- United States

- /

- Pharma

- /

- NasdaqCM:CORT

Corcept Therapeutics (NasdaqCM:CORT) Dropped From Russell 2000 and Growth Index

Reviewed by Simply Wall St

Corcept Therapeutics (NasdaqCM:CORT) recently saw a decline in its share price by 1.43% over the last week. This price movement occurred against a backdrop of the company's removal from the Russell 2000 and Russell 2000 Growth indices, while simultaneously gaining inclusion in several other indices, like the Russell 1000 and Russell Midcap Growth Index. These index changes suggest shifts in investment positioning that could impact market sentiment. Amidst these developments, the overall market experienced gains, indicating a contrasting trend as major indexes like the S&P 500 and Nasdaq continued to rise, possibly tempering the impact of company-specific news on Corcept's performance.

We've spotted 1 possible red flag for Corcept Therapeutics you should be aware of.

Corcept Therapeutics' recent inclusion in the Russell 1000 and Russell Midcap Growth Index could influence investor sentiment positively, contrasting the impact of its removal from the Russell 2000 indices. These changes may attract a different category of investors and potentially increase the stock's trading volume. Over the past five years, Corcept's total shareholder return of 337.92% highlights substantial growth, offering a broader context to recent week-to-week price fluctuations that may appear minor when viewed against its long-term performance.

In comparison to the broader market, Corcept's recent one-year performance outpaced the US Pharmaceuticals industry, which had a negative performance. This suggests resilience despite the company's ongoing challenges, including patent litigation and transitions to generics. Recent index changes may not drastically alter the revenue forecast or earnings, which have strong growth assumptions linked to the launch of relacorilant and other developments in oncology. The 44.5% discount to analyst price targets, with the share price at US$76.77 compared to the consensus target of US$138.25, indicates a potential upside based on projected earnings growth and market expansion. Investors should critically assess these factors in light of the broader investment landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CORT

Corcept Therapeutics

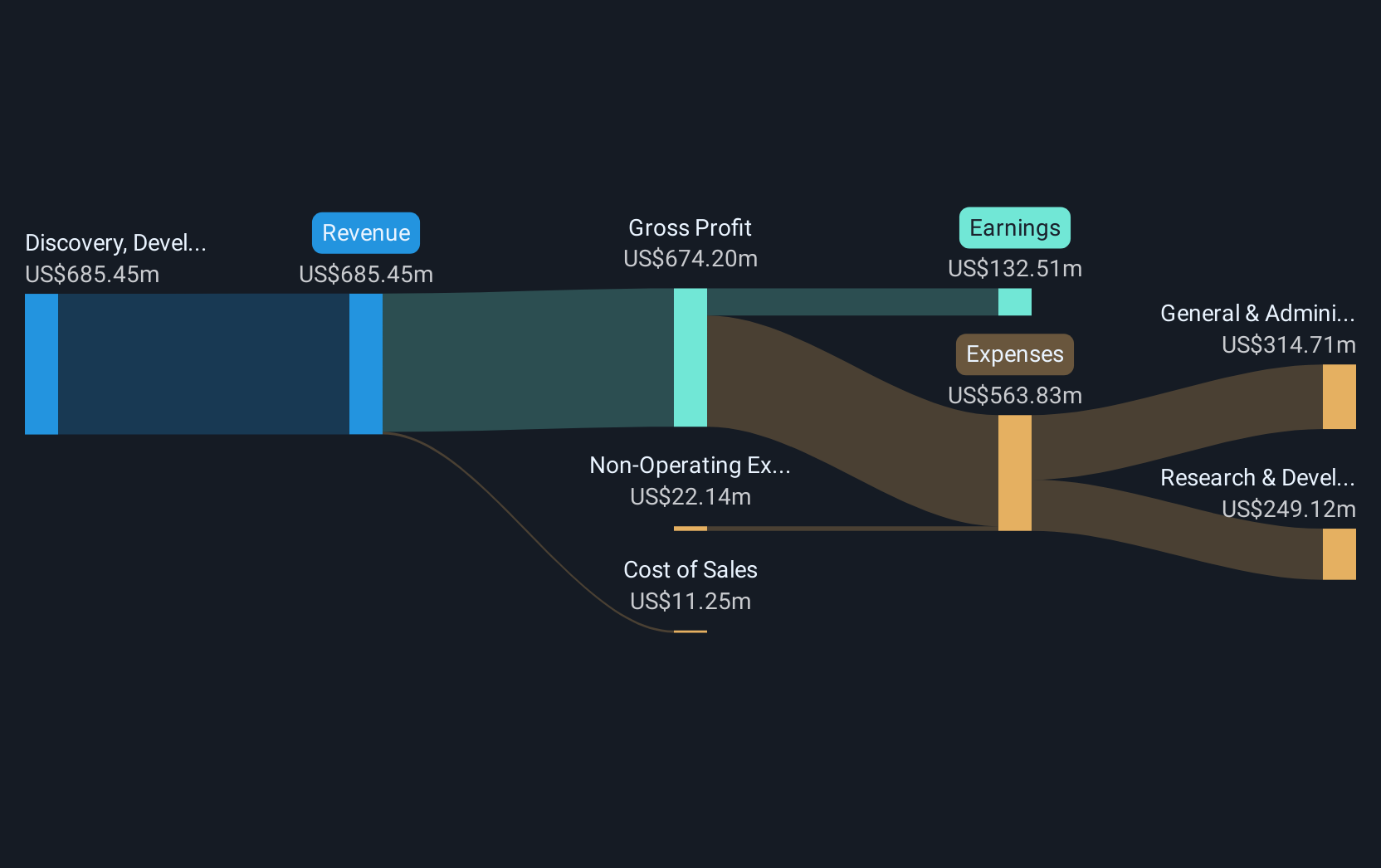

Engages in discovery and development of medication for the treatment of severe endocrinologic, oncologic, metabolic, and neurologic disorders in the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)