- United States

- /

- Biotech

- /

- NasdaqGS:BCYC

Announcing: Bicycle Therapeutics (NASDAQ:BCYC) Stock Increased An Energizing 141% In The Last Year

When you buy shares in a company, there is always a risk that the price drops to zero. On the other hand, if you find a high quality business to buy (at the right price) you can more than double your money! Take, for example Bicycle Therapeutics plc (NASDAQ:BCYC). Its share price is already up an impressive 141% in the last twelve months. It's also up 41% in about a month. Bicycle Therapeutics hasn't been listed for long, so it's still not clear if it is a long term winner.

Check out our latest analysis for Bicycle Therapeutics

Given that Bicycle Therapeutics didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over the last twelve months, Bicycle Therapeutics' revenue grew by 23%. That's a fairly respectable growth rate. The revenue growth is decent but the share price had an even better year, gaining 141%. If the profitability is on the horizon then now could be a very exciting time to be a shareholder. Of course, we are always cautious about succumbing to 'fear of missing out' when a stock has shot up strongly.

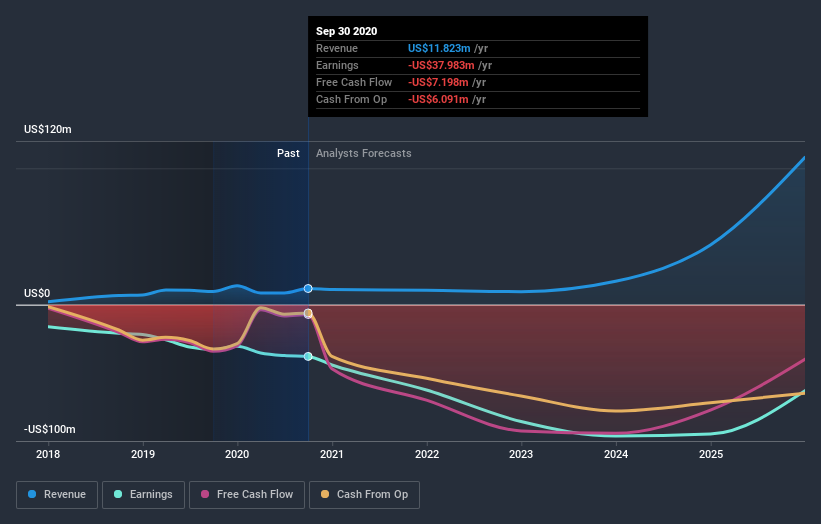

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on Bicycle Therapeutics' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Bicycle Therapeutics shareholders should be happy with the total gain of 141% over the last twelve months. A substantial portion of that gain has come in the last three months, with the stock up 40% in that time. Demand for the stock from multiple parties is pushing the price higher; it could be that word is getting out about its virtues as a business. It's always interesting to track share price performance over the longer term. But to understand Bicycle Therapeutics better, we need to consider many other factors. For example, we've discovered 4 warning signs for Bicycle Therapeutics (1 makes us a bit uncomfortable!) that you should be aware of before investing here.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you decide to trade Bicycle Therapeutics, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Bicycle Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:BCYC

Bicycle Therapeutics

A clinical-stage pharmaceutical company, develops a class of medicines for diseases that are underserved by existing therapeutics in the United States and the United Kingdom.

Flawless balance sheet with limited growth.

Market Insights

Community Narratives