- United States

- /

- Biotech

- /

- NasdaqGS:CGON

How Investors May Respond To CG Oncology (CGON) Leadership Transition Amid Rising Revenue and Expanding Losses

Reviewed by Sasha Jovanovic

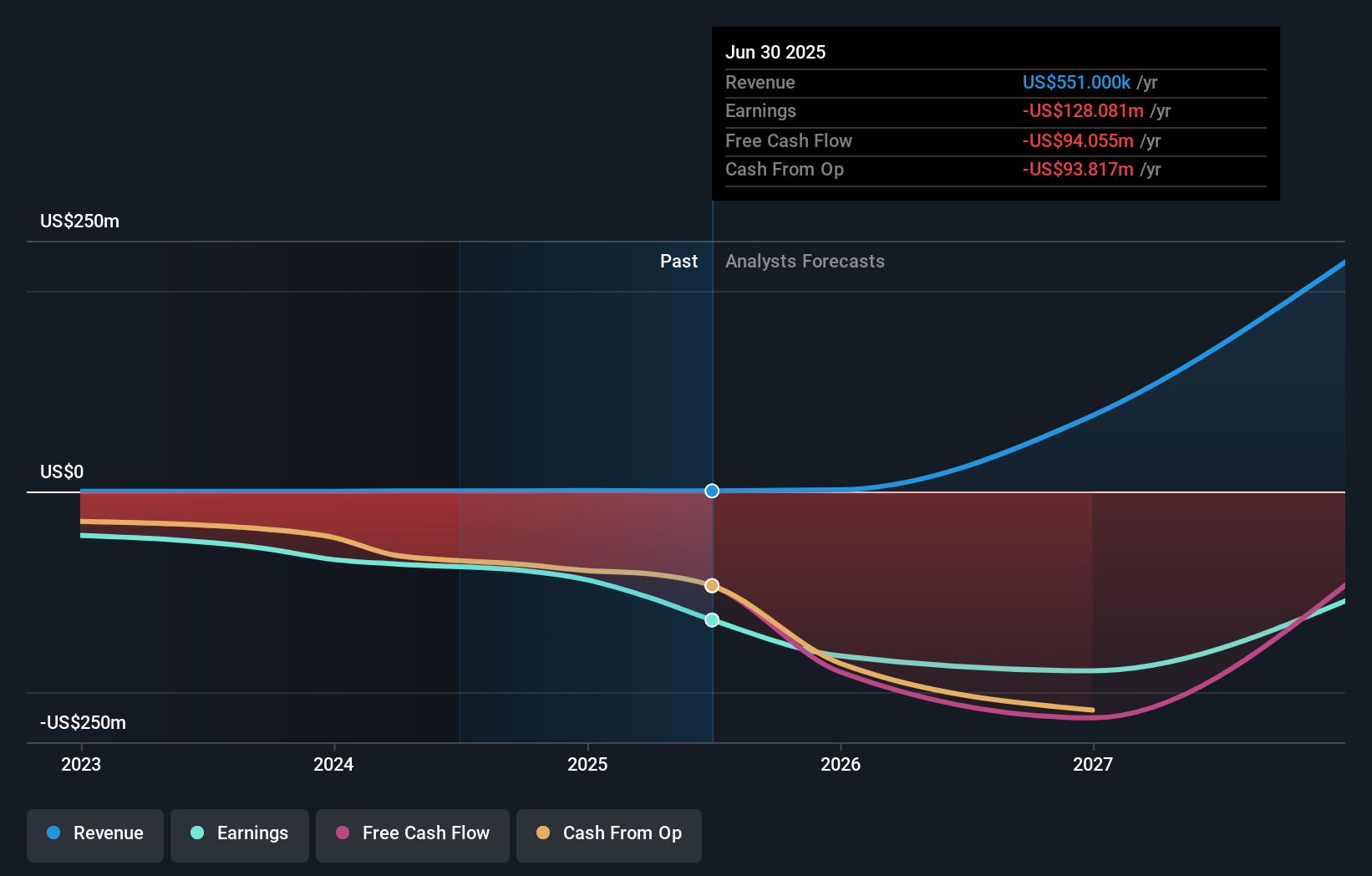

- On November 14, 2025, CG Oncology reported its third quarter and nine-month financial results, highlighting a significant year-over-year increase in revenue to US$1.67 million and US$1.72 million respectively, but with a wider net loss for both periods.

- In addition, the company announced the appointment of Jim DeTore as interim principal financial and accounting officer effective November 17, signifying a transition in leadership amid financial changes.

- We'll examine how the arrival of a new financial leader during a period of growing revenue but expanding losses shapes CG Oncology's investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is CG Oncology's Investment Narrative?

For anyone considering CG Oncology, the big picture often centers on belief in the potential of cretostimogene’s development and wider adoption in bladder cancer treatment. Recent news has introduced an added layer of uncertainty, with Jim DeTore stepping in as interim principal financial and accounting officer. His arrival comes at a point when revenue is rising but losses are widening, and operational efficiency is under scrutiny. As a result, short-term catalysts such as major clinical trial milestones or regulatory updates remain unchanged, but the leadership transition could affect investor confidence or internal execution if integration is bumpy. At the same time, the company’s ongoing cash burn and lack of near-term profitability still weigh heavily as the most significant risks, and the broader risk profile may have shifted slightly higher due to the new leadership adjustment. If early signs point to smooth onboarding, the impact may ultimately prove minor. On the other hand, ongoing losses and executive turnover are important risks investors should be watching.

CG Oncology's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore another fair value estimate on CG Oncology - why the stock might be worth over 9x more than the current price!

Build Your Own CG Oncology Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CG Oncology research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free CG Oncology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CG Oncology's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CGON

CG Oncology

A late-stage clinical biopharmaceutical company, develops and commercializes backbone bladder-sparing therapeutics for patients with bladder cancer.

Adequate balance sheet and fair value.

Market Insights

Community Narratives