- United States

- /

- Biotech

- /

- NasdaqCM:CGEN

Shareholders Will Probably Not Have Any Issues With Compugen Ltd.'s (NASDAQ:CGEN) CEO Compensation

CEO Anat Cohen-Dayag has done a decent job of delivering relatively good performance at Compugen Ltd. (NASDAQ:CGEN) recently. As shareholders go into the upcoming AGM on 02 September 2021, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. We present our case of why we think CEO compensation looks fair.

Check out our latest analysis for Compugen

Comparing Compugen Ltd.'s CEO Compensation With the industry

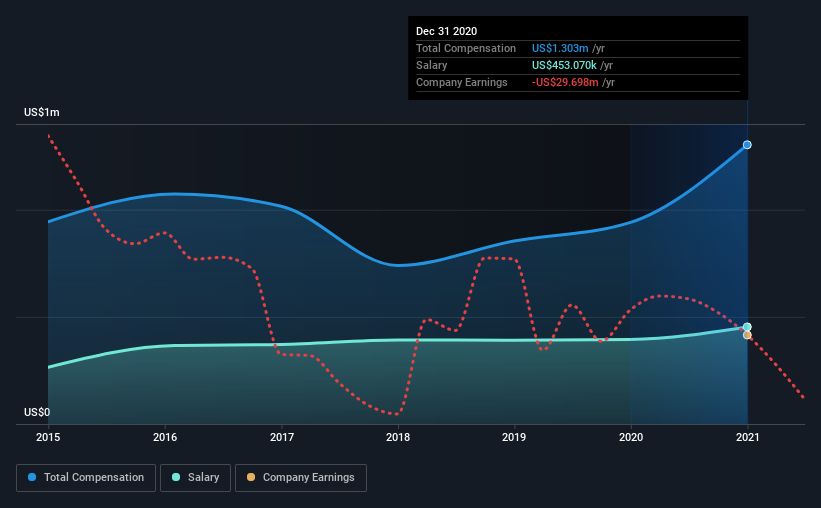

According to our data, Compugen Ltd. has a market capitalization of US$550m, and paid its CEO total annual compensation worth US$1.3m over the year to December 2020. Notably, that's an increase of 38% over the year before. We think total compensation is more important but our data shows that the CEO salary is lower, at US$453k.

On examining similar-sized companies in the industry with market capitalizations between US$200m and US$800m, we discovered that the median CEO total compensation of that group was US$1.1m. From this we gather that Anat Cohen-Dayag is paid around the median for CEOs in the industry. Moreover, Anat Cohen-Dayag also holds US$357k worth of Compugen stock directly under their own name.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$453k | US$395k | 35% |

| Other | US$850k | US$546k | 65% |

| Total Compensation | US$1.3m | US$941k | 100% |

Speaking on an industry level, nearly 18% of total compensation represents salary, while the remainder of 82% is other remuneration. Compugen pays out 35% of remuneration in the form of a salary, significantly higher than the industry average. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

Compugen Ltd.'s Growth

Compugen Ltd.'s earnings per share (EPS) grew 9.8% per year over the last three years. Its revenue is up 67% over the last year.

It's great to see that revenue growth is strong. With that in mind, the modestly improving EPS seems positive. We wouldn't say this is necessarily top notch growth, but it is certainly promising. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Compugen Ltd. Been A Good Investment?

Most shareholders would probably be pleased with Compugen Ltd. for providing a total return of 57% over three years. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. However, we still think that any proposed increase in CEO compensation will be examined closely to make sure the compensation is appropriate and linked to performance.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We did our research and identified 4 warning signs (and 1 which is concerning) in Compugen we think you should know about.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you decide to trade Compugen, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:CGEN

Compugen

A clinical-stage therapeutic discovery and development company, engages in the research, development, and commercialization of therapeutics and product candidates in Israel, the United States, and Europe.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion