- United States

- /

- Tech Hardware

- /

- NasdaqGS:SMCI

3 US Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

As major U.S. indexes experience a volatile period, with the S&P 500 and Nasdaq poised for their fourth straight weekly loss, investors are increasingly looking for stable opportunities amidst the fluctuations. In such an environment, growth companies with high insider ownership can offer a compelling investment case due to the confidence insiders demonstrate in their own businesses.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 21.6% |

| GigaCloud Technology (NasdaqGM:GCT) | 25.7% | 25.4% |

| PDD Holdings (NasdaqGS:PDD) | 32.1% | 21.7% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 12% | 34% |

| Hims & Hers Health (NYSE:HIMS) | 13.8% | 40.5% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 31.2% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.4% | 60.9% |

| Carlyle Group (NasdaqGS:CG) | 29.5% | 22.8% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 74.3% |

| BBB Foods (NYSE:TBBB) | 22.9% | 70.7% |

Let's review some notable picks from our screened stocks.

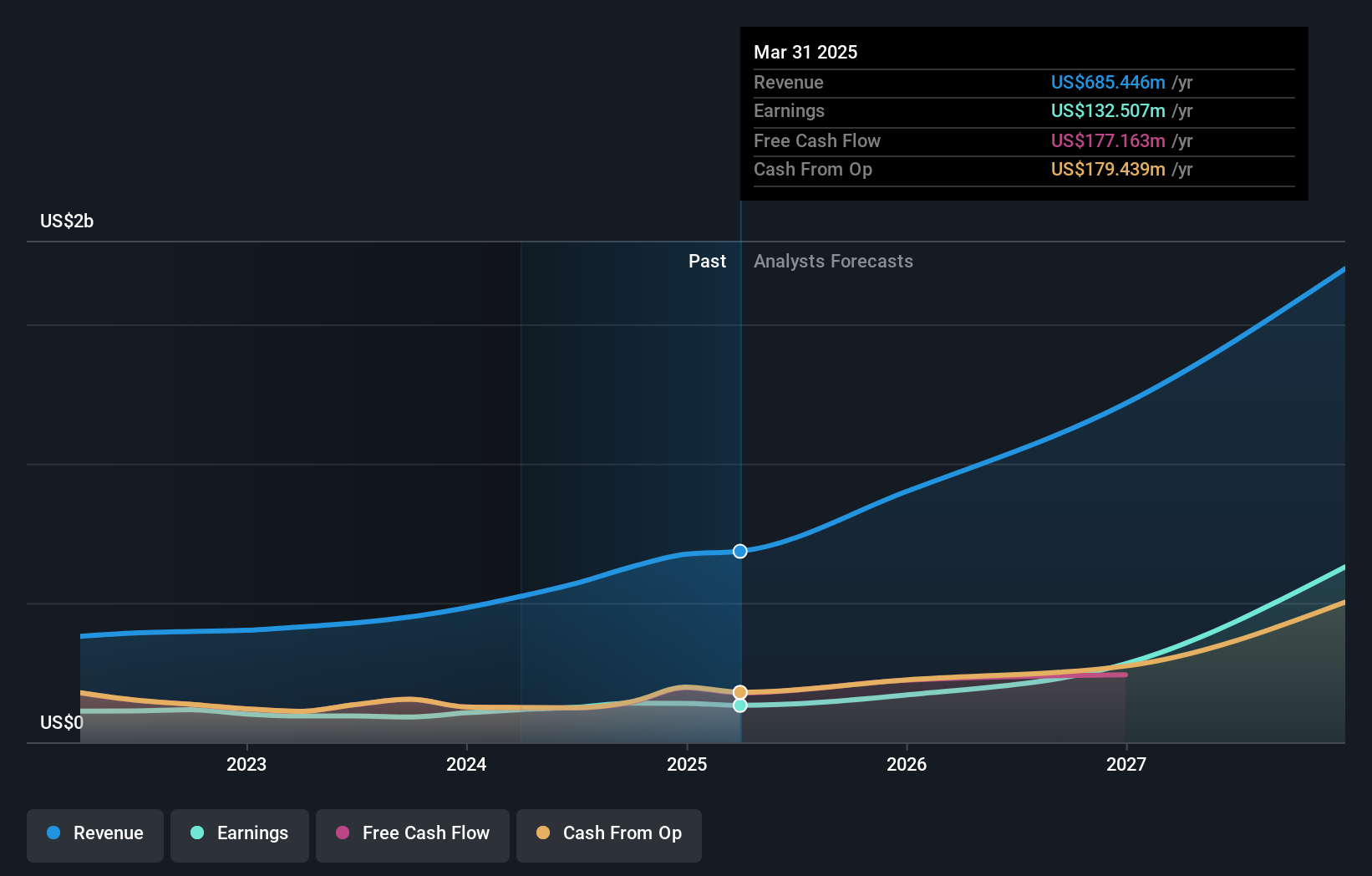

Corcept Therapeutics (NasdaqCM:CORT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Corcept Therapeutics Incorporated focuses on discovering and developing drugs for treating severe endocrinologic, oncologic, metabolic, and neurologic disorders in the United States and has a market cap of $3.56 billion.

Operations: The company's revenue segment includes the discovery, development, and commercialization of pharmaceutical products, generating $569.61 million.

Insider Ownership: 11.5%

