- United States

- /

- Biotech

- /

- NasdaqGM:CHRS

Revenues Working Against Coherus Oncology, Inc.'s (NASDAQ:CHRS) Share Price Following 26% Dive

The Coherus Oncology, Inc. (NASDAQ:CHRS) share price has softened a substantial 26% over the previous 30 days, handing back much of the gains the stock has made lately. Looking at the bigger picture, even after this poor month the stock is up 63% in the last year.

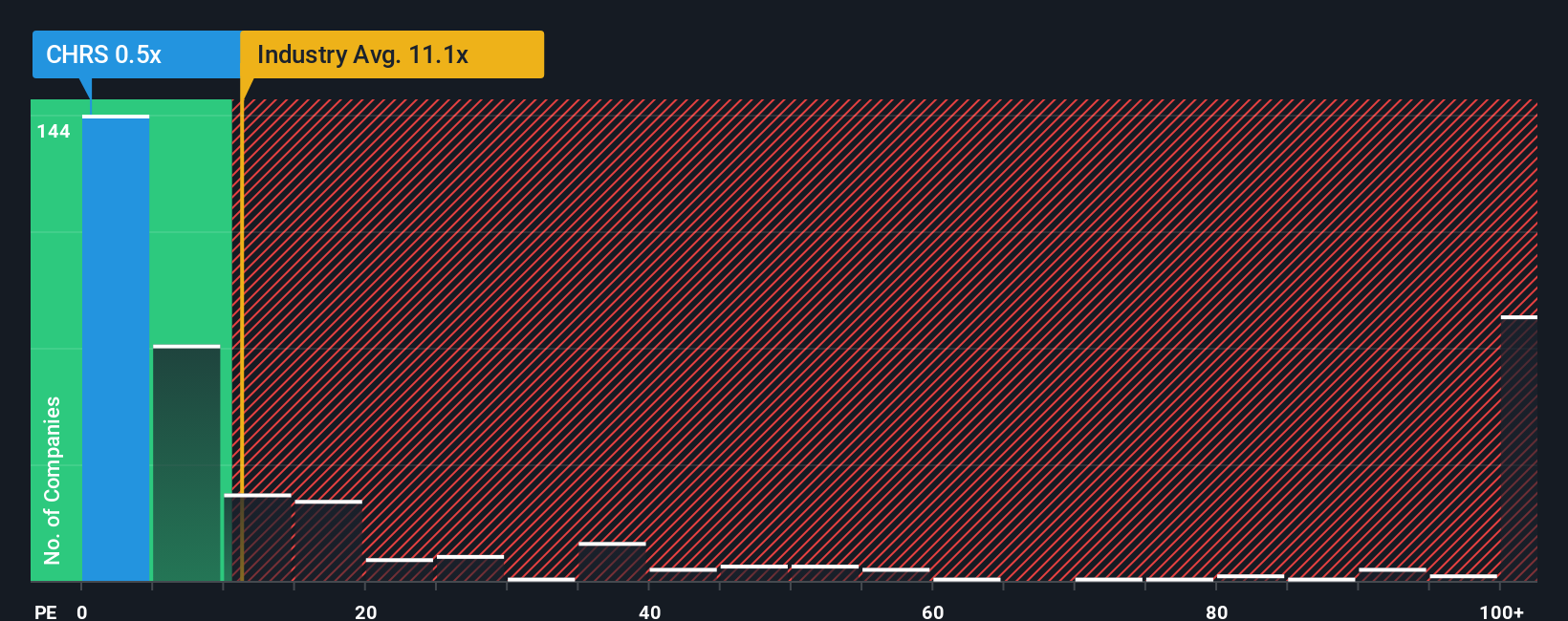

Following the heavy fall in price, Coherus Oncology may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.5x, considering almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 11.1x and even P/S higher than 107x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

See our latest analysis for Coherus Oncology

How Coherus Oncology Has Been Performing

There hasn't been much to differentiate Coherus Oncology's and the industry's revenue growth lately. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If not, then existing shareholders have reason to be optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Coherus Oncology will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Coherus Oncology's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 152% last year. As a result, it also grew revenue by 16% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Looking ahead now, revenue is anticipated to slump, contracting by 15% per annum during the coming three years according to the four analysts following the company. That's not great when the rest of the industry is expected to grow by 129% per year.

With this in consideration, we find it intriguing that Coherus Oncology's P/S is closely matching its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What We Can Learn From Coherus Oncology's P/S?

Shares in Coherus Oncology have plummeted and its P/S has followed suit. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It's clear to see that Coherus Oncology maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Coherus Oncology (at least 1 which is concerning), and understanding these should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:CHRS

Coherus Oncology

A biopharmaceutical company, researches, develops, and commercializes immunotherapies to treat cancer in the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives