- United States

- /

- Biotech

- /

- NasdaqCM:CAPR

Capricor Therapeutics (NASDAQ:CAPR) delivers shareholders fantastic 53% CAGR over 5 years, surging 8.8% in the last week alone

Capricor Therapeutics, Inc. (NASDAQ:CAPR) shareholders might understandably be very concerned that the share price has dropped 36% in the last quarter. But that does not change the realty that the stock's performance has been terrific, over five years. To be precise, the stock price is 746% higher than it was five years ago, a wonderful performance by any measure. Arguably, the recent fall is to be expected after such a strong rise. The most important thing for savvy investors to consider is whether the underlying business can justify the share price gain. We love happy stories like this one. The company should be really proud of that performance!

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

Check out our latest analysis for Capricor Therapeutics

Given that Capricor Therapeutics didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually desire strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last 5 years Capricor Therapeutics saw its revenue grow at 76% per year. That's well above most pre-profit companies. Fortunately, the market has not missed this, and has pushed the share price up by 53% per year in that time. It's never too late to start following a top notch stock like Capricor Therapeutics, since some long term winners go on winning for decades. On the face of it, this looks lke a good opportunity, although we note sentiment seems very positive already.

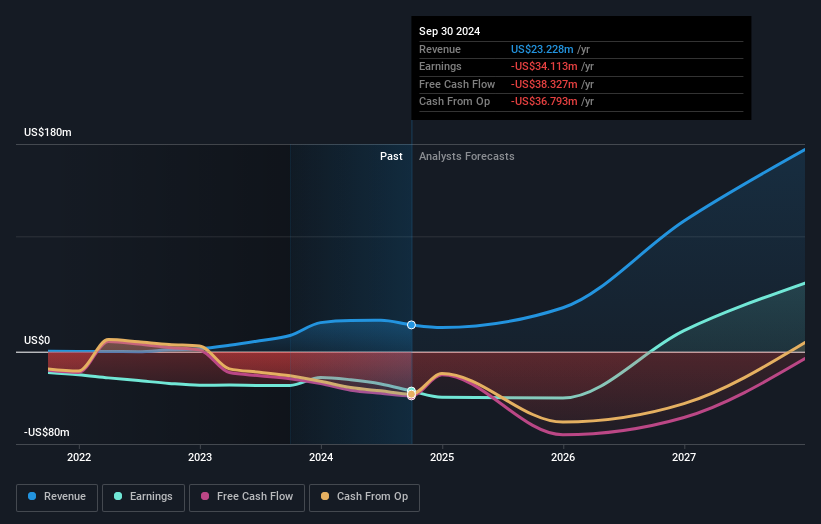

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

It's good to see that Capricor Therapeutics has rewarded shareholders with a total shareholder return of 232% in the last twelve months. Since the one-year TSR is better than the five-year TSR (the latter coming in at 53% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand Capricor Therapeutics better, we need to consider many other factors. Even so, be aware that Capricor Therapeutics is showing 2 warning signs in our investment analysis , and 1 of those is significant...

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:CAPR

Capricor Therapeutics

A clinical-stage biotechnology company, engages in the development of transformative cell and exosome-based therapeutics for treating duchenne muscular dystrophy (DMD) and other diseases with unmet medical needs in the United States.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives