- United States

- /

- Biotech

- /

- NasdaqCM:CAPR

Capricor Therapeutics (CAPR): A Deep Dive Into Valuation After Shkreli Short and FDA Setback

Reviewed by Simply Wall St

Capricor Therapeutics, Inc. found itself at the center of market turbulence after well-known investor Martin Shkreli disclosed a short position targeting the company’s lead drug, Deramiocel. Shkreli also raised doubts about its clinical prospects.

See our latest analysis for Capricor Therapeutics.

This controversy has only sharpened focus on Capricor’s turbulent run. While the share price saw a sharp one-day rebound of 12.8%, longer-term momentum remains weak with a year-to-date share price return of -65%. Despite pockets of optimism around its exosome platform, the total shareholder return has lagged significantly over the past year. This underscores persistent uncertainty around clinical outcomes and future value.

If recent biotech drama has you rethinking where growth could come from next, this is the perfect moment to broaden your perspective and discover See the full list for free.

With share prices battered, but management highlighting key advances in exosome technology, the question now is whether Capricor’s deep discount signals undervaluation or if the market is already factoring in all foreseeable risks and growth potential.

Most Popular Narrative: 74.8% Undervalued

Capricor Therapeutics is trading far below the narrative’s fair value estimate of $20.60. Its last close was $5.19. This major gap underscores the conviction in the consensus outlook and raises the stakes for anyone wondering what could drive a rerating.

The continued rise in the global prevalence of rare and genetic diseases is directly fueling unmet medical needs in areas like Duchenne Muscular Dystrophy (DMD), placing Capricor's Deramiocel in a strong position for regulatory support and future market demand. This could drive substantial revenue growth upon successful approval.

Want to know what’s powering this huge upside? This narrative leans on shockingly bold assumptions about skyrocketing revenue growth, industry-changing profit margins, and an aggressive future earnings multiple. Craving the details behind these numbers? Dive in to see what the market might be missing.

Result: Fair Value of $20.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing regulatory unpredictability and Capricor’s reliance on a single late-stage therapy leave its forecasts vulnerable to further setbacks and delays.

Find out about the key risks to this Capricor Therapeutics narrative.

Another View: Is the Market Right?

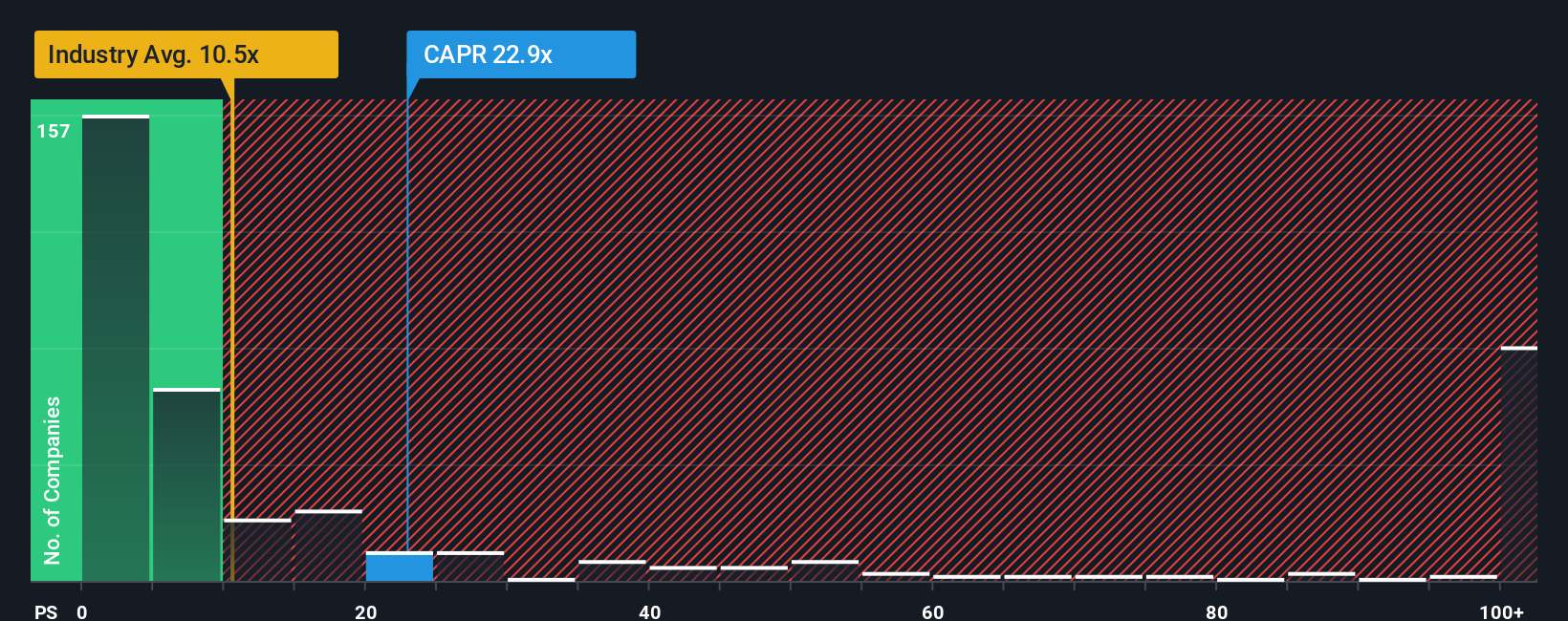

While fair value estimates suggest Capricor is deeply undervalued, the current price-to-sales ratio tells a different story. At 21.3x, it is dramatically higher than the peer average of 3.5x and the US Biotechs industry average of 12.3x. This premium signals that investors might already be pricing in a strong recovery, raising the risk of disappointment if things do not go perfectly. Could the fair ratio suggest more room to fall if market expectations reset?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Capricor Therapeutics Narrative

If this analysis does not quite fit your outlook or you would rather dive in and reach your own conclusions, you can assemble your own view in under three minutes. Do it your way

A great starting point for your Capricor Therapeutics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Stay one step ahead by searching beyond Capricor and finding new opportunities in today’s ever-changing market. The right screener could reveal your next winning idea.

- Explore the future of medicine and innovation by joining the search for the most promising companies with these 30 healthcare AI stocks.

- Find consistent cash flow in your portfolio by checking out these 15 dividend stocks with yields > 3% offering high-yielding stocks ready to reward patient investors.

- Research fast-moving trends at the intersection of finance and technology by looking into these 81 cryptocurrency and blockchain stocks before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CAPR

Capricor Therapeutics

A clinical-stage biotechnology company, engages in the development of transformative cell and exosome-based therapeutics for treating duchenne muscular dystrophy (DMD) and other diseases with unmet medical needs in the United States.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success