- United States

- /

- Biotech

- /

- NasdaqGS:BEAM

Beam Therapeutics (BEAM): Evaluating Valuation After Analyst Coverage Highlights Precision Medicine Progress

Reviewed by Simply Wall St

Recent coverage from Evercore ISI has put Beam Therapeutics (BEAM) in the spotlight, highlighting progress in gene editing as well as interest around upcoming BEAM-302 data, which is expected to be released in early 2026.

See our latest analysis for Beam Therapeutics.

Beam Therapeutics has seen a burst of momentum, with the share price climbing 53% over the past 90 days as investors react to analyst optimism and the buzz surrounding BEAM-302’s future data. Even so, the one-year total shareholder return remains negative. This reflects both recent excitement and the longer climb back from past declines.

Curious about which healthcare stocks are also seeing renewed attention? Discover the next set of opportunities with our See the full list for free.

With shares now well off their lows and analyst price targets implying room for further gains, the key question is whether Beam Therapeutics remains undervalued or if the market has already accounted for all future growth potential.

Most Popular Narrative: 73.7% Undervalued

With Beam Therapeutics’ narrative fair value set at $65 per share versus a last close of $25.03, proponents see a major disconnect between price and potential. This context sets the tone for an in-depth, conviction-driven bull thesis that hinges on technological breakthroughs and pipeline catalysts.

This sum-of-the-parts rNPV analysis of only the two lead assets (BEAM-101 and BEAM-302) derives a base-case intrinsic value of $65 per share. This valuation is based on the following key assumptions from the report: • BEAM-302 (AATD): Assigned a 45% Probability of Success (POS). The model assumes a $3.0 million price and projects $6.0 billion in peak unadjusted annual sales. This program alone contributes $38 per share to the rNPV model.

Want to know what’s powering that sky-high value? One core program with blockbuster sales potential anchors the thesis. The specific sales, success rates, and assumed pricing behind this number might surprise you. Curious which pipeline candidate drives nearly all the narrative’s upside? Don’t miss the deeper details—see the math for yourself.

Result: Fair Value of $65 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, setbacks in clinical trials or delays in regulatory approval could quickly challenge the bullish case and change investor sentiment.

Find out about the key risks to this Beam Therapeutics narrative.

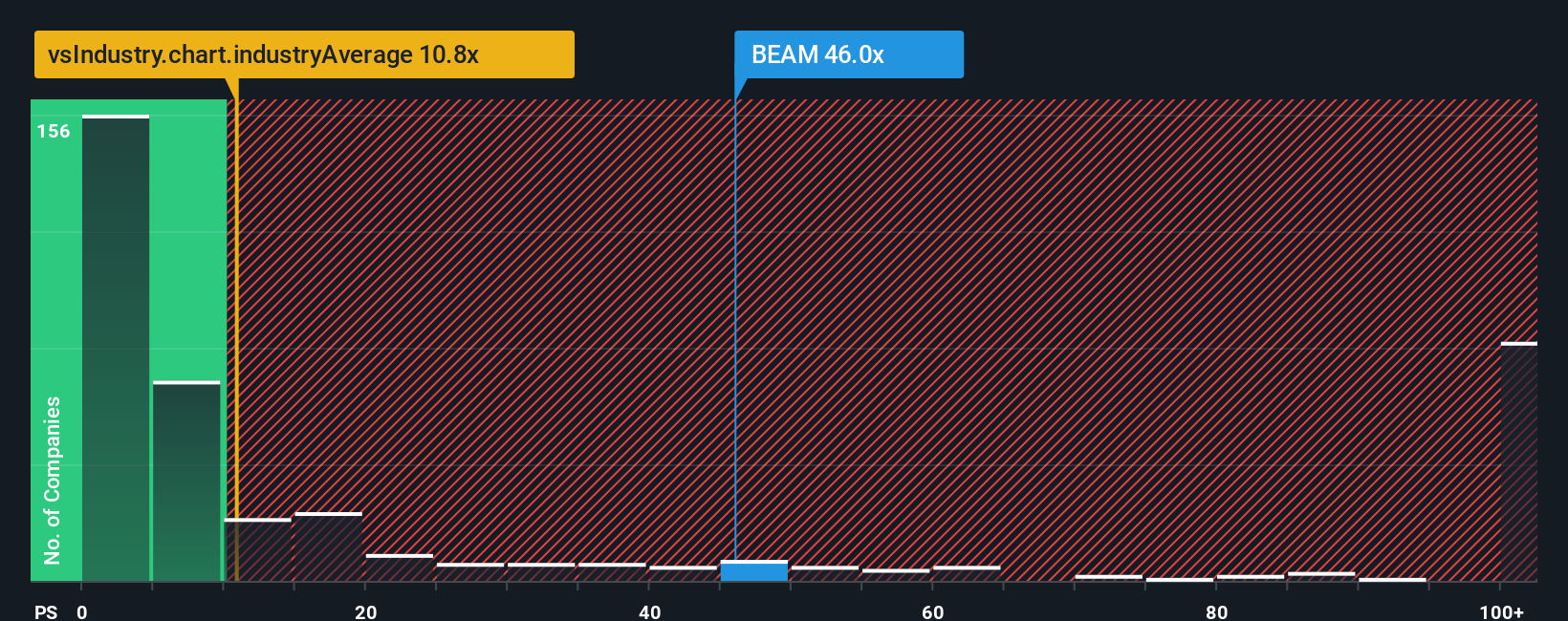

Another View: Price-to-Sales Sends a Warning

While the narrative fair value points to Beam Therapeutics being deeply undervalued, a look at the price-to-sales ratio tells a different story. At 44.3 times sales, Beam’s valuation is dramatically higher than both the industry average of 13.1x and a peer group average of 20.5x. Compared to its estimated fair ratio of 0x, investors are paying a real premium. Is this confidence in the pipeline, or are expectations simply running hot?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Beam Therapeutics Narrative

If you see the story differently or want to dig through the numbers yourself, it’s easy to craft your own perspective in minutes. Do it your way

A great starting point for your Beam Therapeutics research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Ready for More Smart Investing Ideas?

Opportunities are moving fast, and you do not want to miss the next surge. Upgrade your strategy by looking beyond Beam and spotting tomorrow’s winners today.

- Unlock steady cash flow and potential market resilience by reviewing these 15 dividend stocks with yields > 3% offering yields above 3% for income-minded portfolios.

- Take advantage of the artificial intelligence trend by scouting these 25 AI penny stocks positioned to transform industries and harness emerging growth engines.

- Find undervalued gems that others may overlook and elevate your returns with these 928 undervalued stocks based on cash flows based on cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beam Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BEAM

Beam Therapeutics

A biotechnology company, engages in the development of precision genetic medicines for patients suffering from serious diseases in the United States.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.