- United States

- /

- Biotech

- /

- NasdaqGS:BEAM

Beam Therapeutics (BEAM): Evaluating Valuation After FDA Orphan Drug News Sparks Investor Optimism

Reviewed by Simply Wall St

Beam Therapeutics (BEAM) jumped 17% after announcing that its BEAM-302 program received FDA Orphan Drug designation. This regulatory milestone highlights significant progress in the company’s rare disease gene-editing initiatives.

See our latest analysis for Beam Therapeutics.

Beam Therapeutics’ share price has rebounded impressively in recent months, with a sharp 32% 90-day return that reflects growing optimism driven by regulatory milestones and a resurgent gene-editing sector. Despite notable volatility, its most recent 1-year total shareholder return stands at nearly 27%. This suggests momentum may be building as confidence in its pipeline grows.

If you’re interested in spotting other promising plays in healthcare and biotech, it’s a great moment to browse See the full list for free.

With shares still trading well below average analyst price targets despite recent gains, the question for investors now is whether Beam Therapeutics remains undervalued or if the latest rally already reflects its future growth potential.

Most Popular Narrative: 39.7% Undervalued

Compared to the last close at $27.68, the most widely watched narrative pegs Beam Therapeutics’ fair value above current levels and sets the stage for a deeper look at what’s driving this outlook.

Beam Therapeutics is focusing on advancing their two core franchises in hematology and liver genetic diseases, with promising lead programs BEAM-101 for sickle cell disease and BEAM-302 for alpha-1 antitrypsin deficiency. Both show strong preclinical validation, which could lead to increased revenue from new treatments.

Curious what’s fueling this bullish perspective? The narrative hinges on aggressive revenue growth projections, ambitious profit targets, and a sky-high future valuation ratio that sets Beam apart from typical biotech plays. Find out what assumptions are stacked in this dramatic forecast.

Result: Fair Value of $45.92 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing safety concerns with chemotherapy-based conditioning and reliance on early-stage data could slow progress and limit near-term revenue growth for Beam.

Find out about the key risks to this Beam Therapeutics narrative.

Another View: Multiples Raise Caution

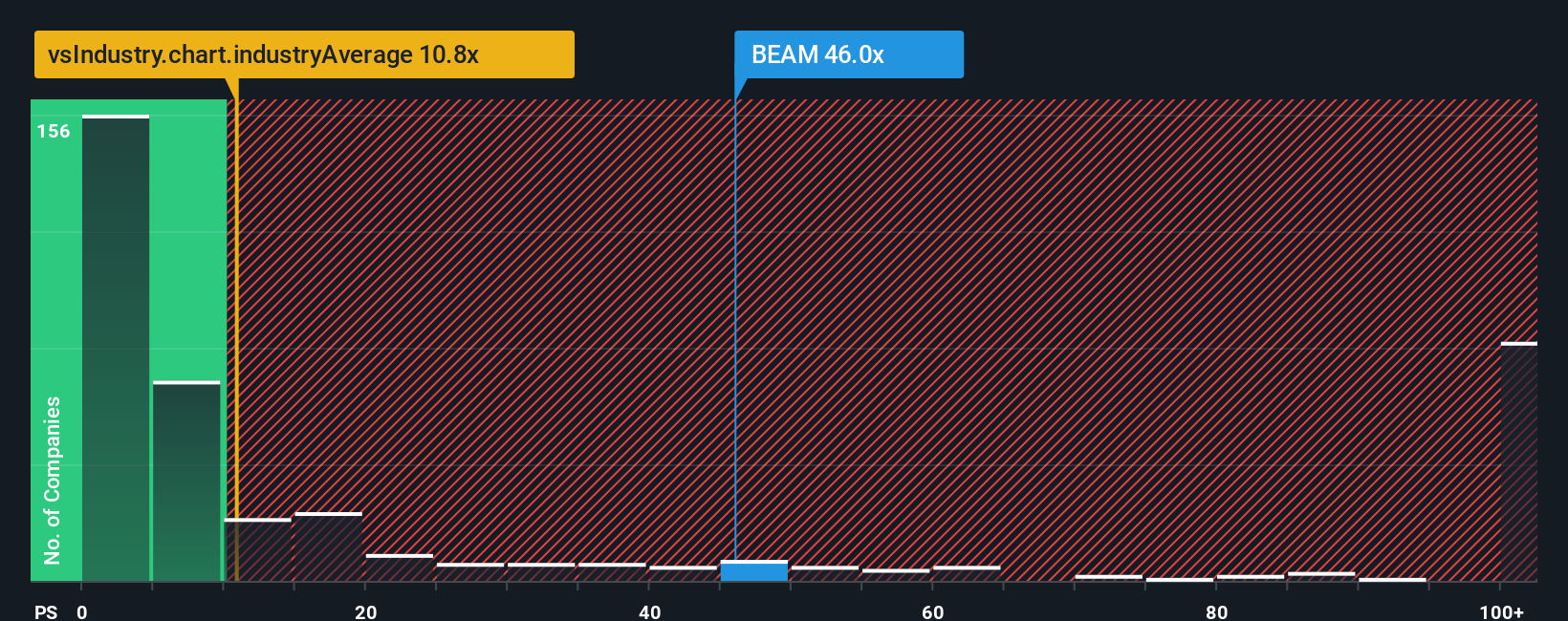

While analyst forecasts point to upside, Beam Therapeutics’ price-to-sales ratio stands at 45.1x, far above both the US Biotechs industry average of 11.3x and the peer average of 13.6x. This substantial premium means investors are paying well above typical levels, adding both risk and expectation for future growth. Could such a high valuation be justified, or is optimism running ahead of fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Beam Therapeutics Narrative

If you’d rather form your own view or want to dig into the underlying numbers yourself, you’re invited to build a personalized Beam Therapeutics thesis in just a few minutes. Do it your way

A great starting point for your Beam Therapeutics research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Ready for More Opportunities?

Set your investments up for success by checking out these unique stock ideas proven to spark portfolio growth and uncover tomorrow’s winners before everyone else takes notice.

- Tap into a wave of fresh growth by uncovering these 875 undervalued stocks based on cash flows, which are trading below their intrinsic value but still packed with long-term potential.

- Catch surging returns from the tech frontier by researching these 26 AI penny stocks, designed for breakthroughs in artificial intelligence and next-generation innovation.

- Strengthen your income stream with these 17 dividend stocks with yields > 3% delivering consistent yields above 3%, which are suited for building reliable wealth over time.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beam Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BEAM

Beam Therapeutics

A biotechnology company, engages in the development of precision genetic medicines for patients suffering from serious diseases in the United States.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives