- United States

- /

- Biotech

- /

- NasdaqCM:CELC

Celcuity (CELC): Evaluating Valuation Following Key Phase 3 Results and Regulatory Progress

Reviewed by Simply Wall St

Celcuity (CELC) is drawing the spotlight after announcing positive topline results from its phase 3 Victoria 1 study. This is a major milestone that aligns with the company’s recent regulatory advances and strengthened financial position.

See our latest analysis for Celcuity.

Momentum is clearly building for Celcuity, as the stock’s 1-month share price return of 85.25% and soaring 605.86% year-to-date gain reflect rising optimism following its major study win, regulatory progress, and recent capital raise. The company’s strong 1-year total shareholder return of 632.07% signals the rally is more than just a short-term reaction. However, recent earnings show losses continue to widen alongside those advances.

If you’re interested in discovering other healthcare innovators making headlines, it’s a great time to explore opportunities with our See the full list for free.

With shares sitting just below analyst price targets after a stunning rally, investors now face a key question: Is Celcuity still undervalued, or is the market already pricing in all of its future growth potential?

Price-to-Book Ratio of 36.7x: Is it justified?

Celcuity is currently trading at a price-to-book (P/B) ratio of 36.7x, which is dramatically higher than both its peers and the biotech industry average. With a last close price of $92.68, this points to a valuation that has soared well beyond sector norms.

The price-to-book ratio measures how the market values a company's net assets. In biotech, a high P/B ratio often signals strong investor confidence in future discoveries or commercialization, especially for firms still in the development phase.

For Celcuity, the 36.7x P/B multiple is not just a stretch. It is many times the US Biotechs industry average of 2.5x and also higher than the peer average of 10.8x. This suggests the market is pricing in considerable optimism about Celcuity’s growth prospects and the impact of its recent study results. However, it also puts pressure on the company to deliver major progress to justify this premium.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 36.7x (OVERVALUED)

However, risks remain if Celcuity’s clinical progress slows or if investor sentiment shifts. These factors could challenge the lofty valuation currently reflected in its share price.

Find out about the key risks to this Celcuity narrative.

Another View: The DCF Perspective

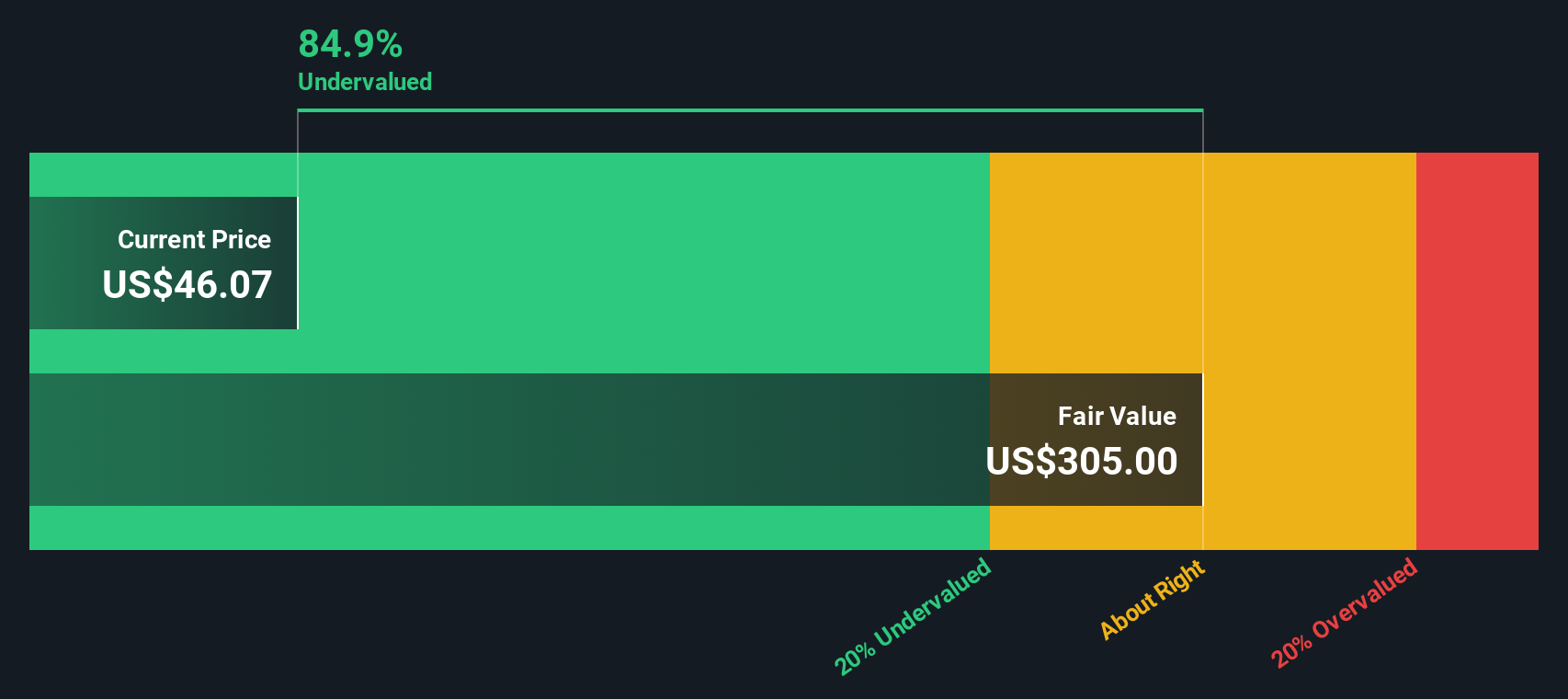

While Celcuity's price-to-book ratio suggests the shares are expensive, our DCF model provides a completely different angle. According to this approach, Celcuity is actually trading 76% below its estimated fair value, hinting at major upside potential based on future cash flows. Can the fundamentals catch up to this optimistic model, or does the market see risks that the math might miss?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Celcuity for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 879 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Celcuity Narrative

If you want to dig deeper or have a different perspective, you can quickly shape your own investment thesis in just a few minutes. Do it your way

A great starting point for your Celcuity research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more smart investment opportunities?

The market keeps evolving, and you don’t want to miss stocks with explosive potential or steady returns. Let the Simply Wall St Screener help you spot hidden gems and powerful trends shaping tomorrow’s portfolios.

- Uncover the upside of high-yield opportunities by checking out these 16 dividend stocks with yields > 3% that could boost your income every year.

- Jump in early with these 3593 penny stocks with strong financials which are positioned for fast growth thanks to strong financials and big market ambitions.

- Chase the next wave of innovation with these 25 AI penny stocks operating at the forefront of artificial intelligence and game-changing technologies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CELC

Celcuity

A clinical-stage biotechnology company, focuses on the development of targeted therapies for the treatment of various solid tumors in the United States.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives