- United States

- /

- Biotech

- /

- NasdaqCM:CELC

A Look at Celcuity (CELC) Valuation Following Phase 3 Breast Cancer and Prostate Cancer Trial Results

Reviewed by Simply Wall St

Celcuity (NasdaqCM:CELC) delivered a packed update for investors, unveiling fresh results from its VIKTORIA-1 Phase 3 breast cancer trial and new data on its prostate cancer study. These clinical developments were announced in conjunction with presentations at the ESMO Congress.

See our latest analysis for Celcuity.

Celcuity’s run of upbeat clinical news has energized its stock, resulting in a notable 40% share price return over the past month and a substantial 440% year-to-date gain. Over the long term, total shareholder returns have compounded further, reflecting growing momentum and renewed confidence in the company’s pipeline.

For readers tracking the next breakout in biotech, this is an ideal moment to discover other innovators via our See the full list for free.

With such rapid gains and promising trial updates, investors must now weigh whether Celcuity’s momentum is signaling a genuine buying opportunity or if the company’s future growth is already fully reflected in the current share price.

Price-to-Book Ratio of 67.9x: Is it justified?

At the current share price of $70.97, Celcuity is valued at a price-to-book (P/B) ratio of 67.9 times, which is substantially higher than both its industry and peer group averages. This level is far above what typical biotech companies command in today's market, placing Celcuity in a rarified valuation bracket.

The price-to-book ratio is a popular valuation metric for biopharma firms, especially during pre-revenue or loss-making phases. It reflects how much investors are willing to pay for each dollar of net assets, making it a useful benchmark for highly speculative, research-driven companies with little current revenue.

Celcuity's outsized multiple means that the market is either pricing in extraordinary future prospects or may be overlooking near-term risks. Compared to the US Biotechs industry average of just 2.5x and a peer average of 13.8x, Celcuity trades at a remarkable premium. This gap draws attention to the speculative nature of the current rally and the weight of expectations being placed on future milestones.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 67.9x (OVERVALUED)

However, risks remain, including Celcuity’s lack of revenue and the possibility of trial setbacks that could quickly dampen the current optimism.

Find out about the key risks to this Celcuity narrative.

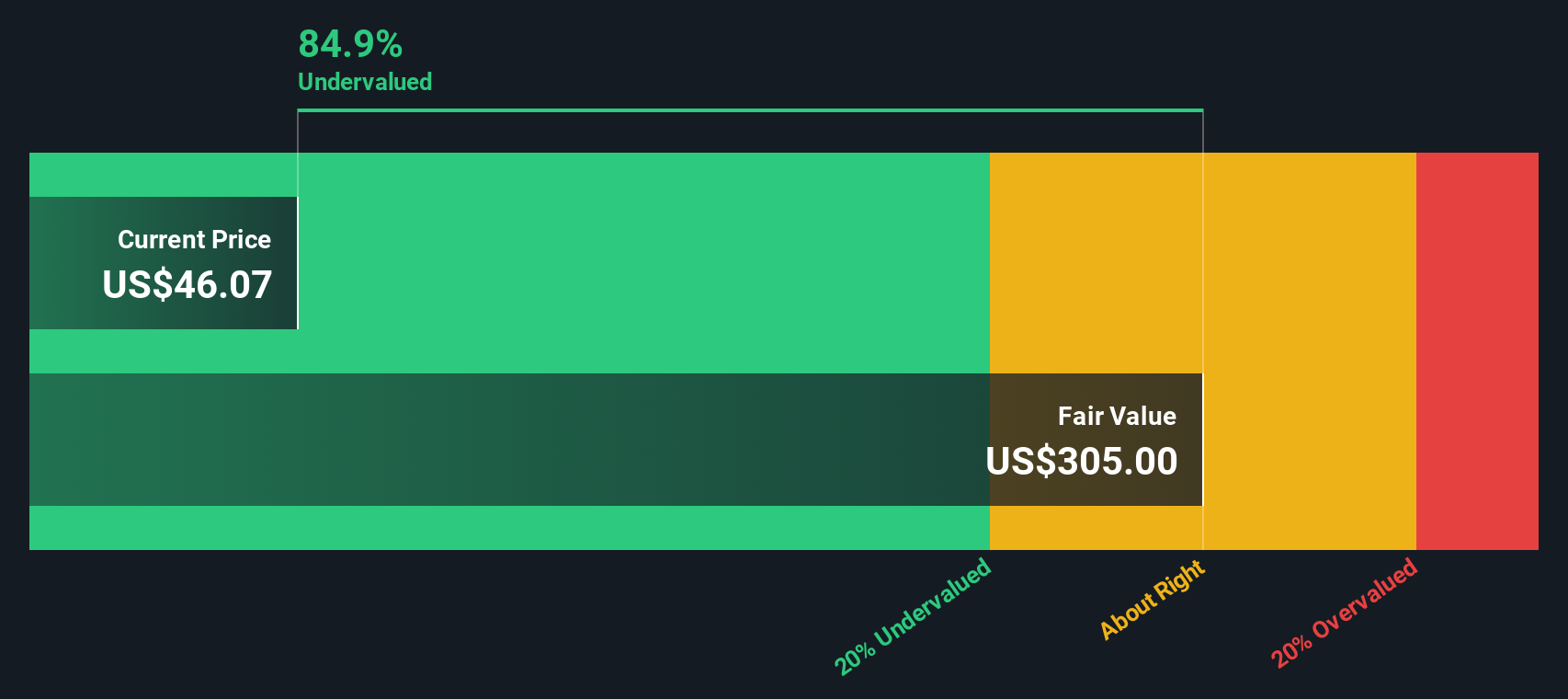

Another View: Discounted Cash Flow Suggests Deep Value

While the price-to-book ratio paints Celcuity as highly overvalued, the SWS DCF model draws a strikingly different picture. It estimates a fair value nearly four times the current share price. This suggests Celcuity could be severely undervalued. Could the market be underestimating the company’s potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Celcuity for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Celcuity Narrative

If you see things differently or want to dive deeper on your own, it only takes a few minutes to build your own perspective and see where it leads. So why not Do it your way

A great starting point for your Celcuity research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Make your next move count by checking out other standout opportunities beyond Celcuity. The right tool can put you ahead of shifting trends and unlock hidden potential.

- Cash in on tomorrow's trends by unleashing the power of AI with these 27 AI penny stocks, where emerging technologies are creating new possibilities for investors.

- Supercharge your portfolio with these 877 undervalued stocks based on cash flows, targeting stocks the market has overlooked but our models see as positioned for upside.

- Spot tomorrow’s blockchain leaders early by tapping into these 80 cryptocurrency and blockchain stocks, featuring innovative companies at the forefront of digital asset transformation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CELC

Celcuity

A clinical-stage biotechnology company, focuses on the development of targeted therapies for the treatment of various solid tumors in the United States.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives