- United States

- /

- Pharma

- /

- NasdaqCM:BLTE

Belite Bio (BLTE): Assessing Valuation After Phase 3 Stargardt Disease Trial Milestone

Reviewed by Kshitija Bhandaru

Belite Bio (NasdaqCM:BLTE) just hit a major milestone that has investors paying close attention, whether you have been watching from the sidelines or already hold shares. The company announced that the last participant has now completed their visit in the Phase 3 DRAGON clinical trial for Tinlarebant, their experimental treatment targeting Stargardt disease type 1, a rare and progressive vision disorder. This marks a key step toward possible regulatory approval, with results from the trial on the horizon and new drug application plans moving forward into next year.

It is not surprising that investors took notice. Over the past year, Belite Bio’s stock has rallied 45%, with most of that momentum building over the past three months. Recent news of a significant private placement alongside this clinical update adds another layer of confidence, suggesting that both institutional backers and the market see meaningful upside potential as the company moves closer to a commercialization decision.

With shares already on the move after this milestone, investors may now wonder whether Belite Bio remains undervalued for future growth in rare ophthalmology or if the market has already priced in the next major development.

Price-to-Book of 15.4x: Is it justified?

Based on the price-to-book ratio, Belite Bio shares appear expensive relative to the US Pharmaceuticals industry, which trades at a much lower average. The company’s price-to-book ratio currently stands at 15.4x, while the industry’s average is 2.1x.

The price-to-book ratio compares a company’s market value to its book value. This measure provides perspective on how much investors are willing to pay for its net assets. In pharmaceuticals and biotech, where R&D and future growth are critical, higher ratios can sometimes be justified, but this figure is significantly above peers.

This elevated valuation suggests that the market has priced in high expectations for future growth. The valuation may reflect anticipation of strong results from ongoing clinical trials or potential commercialization prospects. Investors should consider whether Belite Bio’s pipeline and earnings potential justify such a premium.

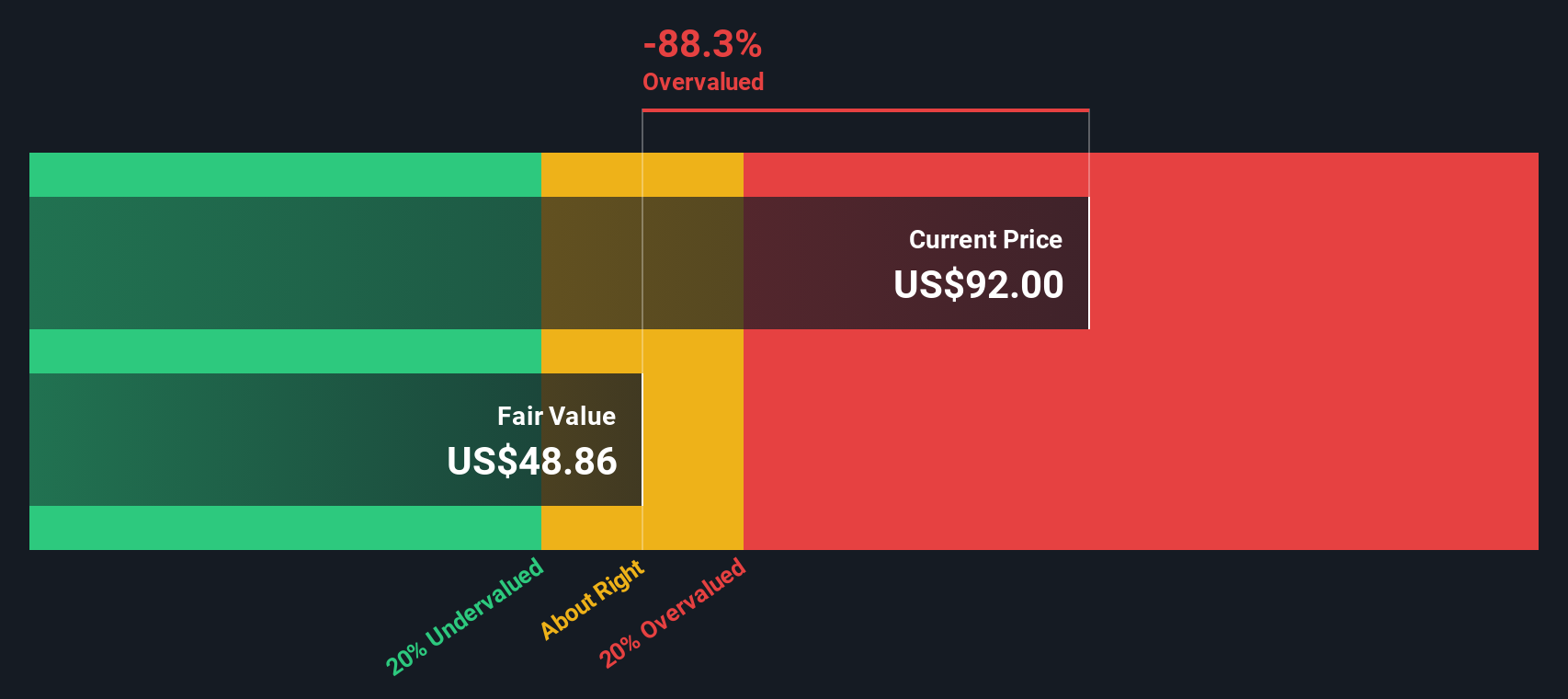

Result: Fair Value of $48.86 (OVERVALUED)

See our latest analysis for Belite Bio.However, uncertainty remains if trial results disappoint or if regulatory hurdles arise. Both of these factors could spark volatility in Belite Bio’s share price.

Find out about the key risks to this Belite Bio narrative.Another View: Discounted Cash Flow

Looking at Belite Bio through the lens of our DCF model tells a similar story as the earlier approach. This method suggests shares are trading above estimated fair value. But which outlook will the market trust most?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Belite Bio Narrative

If you want a different perspective or would rather analyze the numbers firsthand, it takes less than three minutes to craft your own view. Do it your way

A great starting point for your Belite Bio research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you want to stay ahead of the market, let yourself in on some of the most promising opportunities waiting just beyond Belite Bio. Make your next smart investment move and don’t miss out.

- Spot companies leading the artificial intelligence boom and seize new opportunities by checking out these AI penny stocks.

- Capture attractive yields and steady cash flow by starting with a selection of dividend stocks with yields > 3% for income-focused portfolios.

- Get in early on potential bargains by scouting undervalued stocks based on cash flows identified through robust cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Belite Bio might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BLTE

Belite Bio

A clinical stage biopharmaceutical drug development company, engages in the research and development of novel therapeutics targeting retinal degenerative eye diseases with unmet medical needs in the United States.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives