- United States

- /

- Pharma

- /

- NasdaqCM:CORT

Corcept Therapeutics (CORT): Exploring Valuation After Recent Share Price Moves

Reviewed by Simply Wall St

Corcept Therapeutics (CORT) shares have seen some movement lately, and even though there isn't a single headline-grabbing event driving this shift, the stock's recent performance offers an interesting angle for investors to consider.

See our latest analysis for Corcept Therapeutics.

Corcept’s share price has pulled back in recent weeks but remains strongly up for the year, suggesting that investor confidence in its growth story could still be building. With a 43% year-to-date share price return and a standout 48% total shareholder return over the past year, momentum in the stock’s favor has generally persisted over the longer term despite near-term volatility.

If Corcept’s rally has you thinking about other healthcare movers, now is a great time to discover new opportunities with the See the full list for free.

With strong share price gains and rapid profit growth, is Corcept still trading at a bargain? Or is the market already factoring in much of its future potential for investors looking for a buying opportunity?

Most Popular Narrative: 46.8% Undervalued

With Corcept Therapeutics shares recently closing at $71.56, the prevailing narrative argues that the company’s fair value is significantly higher. This notable gap compared to the calculated fair price prompts a closer look at the reasoning behind this optimistic perspective.

The publication of the CATALYST study and the resulting increased awareness and screening for hypercortisolism among physicians are expanding the potential addressable patient pool. This is expected to drive significant acceleration in revenue growth over the next several years. Anticipated regulatory approvals for relacorilant in both hypercortisolism (end of this year) and platinum-resistant ovarian cancer (next year), supported by clinically differentiated safety and efficacy data, create major new revenue and margin expansion opportunities as the company moves past single-product dependence.

Want to know what bold projections power this high valuation? This narrative claims the company could double revenue and profit margins in a few short years. Curious which blockbuster figures underpin the analysts’ price target? Find out what disruptive growth assumptions are behind this outsized fair value estimate.

Result: Fair Value of $134.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, patent litigation related to Korlym and delays in scaling pharmacy capacity remain key risks that could limit Corcept’s upside and hinder earnings growth.

Find out about the key risks to this Corcept Therapeutics narrative.

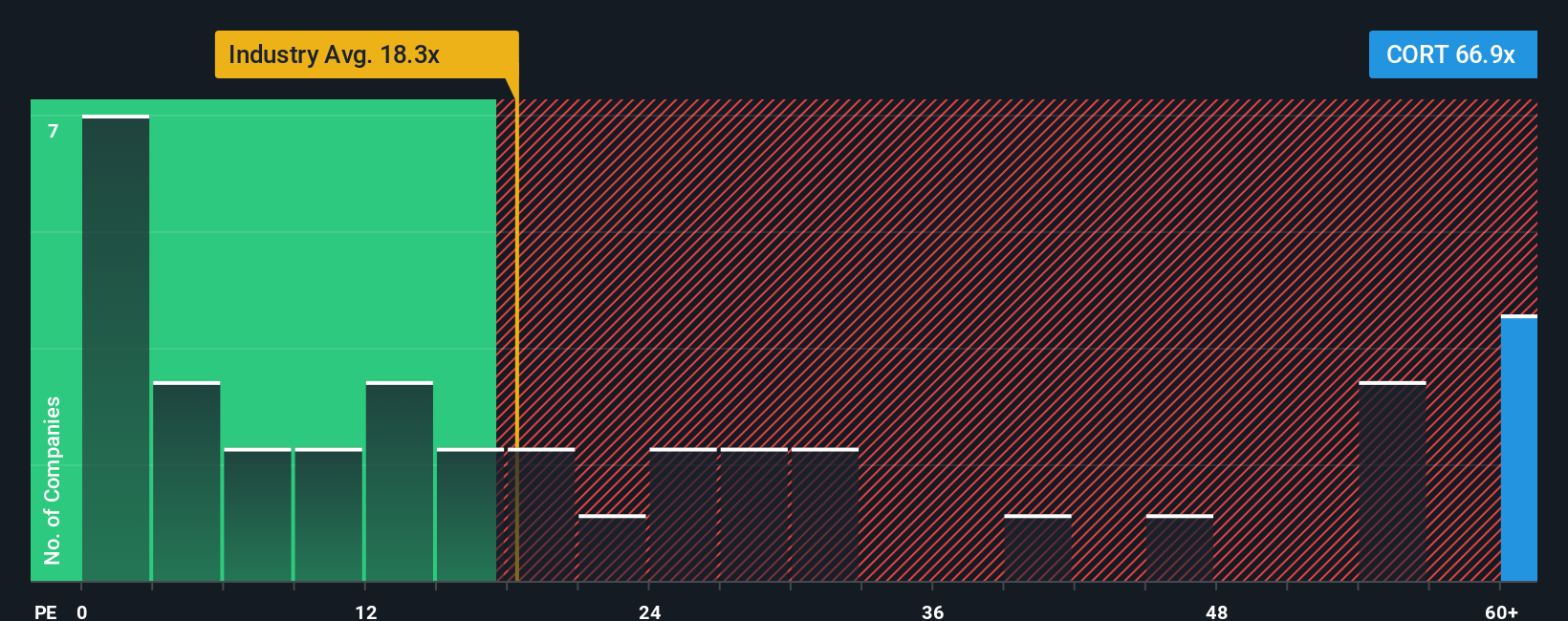

Another View: Market Ratios Point to a Lofty Valuation

While analyst forecasts see Corcept as considerably undervalued, the market’s chosen multiple tells a different story. With a price-to-earnings ratio of 57.1x, Corcept trades far above both the US Pharmaceuticals industry average of 17.3x and the peer average of 36.1x. Even when compared to its fair ratio of 58.4x, the current valuation is right in line, suggesting there is little room for multiple-driven upside or that optimism is already included in the price. Could this rich valuation mean risk if growth falters, or does it signal a high-quality opportunity?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Corcept Therapeutics Narrative

If you want to test these assumptions for yourself or dig deeper into the numbers, you can craft your own perspective in just a few minutes. Share your views with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Corcept Therapeutics.

Looking for more investment ideas?

Smart investors never limit their options. Act now to find unique stock picks tailored to your interests, and avoid missing the next big story in the market.

- Strengthen your portfolio’s foundation by evaluating companies offering income potential, thanks to steady yields with these 21 dividend stocks with yields > 3%.

- Tap into the future of medicine as you review these 34 healthcare AI stocks, which are using artificial intelligence to drive powerful healthcare innovation.

- Ride the next digital breakthrough by investigating game-changing opportunities among these 81 cryptocurrency and blockchain stocks, shaping tomorrow’s financial systems.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CORT

Corcept Therapeutics

Engages in discovery and development of medication for the treatment of severe endocrinologic, oncologic, metabolic, and neurologic disorders in the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives