- United States

- /

- Biotech

- /

- NasdaqCM:CELC

Celcuity (CELC) Is Up 9.3% After FDA NDA Submission for Gedatolisib in Breast Cancer Therapy - Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- Celcuity Inc. recently announced the completion of its New Drug Application submission to the U.S. FDA for gedatolisib for use in HR-positive, HER2-negative advanced breast cancer, under the FDA's Real-Time Oncology Review program.

- This milestone submission is supported by positive Phase 3 data and follows Breakthrough Therapy and Fast Track designations for gedatolisib, potentially streamlining its regulatory path.

- We'll explore how the combination of favorable clinical data and expedited regulatory review shapes Celcuity's evolving investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Celcuity's Investment Narrative?

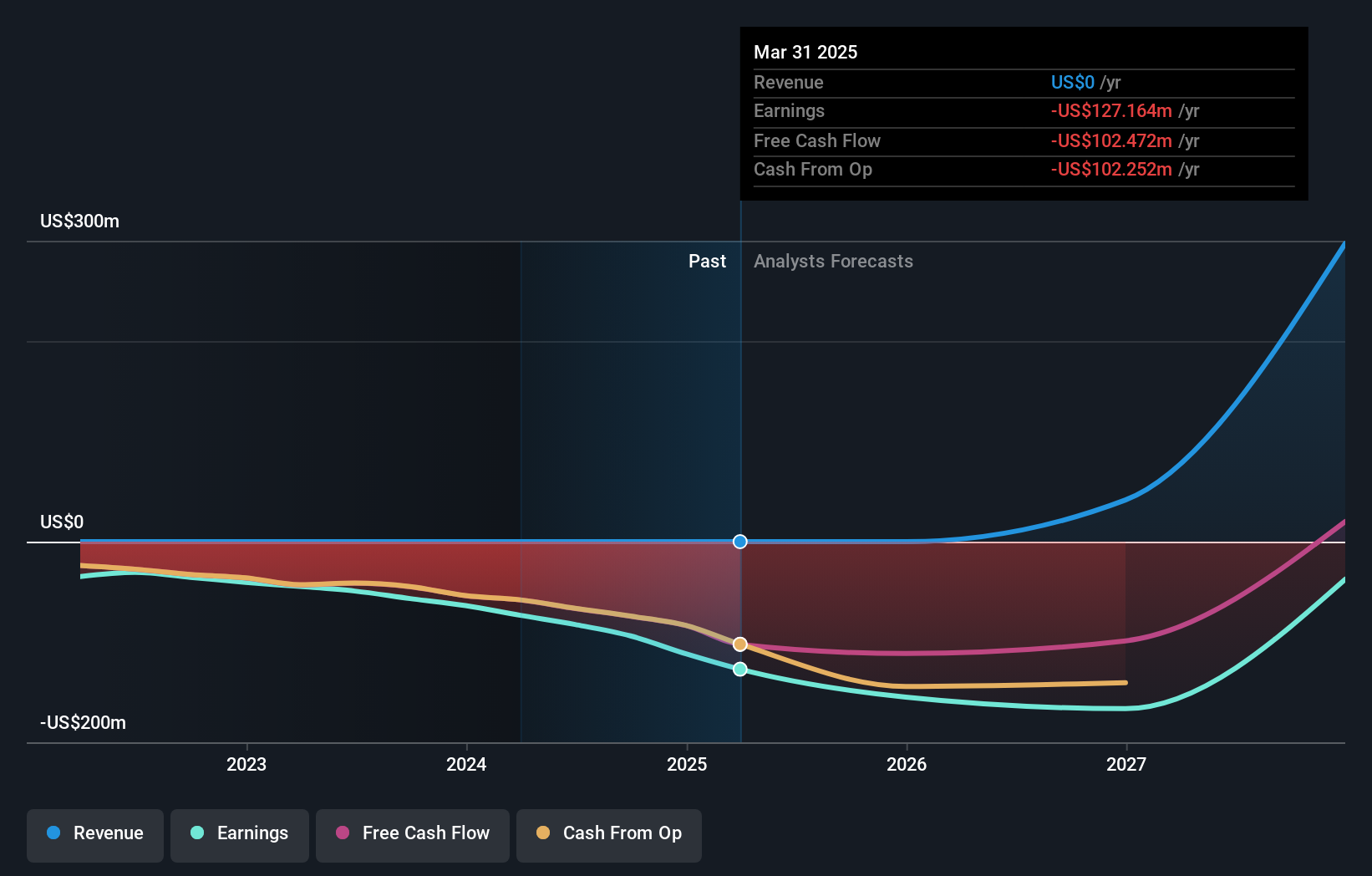

Anyone considering Celcuity as a potential holding right now needs to believe in the transformative potential of its oncology pipeline, and especially in gedatolisib’s ability to secure regulatory approval and become a meaningful commercial therapy. The company’s latest news, completing its New Drug Application submission to the FDA for gedatolisib under the Real-Time Oncology Review program, could meaningfully accelerate one of Celcuity's key short-term catalysts. This progress may ease earlier concerns flagged by analysts about regulatory delays, shifting attention toward product adoption, pricing, and commercial execution as the most immediate risks. With gedatolisib supported by promising Phase 3 data, the real challenge ahead seems less about science and more about successful market entry, uptake and competition from larger pharma. The stock’s rapid recent price appreciation underlines how closely the market is watching these pivotal milestones play out. Yet, competition and pricing remain hurdles that could reshape the outlook, something investors should be aware of.

Celcuity's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore another fair value estimate on Celcuity - why the stock might be worth over 5x more than the current price!

Build Your Own Celcuity Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Celcuity research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Celcuity research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Celcuity's overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CELC

Celcuity

A clinical-stage biotechnology company, focuses on the development of targeted therapies for the treatment of various solid tumors in the United States.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives