- United States

- /

- Life Sciences

- /

- NasdaqCM:NAGE

Revenues Tell The Story For ChromaDex Corporation (NASDAQ:CDXC) As Its Stock Soars 70%

Despite an already strong run, ChromaDex Corporation (NASDAQ:CDXC) shares have been powering on, with a gain of 70% in the last thirty days. The annual gain comes to 280% following the latest surge, making investors sit up and take notice.

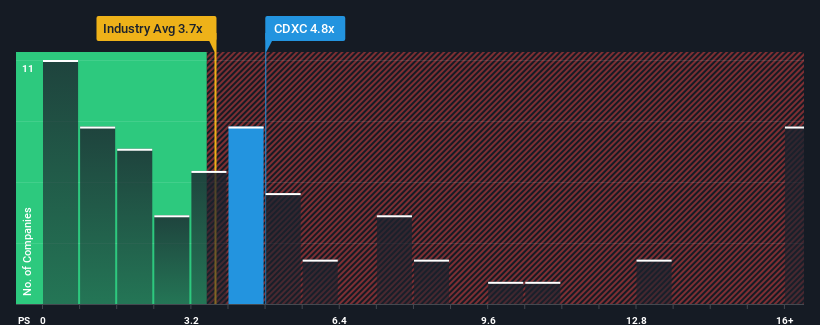

Following the firm bounce in price, ChromaDex may be sending sell signals at present with a price-to-sales (or "P/S") ratio of 4.8x, when you consider almost half of the companies in the Life Sciences industry in the United States have P/S ratios under 3.8x and even P/S lower than 1.7x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for ChromaDex

What Does ChromaDex's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, ChromaDex has been doing relatively well. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on ChromaDex will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For ChromaDex?

In order to justify its P/S ratio, ChromaDex would need to produce impressive growth in excess of the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 10.0%. This was backed up an excellent period prior to see revenue up by 41% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 23% as estimated by the five analysts watching the company. With the industry only predicted to deliver 5.2%, the company is positioned for a stronger revenue result.

With this information, we can see why ChromaDex is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does ChromaDex's P/S Mean For Investors?

The large bounce in ChromaDex's shares has lifted the company's P/S handsomely. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that ChromaDex maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Life Sciences industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

It is also worth noting that we have found 1 warning sign for ChromaDex that you need to take into consideration.

If these risks are making you reconsider your opinion on ChromaDex, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Niagen Bioscience might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:NAGE

Niagen Bioscience

Operates as a bioscience company engages in developing healthy aging products.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives