- United States

- /

- Biotech

- /

- NasdaqGS:COGT

Why Cogent Biosciences (COGT) Is Up After FDA Breakthrough for Bezuclastinib and KRAS Program Update

Reviewed by Sasha Jovanovic

- Cogent Biosciences announced that the FDA has granted Breakthrough Therapy Designation to its drug candidate bezuclastinib for NonAdvanced and Smoldering Systemic Mastocytosis, based on positive results from the pivotal SUMMIT trial.

- The company also presented updated preclinical data highlighting the potential of its pan-KRAS inhibitor program at a leading international cancer research conference, signaling momentum in both late- and early-stage oncology pipelines.

- We'll take a look at how the FDA's Breakthrough Therapy Designation for bezuclastinib shapes Cogent Biosciences' investment narrative and drug pipeline outlook.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Cogent Biosciences' Investment Narrative?

Being a Cogent Biosciences shareholder requires belief in the longer-term potential of its clinical-stage pipeline, especially the future of bezuclastinib in rare blood disorders like systemic mastocytosis. The recent FDA Breakthrough Therapy Designation could be transformative, as it opens up a faster path to market and signals the agency’s confidence in the SUMMIT trial data. This boosts Cogent’s most important near-term catalyst: filing a New Drug Application by year-end and potentially launching bezuclastinib with added regulatory support. It may also amplify attention on upcoming trial results in gastrointestinal stromal tumors and advanced systemic mastocytosis, further shaping expectations. On the other hand, Cogent remains unprofitable, reporting ongoing losses and requiring continuous funding to fuel its pipeline. The main risk is whether bezuclastinib can transition from promising trial data to commercial success, especially as its valuation already factors in significant optimism after a year of strong share price gains. However, ongoing losses and reliance on future funding are important points to keep in mind.

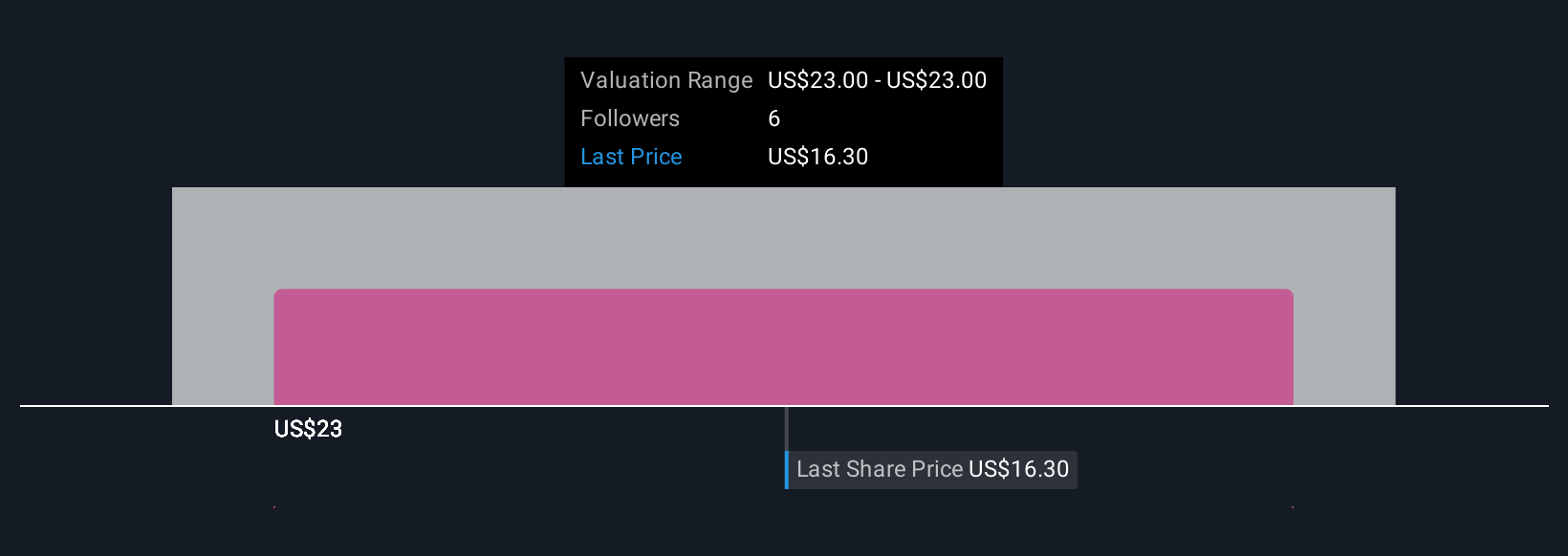

In light of our recent valuation report, it seems possible that Cogent Biosciences is trading beyond its estimated value.Exploring Other Perspectives

Explore another fair value estimate on Cogent Biosciences - why the stock might be worth just $21.83!

Build Your Own Cogent Biosciences Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cogent Biosciences research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Cogent Biosciences research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cogent Biosciences' overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COGT

Cogent Biosciences

A biotechnology company, focuses on developing precision therapies for genetically defined diseases.

Excellent balance sheet with low risk.

Market Insights

Community Narratives