- United States

- /

- Life Sciences

- /

- NasdaqGS:AZTA

Subdued Growth No Barrier To Azenta, Inc.'s (NASDAQ:AZTA) Price

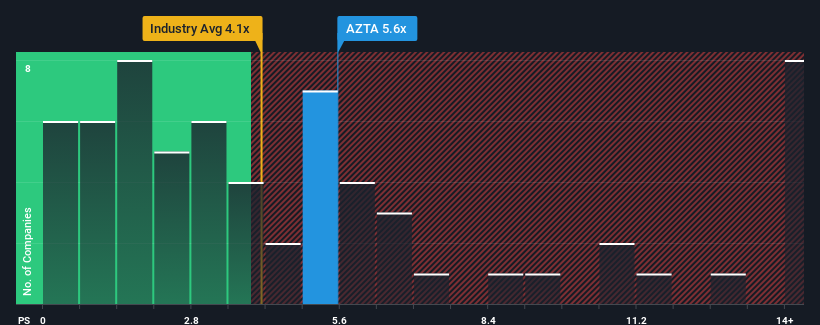

Azenta, Inc.'s (NASDAQ:AZTA) price-to-sales (or "P/S") ratio of 5.6x might make it look like a sell right now compared to the Life Sciences industry in the United States, where around half of the companies have P/S ratios below 4.1x and even P/S below 1.9x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Azenta

What Does Azenta's Recent Performance Look Like?

With its revenue growth in positive territory compared to the declining revenue of most other companies, Azenta has been doing quite well of late. It seems that many are expecting the company to continue defying the broader industry adversity, which has increased investors’ willingness to pay up for the stock. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Azenta's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as high as Azenta's is when the company's growth is on track to outshine the industry.

Taking a look back first, we see that the company grew revenue by an impressive 20% last year. The strong recent performance means it was also able to grow revenue by 71% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 6.6% per year during the coming three years according to the six analysts following the company. With the industry predicted to deliver 4.7% growth each year, the company is positioned for a comparable revenue result.

With this information, we find it interesting that Azenta is trading at a high P/S compared to the industry. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

The Bottom Line On Azenta's P/S

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Analysts are forecasting Azenta's revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for Azenta with six simple checks will allow you to discover any risks that could be an issue.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:AZTA

Azenta

Provides biological and chemical compound sample exploration and management solutions for the life sciences market in the United States, Africa, China, the United Kingdom, rest of Europe, the Asia Pacific, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives