- United States

- /

- Biotech

- /

- NasdaqGS:BNTX

BioNTech (BNTX) Net Losses Rise 22.1% Annually, Challenging Bullish Pipeline Narratives

Reviewed by Simply Wall St

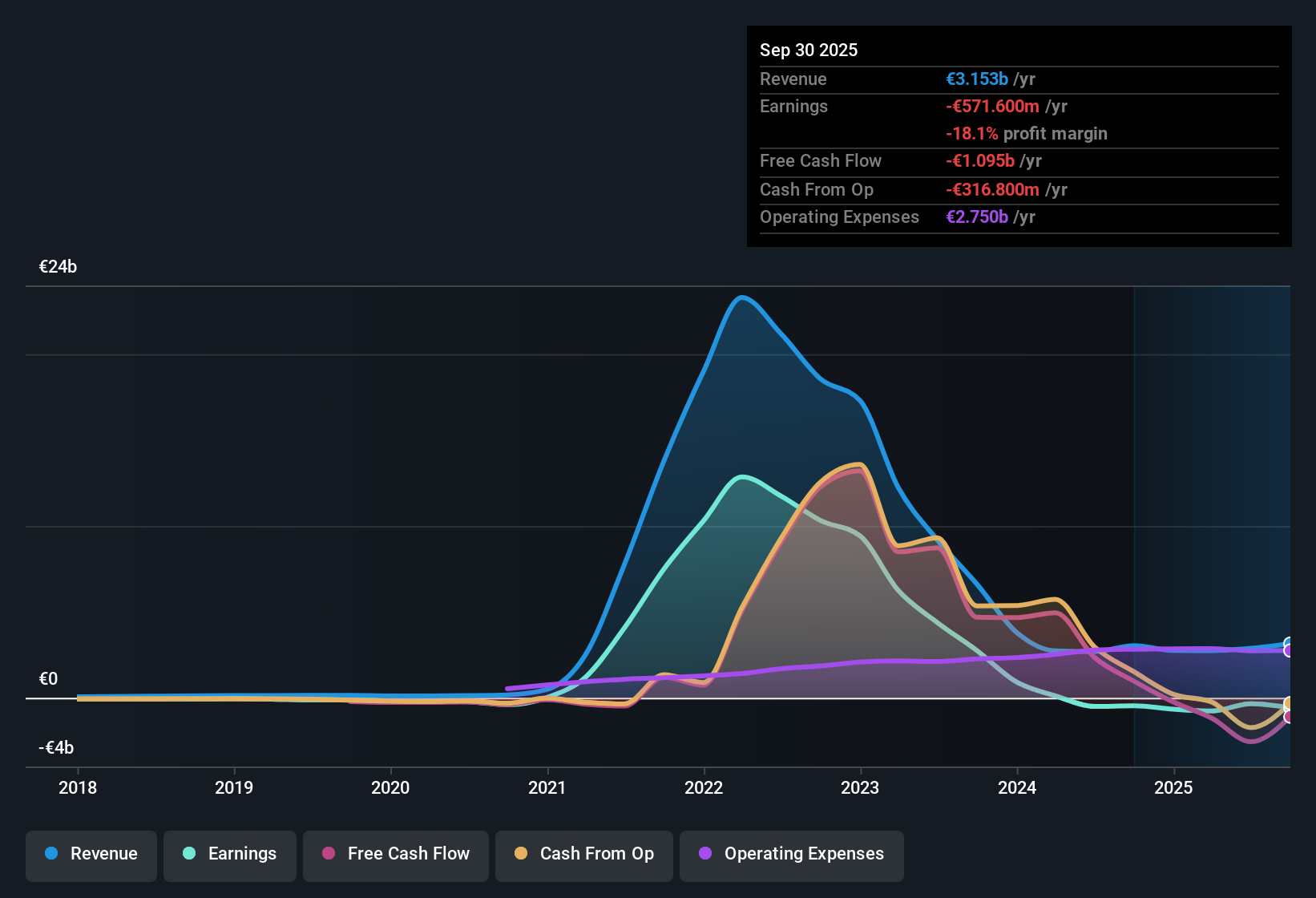

BioNTech (BNTX) remains unprofitable, with net losses increasing at an annual rate of 22.1% over the past five years. While revenue is projected to grow just 1.7% per year, which is much slower than the broader US market's 10.5% rate, the company is expected to stay in the red for at least the next three years. Investors may take note of BioNTech trading below analyst price targets, but persistent weak margins and muted growth expectations continue to cloud the overall outlook.

See our full analysis for BioNTech.Now let’s see how these numbers hold up when set against the market’s main narratives. Some may get reinforced, while others could face fresh scrutiny.

See what the community is saying about BioNTech

Price-to-Sales Ratio: Cheaper Than Industry, Still Rich vs Peers

- BioNTech’s Price-to-Sales ratio is 7.5x. This appears favorable compared to the US biotech industry average of 11.3x, but is higher than direct peer companies trading at just 3.9x.

- According to analysts' consensus, this valuation gap highlights an ongoing debate:

- Some analysts view the discount to the sector as a sign that BioNTech is not being fully credited for its pipeline and diversification efforts, particularly as the company expands partnerships and invests in mRNA technology. These moves are seen as potential drivers of long-term earnings power, even if profits remain elusive for now.

- Others note that stagnant margins and continued losses may indicate that the peer-group discount reflects skepticism about whether BioNTech can deliver on its innovation promise without strong near-term results.

Profit Margins Remain Deep in Red

- BioNTech has averaged a negative profit margin of -12.0% and is not forecast to achieve profitability for at least the next three years, with net losses growing at a 22.1% annual rate over the past five years.

- Based on analysts' consensus, investors are watching two main tensions:

- On one side, BioNTech’s strategic partnerships and pipeline advances in oncology and personalized medicine are expected to lead to new market launches and eventually improve margins as R&D expenses normalize.

- However, the company’s continued heavy investment and the risk of slow or unsuccessful clinical trials make it difficult to expect the rapid margin turnaround some projections anticipate.

Revenue Growth Lags Market, Reinforcing Analyst Skepticism

- The company’s revenue is expected to grow by just 1.7% annually, which is well below the broader US market’s 10.5% forecast. Analysts also project a slight decline of 0.8% per year over the next three years.

- Consensus narrative suggests this underwhelming outlook is a key concern:

- Some optimistic analysts highlight the late-stage oncology pipeline and new strategic partnerships as potential future drivers, arguing global demand and demographic trends could boost revenue when new products are commercialized.

- However, the muted top-line growth and continued reliance on COVID-19 vaccine revenue make it challenging for even bullish observers to suggest BioNTech can outpace the market until more pipeline programs contribute to revenue diversification.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for BioNTech on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on these figures? Put your perspective to work and shape your own company story in just a few minutes. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding BioNTech.

See What Else Is Out There

BioNTech’s disappointing profit margins, muted revenue growth, and ongoing losses make its long-term trajectory uncertain and riskier than many peers.

If you want to avoid sluggish results, check out stable growth stocks screener (2087 results) to focus on companies with consistent earnings and revenue expansion, resulting in stronger performance year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BioNTech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BNTX

BioNTech

A biotechnology company, develops and commercializes immunotherapies to treat cancer and infectious diseases in Germany.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives