- United States

- /

- Biotech

- /

- NasdaqCM:CDTX

Will Breakthrough CD388 Results and FDA Designations Change Cidara Therapeutics' (CDTX) Narrative?

Reviewed by Sasha Jovanovic

- Cidara Therapeutics recently presented statistically significant positive Phase 2b results for its lead immunotherapy, CD388, aimed at preventing influenza A and B in high-risk groups.

- The data announcement comes as CD388 has secured both FDA Fast Track and Breakthrough Therapy designations, further highlighting its regulatory momentum.

- We'll explore how the dual regulatory recognitions for CD388 enhance Cidara Therapeutics' investment narrative within the biotech sector.

AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Cidara Therapeutics' Investment Narrative?

Investors drawn to Cidara Therapeutics are often betting on the company’s ability to convert clinical progress into commercial reality, especially given its unprofitable status, limited revenue, and history of shareholder dilution. The big picture here is that Cidara’s value hinges on the promise of CD388, which has now cleared an important Phase 2b hurdle and secured both FDA Breakthrough Therapy and Fast Track designations. This recent news is a material shift: it bolsters the narrative of regulatory and clinical momentum and becomes the central catalyst for the next 6–12 months as the Phase 3 ANCHOR trial moves forward. Press coverage and market moves reflect increased optimism, but risks remain. Execution on the late-stage trial, regulatory approval and future profitability are still unproven, and rapid historical gains may increase sensitivity to any setbacks or delays. It’s a story tilted toward pipeline success, but the business is not yet out of the woods. On the other hand, the company’s lack of profitability is still a key risk to consider.

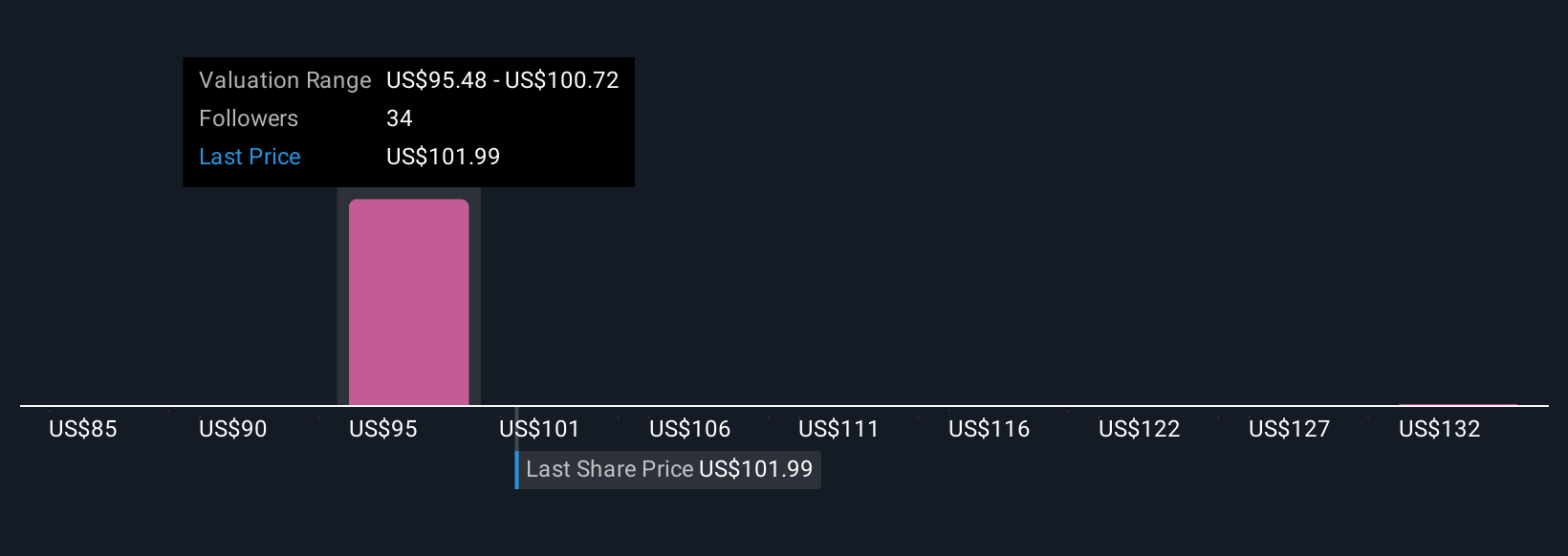

Upon reviewing our latest valuation report, Cidara Therapeutics' share price might be too optimistic.Exploring Other Perspectives

Explore 4 other fair value estimates on Cidara Therapeutics - why the stock might be worth as much as 52% more than the current price!

Build Your Own Cidara Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cidara Therapeutics research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Cidara Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cidara Therapeutics' overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CDTX

Cidara Therapeutics

Operates as a biotechnology company that focuses on developing targeted therapies for patients facing cancers and other serious diseases.

Flawless balance sheet with low risk.

Market Insights

Community Narratives