- United States

- /

- Biotech

- /

- NasdaqCM:CELC

A Look at Celcuity (CELC) Valuation Following Major Late-Stage Clinical and Regulatory Pipeline Advances

Reviewed by Kshitija Bhandaru

Celcuity (NasdaqCM:CELC) just announced major clinical updates for gedatolisib, its lead pipeline candidate. The company shared new results across late-stage breast and prostate cancer trials. These updates include progress toward FDA approval for certain patients.

See our latest analysis for Celcuity.

Celcuity’s shares have seen extraordinary momentum, fueled by these clinical milestones and a string of regulatory advances. With a 295.7% year-to-date share price return and a 228.2% total shareholder return over the past year, investor optimism appears to be gaining steam, supported by the company's expanding late-stage pipeline and high-profile trial updates.

If these breakthroughs in oncology caught your attention, now is the perfect moment to explore more innovation opportunities. See the full list in our See the full list for free..

But with shares soaring nearly threefold this year and clinical momentum at its peak, is Celcuity still flying under Wall Street’s radar, or has the market already factored in expectations for future growth?

Price-to-Book of 49.7x: Is it justified?

Celcuity trades at a striking price-to-book ratio of 49.7x, far above both its direct peers and the industry average. With the last closing price at $51.96, the stock appears highly valued on this metric.

The price-to-book ratio compares a company’s market value to its book value. This offers insight into how much investors are willing to pay for each dollar of net assets. For biotechs, this metric can reflect confidence in future breakthroughs or pipeline potential. However, such a high ratio suggests considerable optimism about upcoming milestones and the value of intangible assets.

Celcuity’s multiple is much higher than the US Biotechs industry average of 2.5x and the peer average of 21.1x. This suggests the market is pricing in remarkable future growth or unprecedented clinical success. This elevated valuation indicates that expectations are for outcomes well beyond those of a typical biotech stock.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 49.7x (OVERVALUED)

However, triple-digit returns depend on continued clinical progress. Any trial setback or regulatory delay could sharply impact Celcuity’s valuation story.

Find out about the key risks to this Celcuity narrative.

Another View: Discounted Cash Flow Model

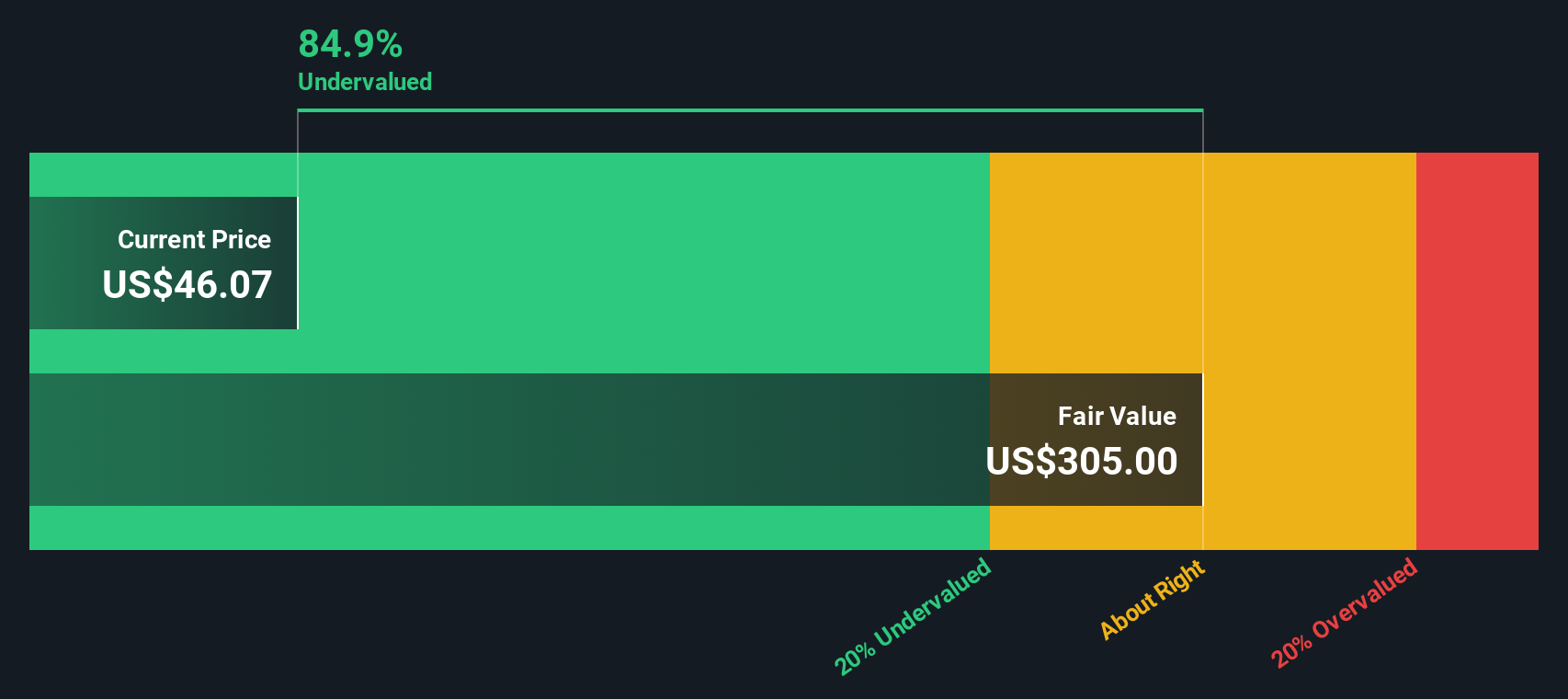

While the price-to-book ratio suggests Celcuity is expensive compared to industry norms, our DCF model presents a very different perspective. According to the SWS DCF model, shares are trading at an 82.8% discount to estimated fair value. This raises the question: Is the market underestimating long-term potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Celcuity for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Celcuity Narrative

If you see the numbers differently or want to bring your own research to the table, you can build a personalized narrative in just minutes. Do it your way.

A great starting point for your Celcuity research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors constantly expand their horizons beyond a single pick. Use these powerful tools to pinpoint your next big opportunity before everyone else does.

- Tap into strong income potential with these 18 dividend stocks with yields > 3%, offering solid yields paired with resilient business models.

- Get ahead of the new tech wave and unleash growth with these 24 AI penny stocks, spotlighting the innovators behind tomorrow's breakthroughs.

- Seize value opportunities before the crowd by scanning these 878 undervalued stocks based on cash flows for stocks whose future cash flows look brighter than their current price tags suggest.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CELC

Celcuity

A clinical-stage biotechnology company, focuses on the development of targeted therapies for the treatment of various solid tumors in the United States.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives