- United States

- /

- Pharma

- /

- NasdaqCM:BFRI

The Market Doesn't Like What It Sees From Biofrontera Inc.'s (NASDAQ:BFRI) Revenues Yet As Shares Tumble 43%

Unfortunately for some shareholders, the Biofrontera Inc. (NASDAQ:BFRI) share price has dived 43% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 81% loss during that time.

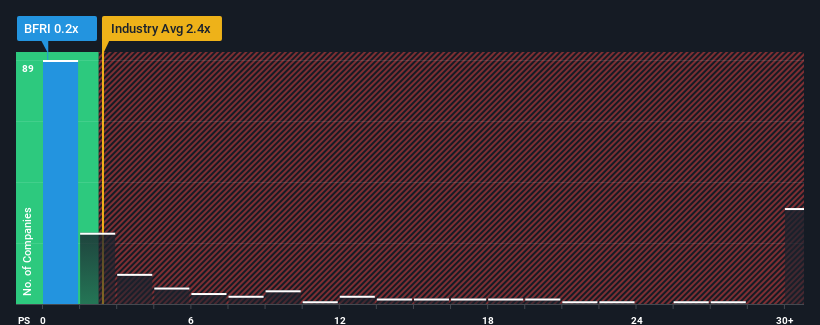

Following the heavy fall in price, Biofrontera may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.2x, considering almost half of all companies in the Pharmaceuticals industry in the United States have P/S ratios greater than 2.4x and even P/S higher than 15x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

See our latest analysis for Biofrontera

How Biofrontera Has Been Performing

Recent times haven't been great for Biofrontera as its revenue has been rising slower than most other companies. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Biofrontera will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

Biofrontera's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 21% last year. The latest three year period has also seen an excellent 78% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 30% per year as estimated by the two analysts watching the company. With the industry predicted to deliver 39% growth per annum, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why Biofrontera's P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

Shares in Biofrontera have plummeted and its P/S has followed suit. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As expected, our analysis of Biofrontera's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 3 warning signs for Biofrontera (1 shouldn't be ignored!) that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Biofrontera might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:BFRI

Biofrontera

A biopharmaceutical company, engages in the commercialization of pharmaceutical products for the treatment of dermatological conditions in the United States.

High growth potential with slight risk.

Market Insights

Community Narratives