- United States

- /

- Life Sciences

- /

- NasdaqGS:BRKR

Reassessing Bruker (BRKR) Valuation After Earnings Beat but Full-Year Outlook Cut

Reviewed by Simply Wall St

Bruker (BRKR) just delivered a mixed signal to investors, topping third quarter earnings expectations while simultaneously cutting its full year outlook, a combination that helps explain the stock’s recent, cautious pullback.

See our latest analysis for Bruker.

That mix of an earnings beat and softer outlook helps explain why Bruker’s recent 1 month share price return of 19.48% and 3 month share price return of 55.79% still sit against a weaker year to date share price return and a 1 year total shareholder return of minus 18.22%. This suggests momentum has only recently started to rebuild as investors reassess the balance between growth potential and execution risk.

If this kind of guidance driven move has you rethinking your watchlist, it might be worth exploring other specialised healthcare stocks that could offer a different balance of growth and resilience.

With shares now hovering near analyst targets after a sharp rebound but still lagging longer term returns, the key question is clear: Is Bruker quietly undervalued, or are markets already pricing in its next leg of growth?

Most Popular Narrative Narrative: 1.6% Undervalued

Bruker’s narrative fair value of $48.83 sits just above the last close at $48.03, framing a valuation built on moderate growth and margin recovery.

The analysts have a consensus price target of $46.727 for Bruker based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $65.0, and the most bearish reporting a price target of just $38.0.

Want to see what powers that tight valuation band? The narrative leans on rising margins, accelerating earnings, and a future multiple that implies far steadier cash generation.

Result: Fair Value of $48.83 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent funding headwinds and reliance on cost cutting instead of organic growth could quickly undermine both the improving narrative and today’s tight valuation.

Find out about the key risks to this Bruker narrative.

Another View: Cash Flows Tell a Tougher Story

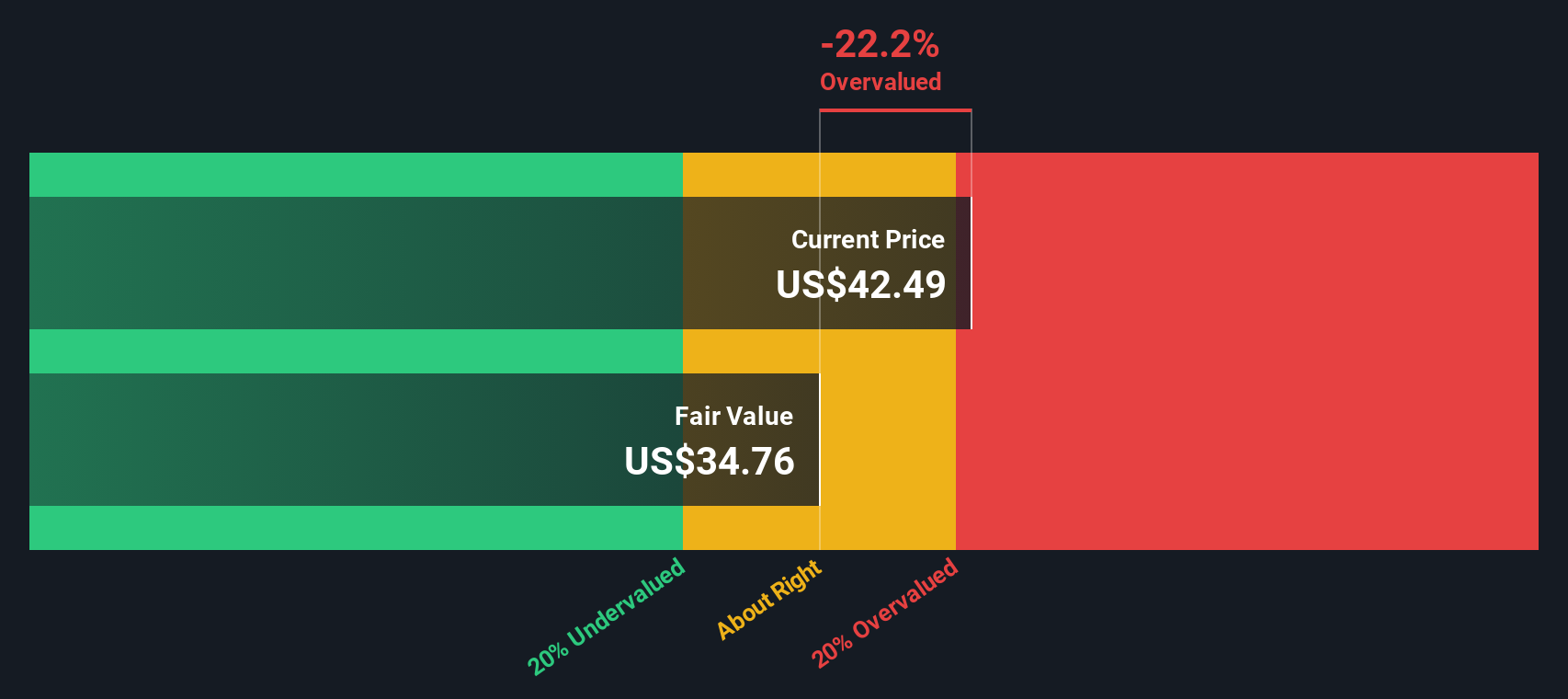

While the narrative fair value points to Bruker being roughly fairly priced, our DCF model paints a stricter picture. Shares at $48.03 are trading above an estimated fair value of $36.91. That implies meaningful downside if optimistic growth and margin recovery do not materialize.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Bruker for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 905 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Bruker Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalised view in just a few minutes using Do it your way.

A great starting point for your Bruker research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Smart investors never stop sharpening their edge, so use the Simply Wall Street Screener to spot fresh opportunities before everyone else is talking about them.

- Capture potential mispricings by scanning these 905 undervalued stocks based on cash flows that strong cash flow analysis suggests the market may be underestimating.

- Ride powerful innovation trends by hunting in these 26 AI penny stocks that could reshape industries with applied artificial intelligence.

- Lock in reliable income streams by focusing on these 15 dividend stocks with yields > 3% that can support long term total returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bruker might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BRKR

Bruker

Develops, manufactures, and distributes scientific instruments, and analytical and diagnostic solutions in the United States, Europe, the Asia Pacific, and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026