- United States

- /

- Biotech

- /

- NasdaqGS:BBIO

A Valuation Check on BridgeBio Pharma (BBIO) After New ATTRibute-CM Data at HFSA 2025

Reviewed by Kshitija Bhandaru

BridgeBio Pharma (BBIO) just released new results from its ATTRibute-CM study at the HFSA 2025 meeting, showing acoramidis cut cardiovascular deaths and recurrent hospitalizations in ATTR-CM patients within the first month of treatment.

The benefits of acoramidis compared to placebo were observed not just early on, but also persisted through 30 to 42 months. BridgeBio’s findings were simultaneously highlighted in a leading medical journal, giving investors a clearer view of the potential long-term impact of this therapy on patient outcomes and future commercial opportunities.

See our latest analysis for BridgeBio Pharma.

BridgeBio Pharma’s shares have steadily gained attention this year, supported not just by the newly published late-stage ATTRibute-CM results, but also by recent regulatory approvals for acoramidis across multiple major markets. The momentum is clearly building and is reflected in a robust 1-year total shareholder return of 108%, as well as a steady climb in recent months. This suggests that renewed confidence in their clinical pipeline is translating into real, long-term value for shareholders.

If you want more ways to spot companies driving progress in healthcare and biotech, check out See the full list for free..

This surge in shareholder value raises a pivotal question for investors: Is BridgeBio still trading at a discount based on its underlying strength, or is the market already factoring in all of its future growth potential?

Most Popular Narrative: 19.7% Undervalued

BridgeBio Pharma's most widely followed narrative sees the stock's fair value at $66.32, about 19.7% above the last close of $53.28. This positions the company as a compelling opportunity in the eyes of analysts expecting sustained growth based on recent clinical and commercial progress.

The company's late-stage pipeline, with three Phase III readouts imminent across high unmet need rare disease indications, positions BridgeBio to leverage advancements in biotechnology for potential first-to-market and best-in-class therapies. This creates the opportunity for multiple revenue inflection points and margin improvement as the portfolio diversifies.

This narrative's math goes far beyond standard growth assumptions. The driving factors include strong sales momentum, optimistically higher future profit margins, and a forward PE ratio comparable to some of biotech’s leading companies. What bold forecasts power such a premium? Only the full narrative reveals the details behind this ambitious fair value.

Result: Fair Value of $66.32 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, BridgeBio’s future hinges on the success of its late-stage pipeline and continued dominance of Attruby. Both face significant competitive threat.

Find out about the key risks to this BridgeBio Pharma narrative.

Another View: Multiples Paint a Different Picture

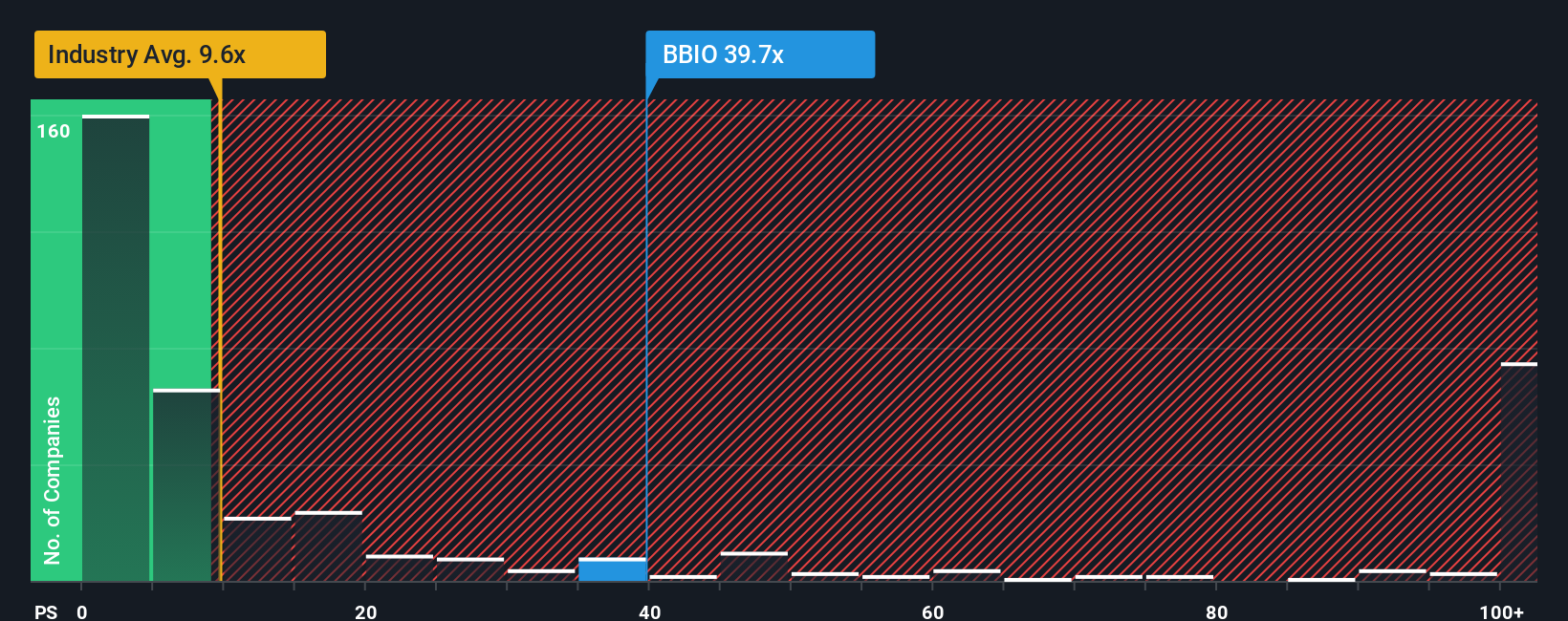

While analyst forecasts suggest BridgeBio Pharma is undervalued based on future growth, its price-to-sales ratio stands at 43.2x. This is much higher than both the US biotech industry average of 9.7x and its fair ratio of 24.3x. The premium valuation signals significant expectations built into the current share price. Could this optimism leave little margin for error if growth slows?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BridgeBio Pharma Narrative

If you think the current narratives don’t quite capture your perspective, explore the data and build your own view in just a few minutes with Do it your way.

A great starting point for your BridgeBio Pharma research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Sharpen your investing outlook by using these handpicked screeners to find fast-moving companies and new trends before the crowd does. You don’t want to miss these growth stories.

- Uncover big potential in technology by evaluating companies leading the AI revolution with these 24 AI penny stocks, a powerful tool for the next wave of digital transformation.

- Boost your portfolio’s earning power and stability by pinpointing top payers through these 19 dividend stocks with yields > 3%, focusing on consistent high-yield performance.

- Stay ahead of the curve in future computing by tracking pioneers via these 26 quantum computing stocks. Breakthroughs in quantum tech could spark significant gains.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BridgeBio Pharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BBIO

BridgeBio Pharma

A commercial-stage biopharmaceutical company, discovers, creates, tests, and delivers transformative medicines to treat patients who suffer from genetic diseases and cancers.

High growth potential and slightly overvalued.

Market Insights

Community Narratives