- United States

- /

- Biotech

- /

- NasdaqGS:BIIB

Is Biogen Now an Opportunity After Recent 25% Share Price Decline?

Reviewed by Bailey Pemberton

If you’re eyeing Biogen’s stock and wondering what your next move should be, you’re not alone. Biotech companies can feel unpredictable, but a closer look at Biogen reveals a story worth paying attention to, especially if you care about finding undervalued opportunities. Over the past year, Biogen’s share price has tumbled, dropping 24.9%. If we zoom out further, the declines are even sharper, with the stock down 45.8% over three years and 46.7% over five. Even just recently, there’s been little to spark enthusiasm, as the stock slid 4.9% in the last week alone.

What’s driving this cautious mood? Investors have grappled with shifting expectations in the biotech sector as a whole, plus the broader market’s changing appetite for riskier growth stories. Though no earth-shattering headlines have directly moved Biogen’s stock price lately, the company sits at the crossroads of innovation and uncertainty. This means sentiment can swing quickly.

But here’s where things get more interesting: when we run Biogen through our value assessment, the company scores a 5 out of 6. That’s a strong indicator Biogen may be undervalued by the market right now. If you’re considering whether there’s an opportunity hidden within those tough price charts, our next step is to dig into the different ways valuation is measured. And if you think numbers tell the whole story, stick around. By the end of this article, we’ll share a perspective that goes beyond the traditional valuation checklist.

Why Biogen is lagging behind its peers

Approach 1: Biogen Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and then discounting them back to today's value. This approach aims to determine what those future dollars are truly worth in present terms, making it a cornerstone for long-term investors looking for value.

Biogen currently generates an annual free cash flow of approximately $1.85 billion. Analyst forecasts suggest that Biogen's free cash flow will grow from around $2.82 billion in 2026 to about $2.80 billion by 2029. Beyond that, projections are extrapolated rather than based on consensus. All these figures are in US dollars.

Applying the DCF model, the estimated intrinsic fair value for Biogen comes out to $358.56 per share. When compared to the stock's market price, this implies that Biogen is trading at a discount of 60.3 percent to its calculated fair value. In short, the market may be significantly underestimating the company's future cash generation potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Biogen is undervalued by 60.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Biogen Price vs Earnings

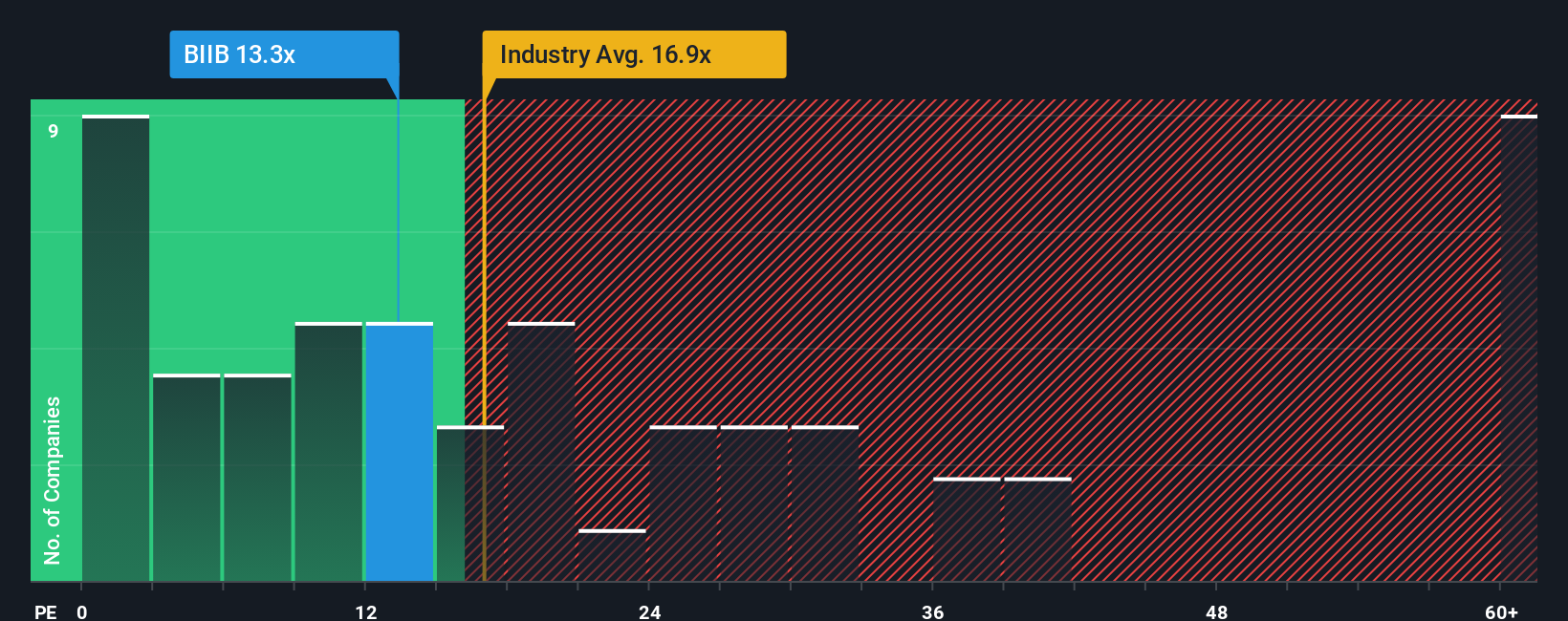

The Price-to-Earnings (PE) ratio is often the go-to valuation metric for profitable companies because it ties a company's stock price directly to its earnings, giving investors a straightforward way to assess value. For established firms like Biogen that consistently generate profits, the PE ratio helps you gauge how much you're paying for each dollar of earnings today.

However, a "normal" or "fair" PE ratio is not set in stone. It shifts based on expectations for a company’s future growth, its risk profile, and how much faith the market has in stable profits ahead. In fast-growing or low-risk environments, investors typically accept higher PE ratios, whereas companies facing uncertainty tend to see lower ones.

Biogen currently trades at a PE ratio of 13.6x. That is below both the biotech industry average of 17.2x and the peer group average of 23.0x. Simply Wall St’s proprietary Fair Ratio for Biogen stands at 19.7x, reflecting its unique mix of moderate growth, profitability, industry context, and company-specific factors.

The Fair Ratio goes deeper than traditional benchmarks. It accounts for more than just peer comparisons or industry norms by integrating Biogen’s expected earnings growth, business model, risk factors, and market standing. This provides a more tailored, realistic benchmark for valuation than simply using broad averages alone.

Compared with the Fair Ratio of 19.7x, Biogen's current PE of 13.6x signals the stock is attractively valued, as the market price is lower than what the underlying fundamentals and growth prospects might suggest.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Biogen Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. Narratives are simple, story-driven forecasts that let you set your own perspective on a company by connecting its business story with your assumptions about future revenue, profits, and fair value.

With Narratives, you do not just look at the numbers. You make sense of them by tying Biogen’s real-world opportunities and risks directly to a financial forecast and intrinsic value. Narratives offer a dynamic and accessible tool housed right on the Simply Wall St Community page, where millions of investors post and refine their views.

This approach helps you decide when to buy, hold, or sell by making it easy to compare your estimated Fair Value to today’s market price. Narratives update automatically whenever fresh news or earnings are released, ensuring your outlook stays relevant and responsive.

For Biogen, some investors see strong growth in novel treatments and global expansion, supporting a fair value as bullish as $260.0 a share. Others worry about competition and pipeline risks, marking their fair value nearer to $128.0. With Narratives, you can create your own version of the story, check it against the market, and gain the clarity and confidence you need, all in one place.

Do you think there's more to the story for Biogen? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Biogen might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BIIB

Biogen

Biogen Inc. discovers, develops, manufactures, and delivers therapies for treating neurological and neurodegenerative diseases in the United States, Europe, Germany, Asia, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives