- United States

- /

- Pharma

- /

- NasdaqCM:CING

Here's Why We're A Bit Worried About Cingulate's (NASDAQ:CING) Cash Burn Situation

We can readily understand why investors are attracted to unprofitable companies. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

Given this risk, we thought we'd take a look at whether Cingulate (NASDAQ:CING) shareholders should be worried about its cash burn. In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. Let's start with an examination of the business' cash, relative to its cash burn.

View our latest analysis for Cingulate

How Long Is Cingulate's Cash Runway?

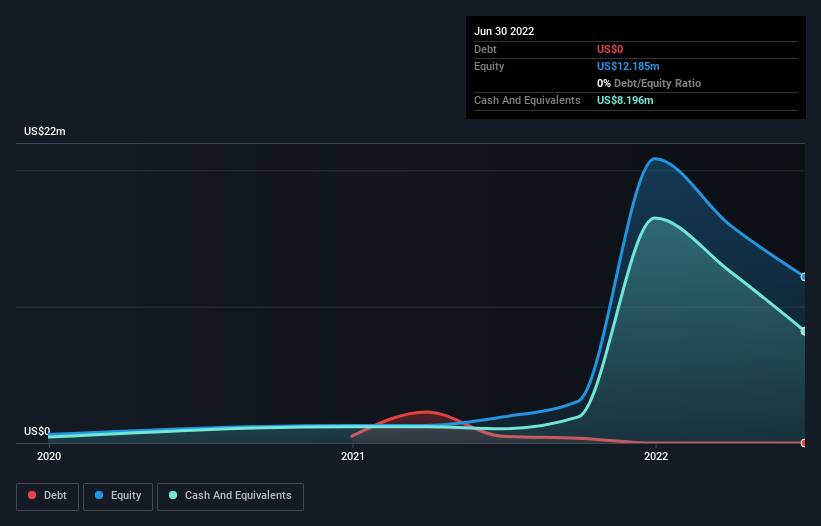

A company's cash runway is calculated by dividing its cash hoard by its cash burn. In June 2022, Cingulate had US$8.2m in cash, and was debt-free. Looking at the last year, the company burnt through US$16m. That means it had a cash runway of around 6 months as of June 2022. To be frank, this kind of short runway puts us on edge, as it indicates the company must reduce its cash burn significantly, or else raise cash imminently. The image below shows how its cash balance has been changing over the last few years.

How Is Cingulate's Cash Burn Changing Over Time?

Cingulate didn't record any revenue over the last year, indicating that it's an early stage company still developing its business. So while we can't look to sales to understand growth, we can look at how the cash burn is changing to understand how expenditure is trending over time. The skyrocketing cash burn up 130% year on year certainly tests our nerves. It's fair to say that sort of rate of increase cannot be maintained for very long, without putting pressure on the balance sheet. Clearly, however, the crucial factor is whether the company will grow its business going forward. So you might want to take a peek at how much the company is expected to grow in the next few years.

Can Cingulate Raise More Cash Easily?

Since its cash burn is moving in the wrong direction, Cingulate shareholders may wish to think ahead to when the company may need to raise more cash. Companies can raise capital through either debt or equity. Commonly, a business will sell new shares in itself to raise cash and drive growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Since it has a market capitalisation of US$21m, Cingulate's US$16m in cash burn equates to about 79% of its market value. That's very high expenditure relative to the company's size, suggesting it is an extremely high risk stock.

How Risky Is Cingulate's Cash Burn Situation?

As you can probably tell by now, we're rather concerned about Cingulate's cash burn. In particular, we think its cash burn relative to its market cap suggests it isn't in a good position to keep funding growth. And although we accept its cash runway wasn't as worrying as its cash burn relative to its market cap, it was still a real negative; as indeed were all the factors we considered in this article. Looking at the metrics in this article all together, we consider its cash burn situation to be rather dangerous, and likely to cost shareholders one way or the other. On another note, we conducted an in-depth investigation of the company, and identified 5 warning signs for Cingulate (2 are a bit concerning!) that you should be aware of before investing here.

Of course Cingulate may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:CING

Cingulate

A biopharmaceutical company, develops pharmaceutical products using delivery platform technology for the treatment of attention deficit/hyperactivity disorder (ADHD) and anxiety in the United States.

High growth potential with slight risk.

Market Insights

Community Narratives