Corcept Therapeutics has shown strong growth potential with earnings forecasted to grow significantly at 37.34% per year, outpacing the US market's average. Recent results highlight this trend, with Q2 net income rising to US$35.49 million from US$27.53 million a year ago. The company also raised its 2024 revenue guidance to US$640-670 million and added to the Russell 2000 Dynamic Index, reflecting robust insider confidence and strategic positioning for future growth.

- Navigate through the intricacies of Corcept Therapeutics with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that Corcept Therapeutics' share price might be on the cheaper side.

Bruker (NasdaqGS:BRKR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bruker Corporation, with a market cap of $9.13 billion, develops, manufactures, and distributes scientific instruments and analytical and diagnostic solutions globally.

Operations: Bruker's revenue segments include Bruker Nano ($1 billion), Bruker CALID ($990 million), Bruker Biospin ($856.50 million), and Bruker Energy & Supercon Technologies (BEST) ($288 million).

Insider Ownership: 30.4%

Bruker Corporation, a growth company with high insider ownership, recently reported Q2 2024 sales of US$800.7 million but saw net income drop to US$7.6 million from US$57.1 million a year ago. Despite this, the company raised its full-year revenue guidance to between US$3.38 billion and US$3.44 billion, driven by strategic alliances like its collaboration with NovAliX for advanced drug discovery technologies and new product launches such as the neofleX Imaging Profiler for mass spectrometry-based tissue imaging.

- Take a closer look at Bruker's potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that Bruker is priced lower than what may be justified by its financials.

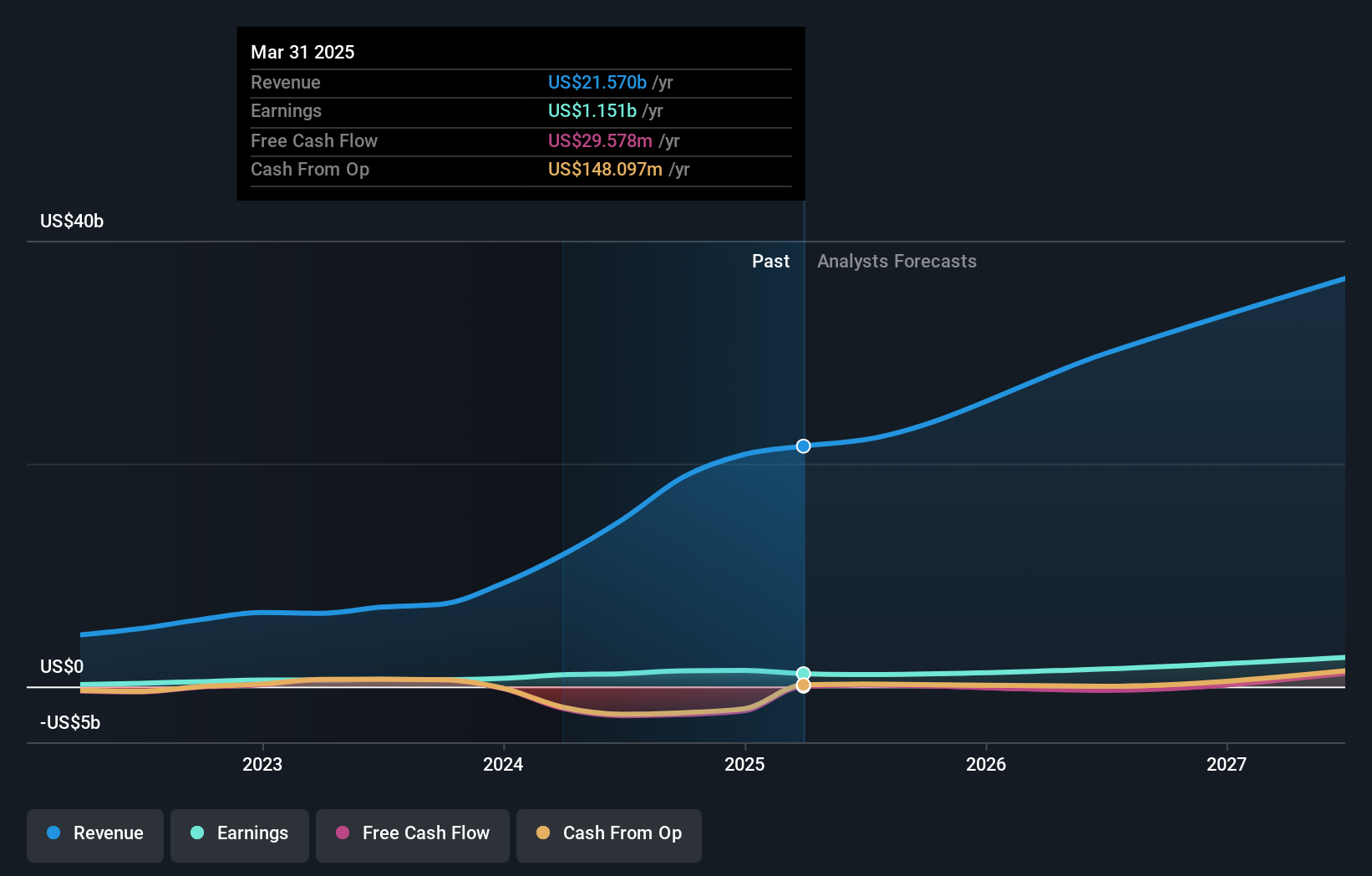

Super Micro Computer (NasdaqGS:SMCI)

Simply Wall St Growth Rating: ★★★★★★

Overview: Super Micro Computer, Inc., along with its subsidiaries, develops and manufactures high-performance server and storage solutions based on modular and open architecture globally, with a market cap of $28.85 billion.

Operations: The company generates $14.94 billion from developing and providing high-performance server solutions.

Insider Ownership: 14.3%

Super Micro Computer, Inc. has demonstrated strong growth with earnings expected to increase by 31.21% annually over the next three years and revenue forecasted to grow at 21.4% per year, outpacing the US market. The company recently reported a significant rise in Q4 sales to US$5.31 billion and net income of US$352.73 million, reflecting robust financial health despite recent shareholder dilution and high share price volatility.

- Get an in-depth perspective on Super Micro Computer's performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility Super Micro Computer's shares may be trading at a premium.

Next Steps

- Delve into our full catalog of 177 Fast Growing US Companies With High Insider Ownership here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SMCI

Super Micro Computer

Develops and manufactures high performance server and storage solutions based on modular and open architecture in the United States, Europe, Asia, and internationally.

Exceptional growth potential with proven track record.