- United States

- /

- Biotech

- /

- NasdaqGS:BBIO

Is BridgeBio’s Rally Justified After Clinical Trial Success and Recent Pullback?

Reviewed by Bailey Pemberton

Thinking about what to do next with BridgeBio Pharma stock? You are definitely not alone. Investors have been buzzing, especially as the company’s price swings have turned a few heads. BridgeBio’s shares last closed at $53.24 and have pulled back 6.0% in the past week, but that dip comes after a big rally. This year, the stock has soared an eye-popping 88.8%, and if you zoom out to the past year, it is up a staggering 117.8%. Even more impressive, if you had held on for three years, you would have seen nearly 390% returns. That kind of performance always attracts attention, but what is behind these numbers?

Much of the excitement traces back to clinical milestones and fresh regulatory updates that have helped boost investor optimism, not just for growth prospects but also for reduced perception of risk around the company’s pipeline. Positive trial results in BridgeBio’s rare disease programs and progress towards key FDA submissions have added fuel to the fire of speculation. While some of these headlines have sparked quick gains, investors are now asking whether all the good news is already factored into the price or if there is still value to be found.

When we look at BridgeBio Pharma through a strict valuation lens, the company scores a 2 out of 6 for undervalued checks. This means it passes in two areas that suggest undervaluation. But numbers only tell part of the story. Let’s walk through the main valuation methods investors use, and stick with me to the end, where I will share a more useful way to decide if BridgeBio is truly a smart buy today.

BridgeBio Pharma scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: BridgeBio Pharma Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a company is worth today by forecasting its future cash flows and discounting them back to the present. For BridgeBio Pharma, this involves projecting how much money the company is expected to generate over the next decade and then adjusting for the risk and time value of money.

Currently, BridgeBio’s Free Cash Flow (FCF) is negative, sitting at -$665.3 Million. However, analysts expect rapid improvement. Cash flow projections grow from an estimated -$285.7 Million in 2026 to $1.19 Billion by 2029. Beyond 2029, further increases are extrapolated, and by 2035 the model estimates FCF could reach over $3.62 Billion. These forecasts are in US dollars and reflect both analyst consensus and modeled growth.

