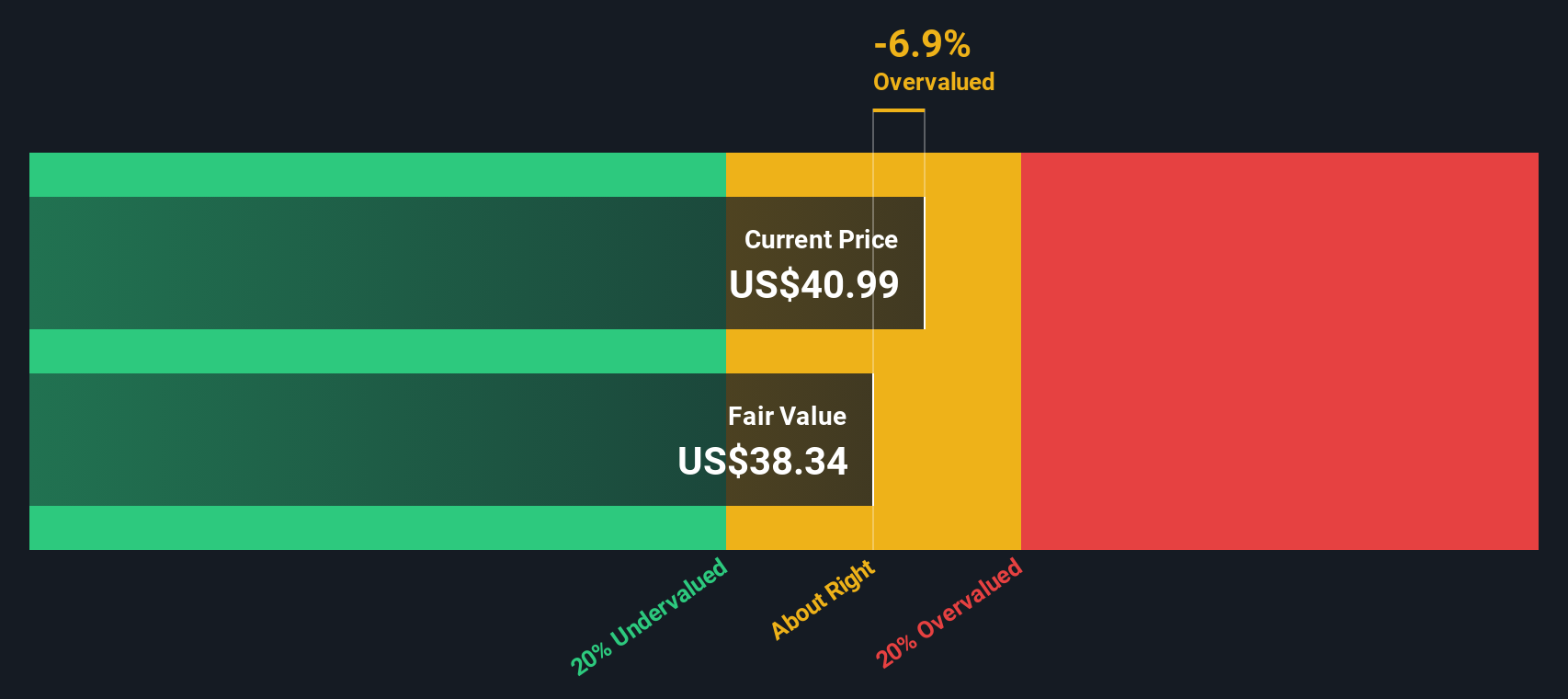

With the stock trading at a notable discount to analyst targets and optimism building after recent clinical milestones, investors are considering whether Crinetics represents an undervalued opportunity or if the market is already pricing in its next stage of growth.

Price-to-Book of 4x: Is it justified?

On a price-to-book basis, Crinetics Pharmaceuticals is trading at 4 times its book value, which is notably higher than the industry average. The last close was $45.56, suggesting investors are paying a premium compared to peers in the US pharmaceuticals sector.

The price-to-book ratio measures what shareholders are paying for each dollar of net assets. This is especially important for biotech companies, where tangible book value can offer a baseline for valuation in the absence of profits.

With Crinetics currently unprofitable and no clear path to near-term profitability, the market appears to be factoring in strong pipeline prospects and future growth expectations well ahead of tangible fundamentals.

At 4x, this price-to-book multiple makes Crinetics expensive compared to the US pharmaceuticals industry average of 2.5x. Such a premium indicates that expectations for new drug launches or clinical milestones remain high among investors.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 4x (OVERVALUED)

However, setbacks in clinical trials or slower regulatory progress could quickly change investor sentiment and impact Crinetics Pharmaceuticals’ outlook.

Find out about the key risks to this Crinetics Pharmaceuticals narrative.

Another View: Discounted Cash Flow Analysis

Looking at Crinetics Pharmaceuticals through the lens of our DCF model gives a sharply different story. The SWS DCF model estimates the fair value at $115.51, over double the current share price of $45.56. This points to the stock being significantly undervalued. This raises the question: are investors overlooking long-term fundamentals in favor of short-term risks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Crinetics Pharmaceuticals for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 916 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Crinetics Pharmaceuticals Narrative

If you see things differently or want to shape your own story, it takes just a few minutes to explore the numbers and build your perspective. Do it your way.

A great starting point for your Crinetics Pharmaceuticals research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let other opportunities pass you by. Use the Simply Wall Street Screener to pinpoint stocks with bold upside or unique advantages that might fit your goals.

- Unlock high yields with ease and browse these 15 dividend stocks with yields > 3% featuring companies offering robust dividend payouts above 3%.

- Supercharge your portfolio by targeting these 25 AI penny stocks focused on the next wave of artificial intelligence innovation.

- Capitalize on untapped value with these 916 undervalued stocks based on cash flows where cash flow fundamentals can help identify hidden gems before the rest of the market takes notice.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRNX

Crinetics Pharmaceuticals

A clinical-stage pharmaceutical company, focuses on the discovery, development, and commercialization of novel therapeutics for rare endocrine diseases and endocrine-related tumors.

Excellent balance sheet and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026