- United States

- /

- Biotech

- /

- NasdaqCM:ELUT

Little Excitement Around Aziyo Biologics, Inc.'s (NASDAQ:AZYO) Revenues As Shares Take 63% Pounding

Aziyo Biologics, Inc. (NASDAQ:AZYO) shareholders that were waiting for something to happen have been dealt a blow with a 63% share price drop in the last month. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 80% loss during that time.

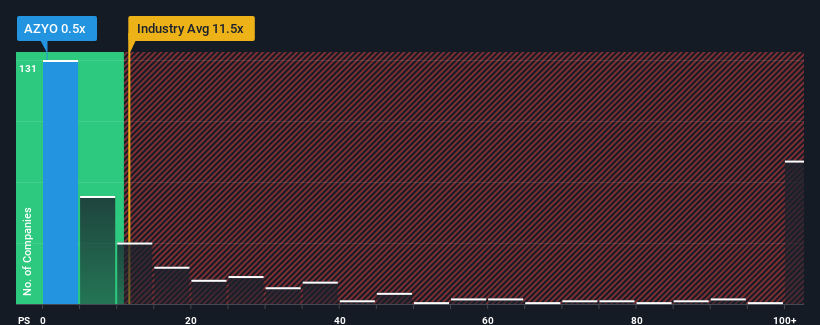

After such a large drop in price, Aziyo Biologics' price-to-sales (or "P/S") ratio of 0.5x might make it look like a strong buy right now compared to the wider Biotechs industry in the United States, where around half of the companies have P/S ratios above 11.5x and even P/S above 50x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Aziyo Biologics

How Has Aziyo Biologics Performed Recently?

Recent times haven't been great for Aziyo Biologics as its revenue has been rising slower than most other companies. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Aziyo Biologics.Is There Any Revenue Growth Forecasted For Aziyo Biologics?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Aziyo Biologics' to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 3.8%. Revenue has also lifted 15% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 20% during the coming year according to the sole analyst following the company. Meanwhile, the rest of the industry is forecast to expand by 83%, which is noticeably more attractive.

With this in consideration, its clear as to why Aziyo Biologics' P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Aziyo Biologics' P/S

Shares in Aziyo Biologics have plummeted and its P/S has followed suit. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Aziyo Biologics' analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

It is also worth noting that we have found 6 warning signs for Aziyo Biologics (3 are potentially serious!) that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Elutia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:ELUT

Elutia

A commercial-stage company, develops and commercializes drug-eluting biologics products for neurostimulation and breast reconstruction in the United States.

Medium-low and fair value.

Similar Companies

Market Insights

Community Narratives