- United States

- /

- Biotech

- /

- NasdaqGM:BCAX

How FDA Breakthrough Status And Early Data At Bicara Therapeutics (BCAX) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Bicara Therapeutics recently reported early Phase 1b expansion cohort data for its antibody-cytokine fusion ficerafusp alfa plus pembrolizumab in first-line HPV-negative recurrent/metastatic head and neck squamous cell carcinoma, alongside a Breakthrough Therapy Designation from the US FDA for this combination.

- These milestones highlight how regulators are signaling potential clinical relevance in a difficult-to-treat, biomarker-defined population, which could reshape expectations for Bicara’s lead program.

- We’ll now examine how the Breakthrough Therapy Designation shapes Bicara’s investment narrative and what it could mean for future development.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Bicara Therapeutics' Investment Narrative?

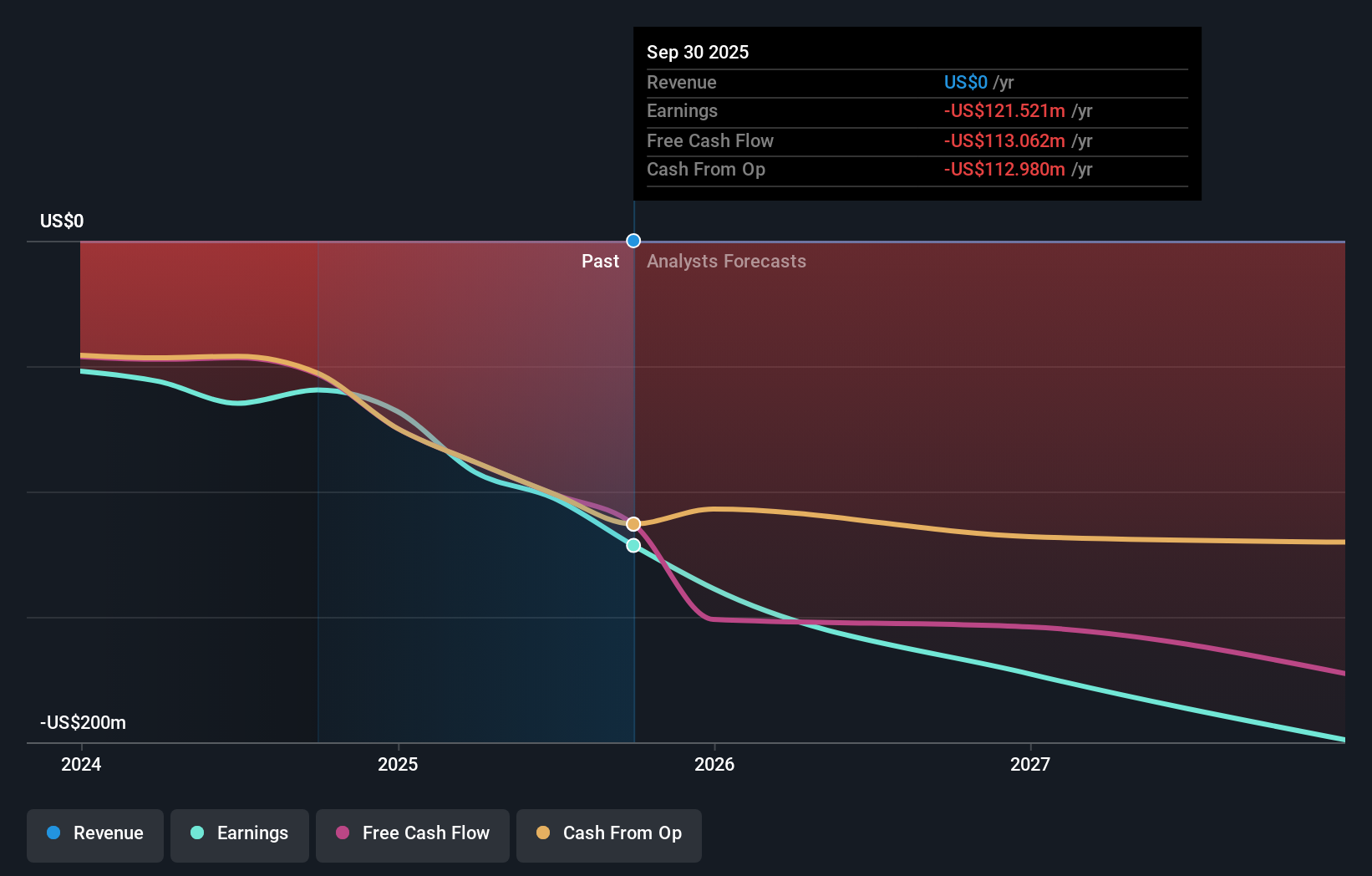

For Bicara, the investment case really comes down to whether you believe ficerafusp alfa can translate its early head and neck cancer data into a viable, de‑risked commercial pathway. The recent ESMO Asia abstract and FDA Breakthrough Therapy Designation sharpen that narrative by putting more focus on the pivotal FORTIFI‑HN01 trial as the central short term catalyst, while also raising the stakes if data or timelines disappoint. With no revenue, widening losses of about US$100.56 million year to date, and an at‑the‑market US$150 million equity program in place, the key risks remain clinical execution, financing needs, and dilution. Given the stock’s sharp move over the past three months, this news flow feels material, as it can influence both market confidence and Bicara’s ability to raise capital on reasonable terms.

However, one issue around future funding and shareholder dilution is easy to overlook but important. In light of our recent valuation report, it seems possible that Bicara Therapeutics is trading beyond its estimated value.Exploring Other Perspectives

Explore another fair value estimate on Bicara Therapeutics - why the stock might be worth just $32.57!

Build Your Own Bicara Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bicara Therapeutics research is our analysis highlighting 4 important warning signs that could impact your investment decision.

- Our free Bicara Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bicara Therapeutics' overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bicara Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:BCAX

Bicara Therapeutics

A clinical-stage biopharmaceutical company, engages in the development of bifunctional therapies for solid tumors.

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026