- United States

- /

- Biotech

- /

- NasdaqGS:BNTX

Assessing BioNTech (NasdaqGS:BNTX) Valuation Following Modest Share Price Recovery

Reviewed by Simply Wall St

BioNTech (BNTX) shares edged up about 1% at the close, bringing its month gain to just over 6%. Despite a slight loss over the past 3 months, the stock’s recent movement offers investors a reason to revisit its valuation fundamentals.

See our latest analysis for BioNTech.

BioNTech’s share price has bounced back this month, reversing some of its recent softness. However, the one-year total shareholder return of -7.5% still reflects a period of fading momentum after a stellar run over the past five years. A modest recovery in the past month hints at shifting sentiment as investors reassess the company’s longer-term growth potential and valuation story.

If BioNTech’s rebound has you curious about what else is gaining traction in healthcare, there are plenty of opportunities worth a closer look. Explore See the full list for free..

With recent volatility and a modest recovery underway, the key question remains: does BioNTech’s current price reflect untapped value, or is the market already factoring in all potential future growth? Could this be a hidden opportunity to buy in?

Most Popular Narrative: 22% Undervalued

At $104.67, BioNTech’s shares sit over 22% below the narrative’s fair value estimate, placing a spotlight on what could be a potential disconnect between market price and long-term outlook.

Expanding oncology pipeline, innovative mRNA technologies, and global partnerships position BioNTech for long-term growth and improved profitability through revenue diversification.

Curious what’s really fueling that premium valuation? Analysts are factoring in a future where BioNTech upends its business through a major pipeline shift and aggressive margin targets. Is the next phase of growth already forecasted or are you missing out on the core financial drivers? Find out what's behind the bullish outlook; there is more beneath the surface.

Result: Fair Value of $134.58 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing reliance on COVID-19 vaccines and potential delays in late-stage oncology trials could pose challenges to the company’s ambitious expansion plans.

Find out about the key risks to this BioNTech narrative.

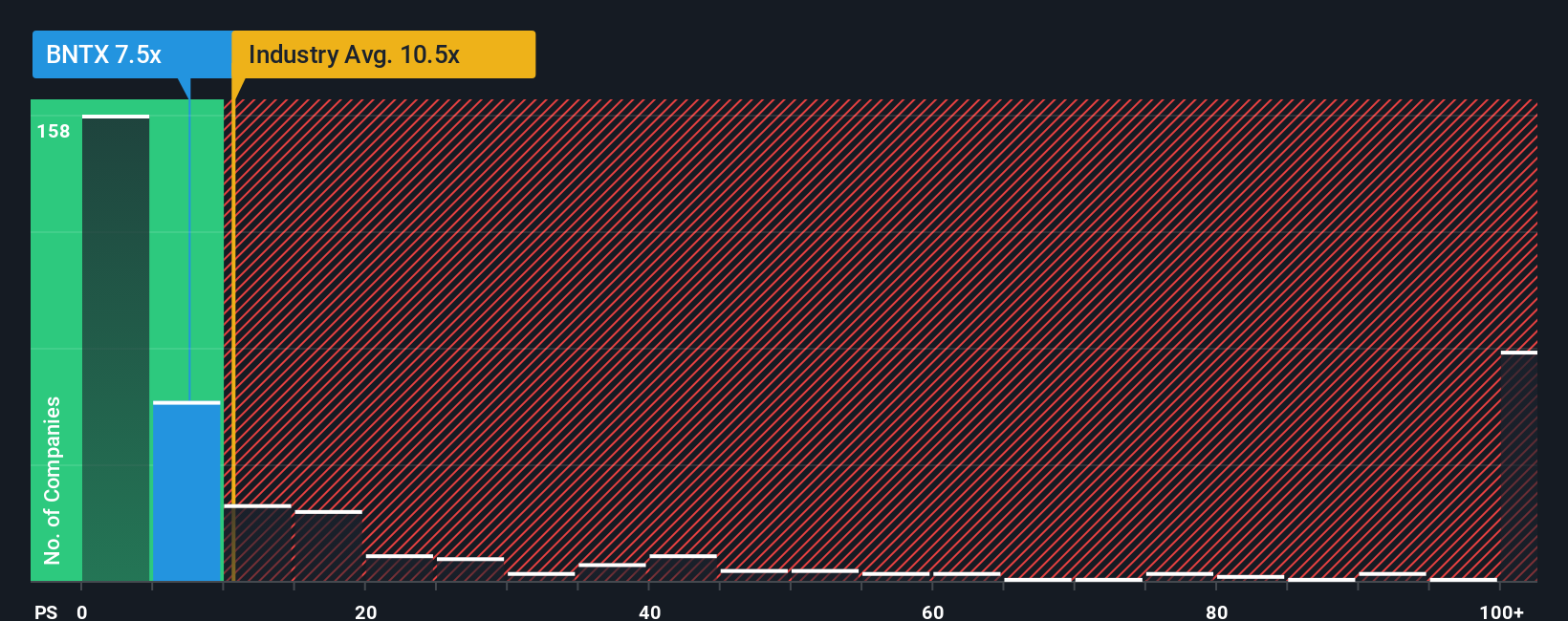

Another View: Multiples Tell a Different Story

Looking at BioNTech through the lens of its price-to-sales ratio, the picture shifts. The company is trading at 7.6x sales, which is notably higher than peer companies averaging 4x, and well above its fair ratio of 6.5x. This raises questions about potential overvaluation and future upside risk for investors.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BioNTech Narrative

If you see the story differently or want to weigh your own evidence, it’s easy to shape your own take using the latest data. Your perspective could be built in just a few minutes. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding BioNTech.

Looking for More Investment Ideas?

Smart investing means keeping ahead of the curve, so do not let new opportunities pass you by. Scan these handpicked markets and catch early movers most investors overlook.

- Unlock strong potential returns by targeting value with these 848 undervalued stocks based on cash flows before the crowd catches on.

- Boost your portfolio’s income with consistent payouts by evaluating these 24 dividend stocks with yields > 3% featuring yields over 3%.

- Seize the advantage in digital disruption, as these 81 cryptocurrency and blockchain stocks is paving new frontiers in finance and technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BioNTech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BNTX

BioNTech

A biotechnology company, develops and commercializes immunotherapies to treat cancer and infectious diseases in Germany.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives