- United States

- /

- Pharma

- /

- NasdaqGS:COLL

Collegium Pharmaceutical (COLL): Exploring Valuation After Recent Share Price Surge

Reviewed by Simply Wall St

Collegium Pharmaceutical (COLL) shares have been on the move lately, with investors taking a closer look at the company’s pain management-focused portfolio as well as how its financials measure up over the past month.

See our latest analysis for Collegium Pharmaceutical.

Collegium Pharmaceutical’s share price has delivered an impressive 32.8% gain over the last month, continuing a surge that puts its 2024 share price return at over 61%. With one-year total shareholder returns topping 50% and even stronger gains for long-term holders, the recent rally suggests investors are seeing fresh growth prospects or reassessing previous risks.

If standout moves like this make you curious about other specialty pharma innovators, the next step is to explore our See the full list for free.

With impressive recent gains and a share price close to analyst targets, investors face a key question: does Collegium remain undervalued given its fundamentals, or is the market already pricing in the company’s growth prospects?

Most Popular Narrative: 1.2% Undervalued

The current narrative places fair value at $46.80, which is just above the last close price of $46.23. This positions Collegium Pharmaceutical as marginally undervalued. This small gap brings focus to the story behind the valuation, particularly its earnings outlook and margin expectations.

Collegium's disciplined capital allocation and ongoing business development (M&A) strategy, including pursuing synergistic pain/CNS assets, is expected to drive portfolio diversification and inorganic growth. This approach further reduces revenue concentration risk and provides additional sources of EBITDA and earnings stability.

Curious about which bold assumptions power this narrative? The attention-grabbing profit margin targets and ambitious portfolio expansion plan could surprise you. Want a glimpse at the controversial projections fueling analyst optimism? Dive into the full narrative to unpack the numbers behind this valuation.

Result: Fair Value of $46.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, potential generic competition for key pain products and ongoing regulatory scrutiny could quickly challenge the company’s margin growth and revenue forecasts.

Find out about the key risks to this Collegium Pharmaceutical narrative.

Another View: Taking the SWS DCF Model Into Account

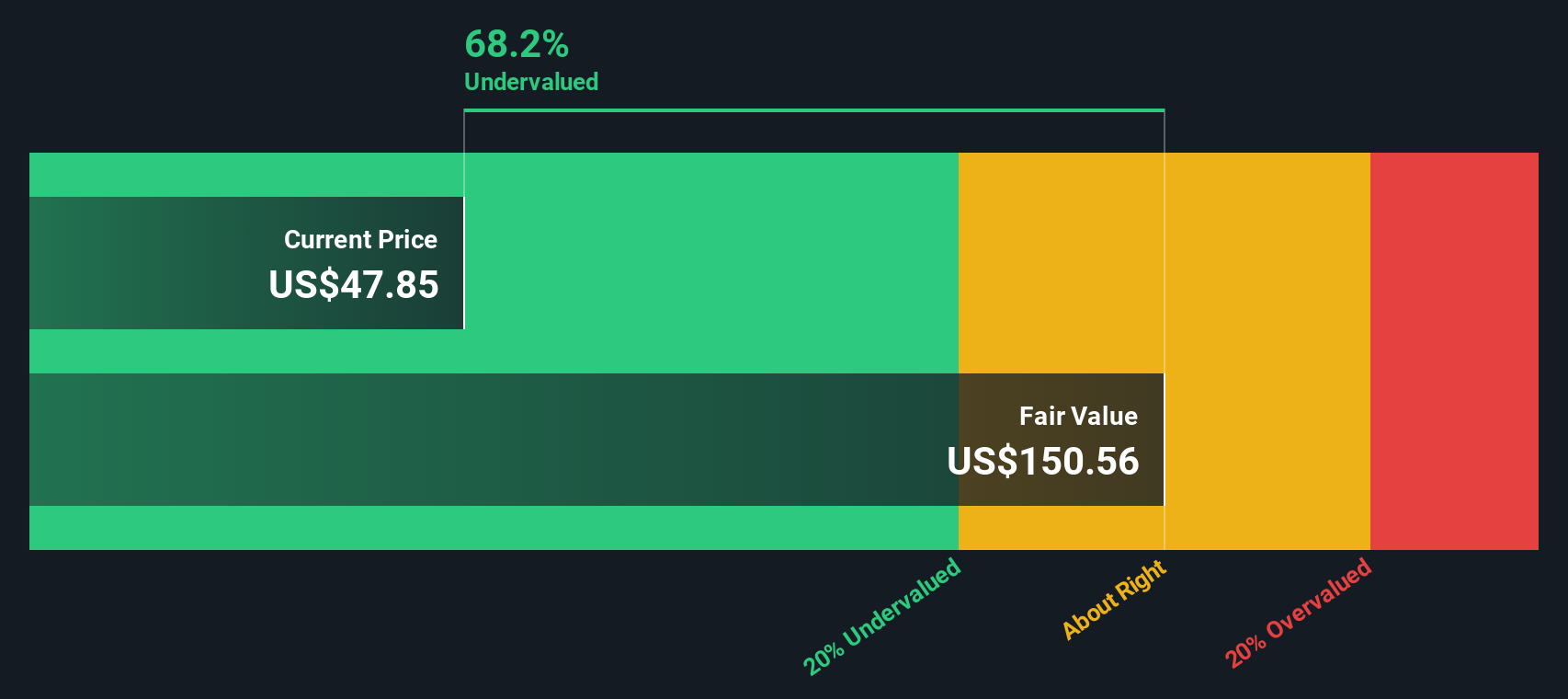

In contrast to recent valuation narratives based on market multiples, our SWS DCF model arrives at a much higher fair value of $150.56 for Collegium Pharmaceutical. This is more than triple the current share price. This raises the question: is the market overlooking long-term cash flow potential or pricing in bigger risks?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Collegium Pharmaceutical Narrative

Prefer to follow your instincts or dive deeper into the numbers yourself? You can easily shape your own perspective and narrative in just a few minutes. Do it your way

A great starting point for your Collegium Pharmaceutical research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Opportunities are everywhere, so don’t let your next winning idea slip away. Use these powerful stock lists to confidently fuel your investment strategy today:

- Start building passive income and boost your returns with these 15 dividend stocks with yields > 3% offering attractive yields and consistent payouts.

- Get ahead of the curve by pinpointing tomorrow’s tech leaders among these 25 AI penny stocks that are disrupting industries using artificial intelligence.

- Zero in on value plays others might miss with these 927 undervalued stocks based on cash flows which are based on strong underlying cash flows and sound fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COLL

Collegium Pharmaceutical

A specialty pharmaceutical company, engages in the development and commercialization of medicines for pain management.

Moderate growth potential with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success