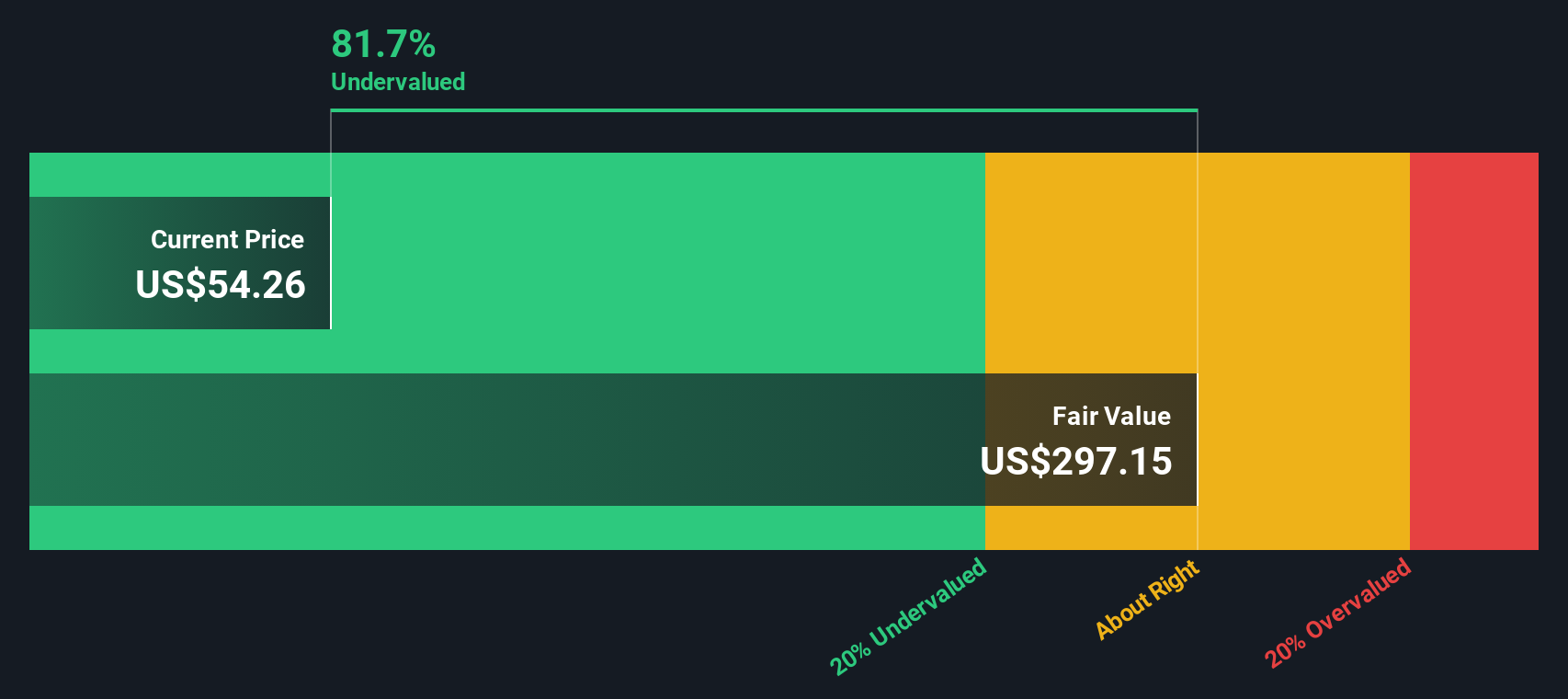

After discounting these future cash flows back to today, the DCF approach calculates an intrinsic value of $297.76 for BridgeBio Pharma stock. Based on the latest share price around $53.24, the DCF model suggests the stock is trading at an 82.1% discount to its estimated fair value, indicating a large margin of undervaluation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests BridgeBio Pharma is undervalued by 82.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: BridgeBio Pharma Price vs Sales

For companies like BridgeBio Pharma that are not yet profitable, the Price-to-Sales (P/S) ratio is often the preferred way to gauge valuation. This is because the P/S ratio allows investors to compare the stock price to the company’s actual revenue, which can be more meaningful than earnings when a business is early in its growth cycle or investing heavily for future expansion.

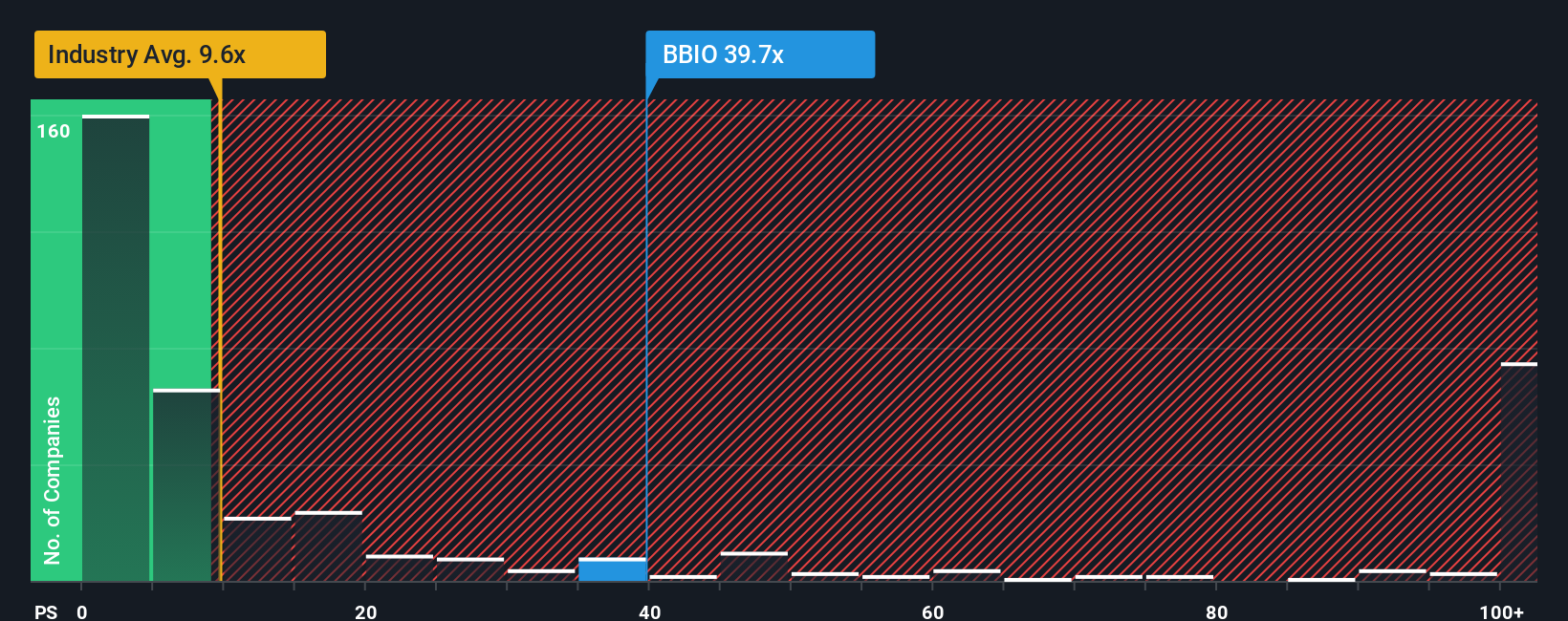

Higher growth prospects and greater business risks both influence what counts as a “normal” or fair multiple. A fast-growing company in a promising field may justify a higher P/S ratio, while a steady or less risky company would require a lower one. Looking at BridgeBio Pharma today, the company trades at a P/S ratio of 43.2x. This is much higher than the biotech industry average of 11.3x and the peer average of about 19x.

To provide a more tailored benchmark, Simply Wall St has developed the “Fair Ratio.” This proprietary metric adjusts for measures like earnings growth, risk profile, profit margins, market capitalization, and industry norms. It offers a more comprehensive take than just industry or peer comparisons. For BridgeBio, the Fair Ratio comes in at 24.2x, reflecting these company-specific factors.

Comparing BridgeBio Pharma’s actual P/S of 43.2x to its Fair Ratio of 24.2x suggests the stock is trading well above its likely justified level. While the company’s growth is compelling, the current price reflects a lot of optimism already.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your BridgeBio Pharma Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your story behind the numbers; it is how you connect what you believe about a company’s future with a straightforward forecast of its financials, which then leads to an estimated fair value. Narratives make investing more approachable because they allow you to lay out your expectations for revenue growth, profit margins, and future milestones in plain language, backed up by actual numbers, so you can see the logic behind your price target.

Available on the Simply Wall St Community page, and used by millions of investors, Narratives help you decide when to buy or sell by letting you compare your personal fair value with the current price in real time. What makes Narratives powerful is that they update dynamically whenever big news or earnings hit, so your perspective always reflects the latest developments.

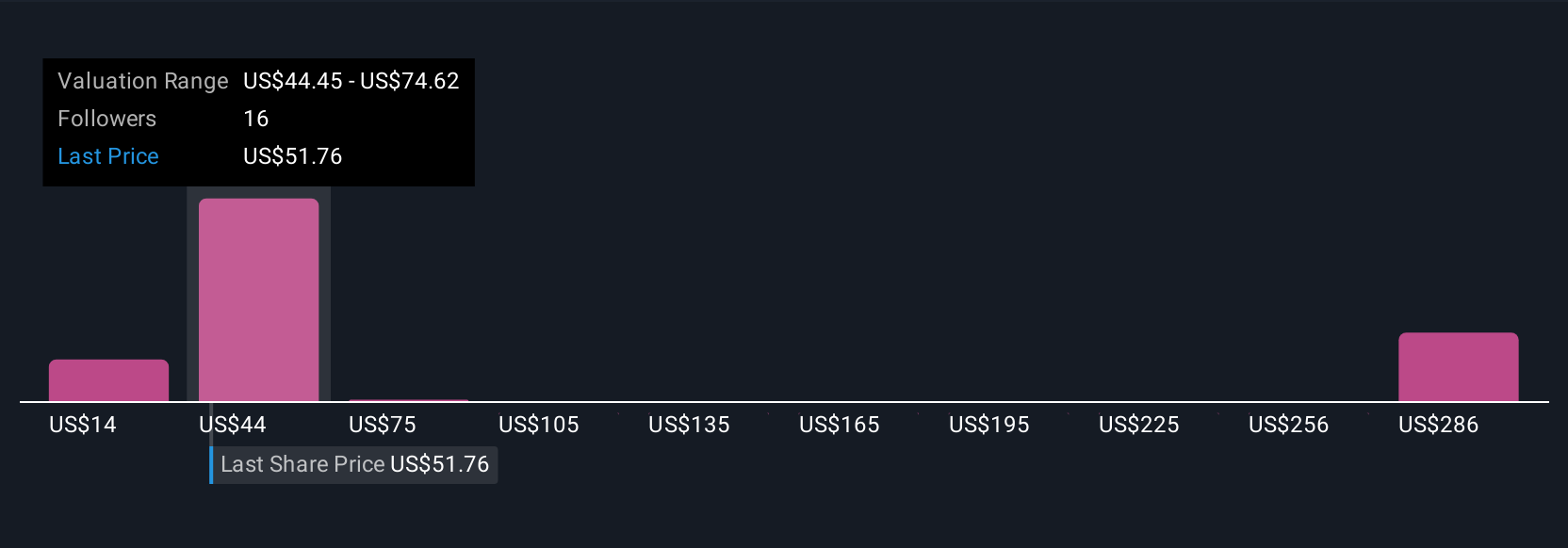

For example, one investor’s BridgeBio Pharma Narrative might assume rapid commercial ramp-up, pipeline wins, and see fair value as high as $95 per share; another, more cautious investor may focus on profit risks and competitive threats, estimating fair value closer to $41. These differences illustrate the value of building and refining your own Narrative based on what you believe is likely, and letting updated insights guide your next move.

Do you think there's more to the story for BridgeBio Pharma? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BridgeBio Pharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BBIO

BridgeBio Pharma

A commercial-stage biopharmaceutical company, discovers, creates, tests, and delivers transformative medicines to treat patients who suffer from genetic diseases and cancers.

High growth potential and slightly overvalued.

Market Insights

Community Narratives