- United States

- /

- Pharma

- /

- NasdaqGM:AVDL

Assessing Avadel Pharmaceuticals After Regulatory Milestones and 94.5% Share Price Surge in 2025

Reviewed by Bailey Pemberton

- Wondering if Avadel Pharmaceuticals’ stock is a hidden gem or priced to perfection? Let's break down what really matters for curious investors trying to spot value.

- After skyrocketing 94.5% year-to-date, with a recent 13.2% gain over the last month (even after a 7.1% pullback in the past week), Avadel’s price action is definitely worth a closer look. Big moves like these often reflect shifting views on growth or risk.

- These gains come on the heels of significant updates, including regulatory milestones that have reassured markets and product launches that have caught investor attention. This makes it more than just a momentum story. Analysts and observers have noted the optimism building around the company's latest strategic developments.

- On our valuation checks, Avadel Pharmaceuticals scores a 3 out of 6 for undervaluation, which means there's room for debate over whether its price reflects true worth. Let’s dig into the different ways to value this stock, and be sure to stick around for a fresh perspective on valuation at the end.

Approach 1: Avadel Pharmaceuticals Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s worth by projecting its future cash flows and then discounting them back to their present value. This method aims to answer what Avadel Pharmaceuticals is truly worth today, based on expected cash it can generate in the future.

Currently, Avadel’s Free Cash Flow stands at $10.78 million. Analysts project growth over the coming years, with the company’s Free Cash Flow estimated to reach $144 million by 2029. Estimates for annual cash flow gradually increase each year throughout this period. For long-range forecasts (years six to ten), the DCF model applies moderate growth rates to extend beyond the estimates analysts have directly provided.

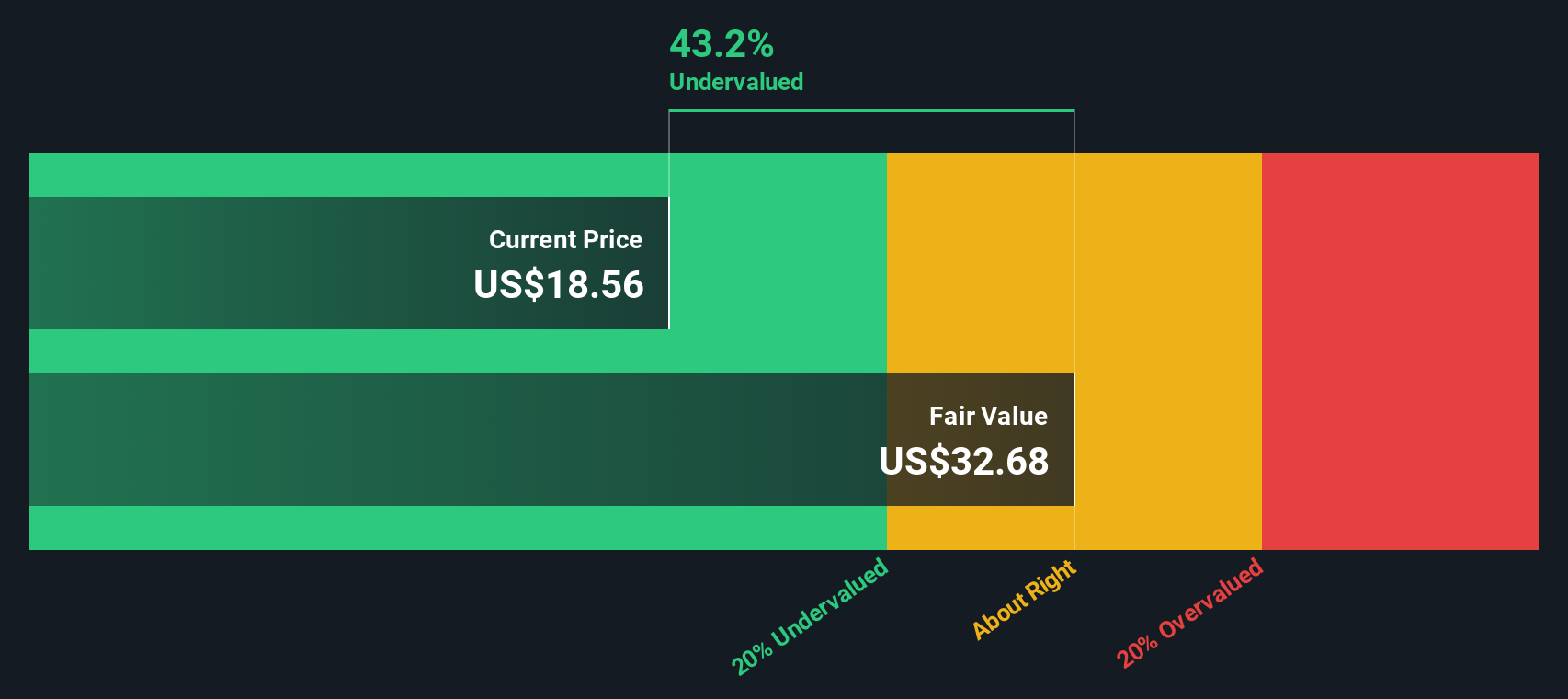

According to the DCF result, Avadel's intrinsic value per share is $32.36. This valuation suggests the stock is trading at a 33.9% discount compared to its estimated fair value, indicating significant potential upside.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Avadel Pharmaceuticals is undervalued by 33.9%. Track this in your watchlist or portfolio, or discover 923 more undervalued stocks based on cash flows.

Approach 2: Avadel Pharmaceuticals Price vs Sales

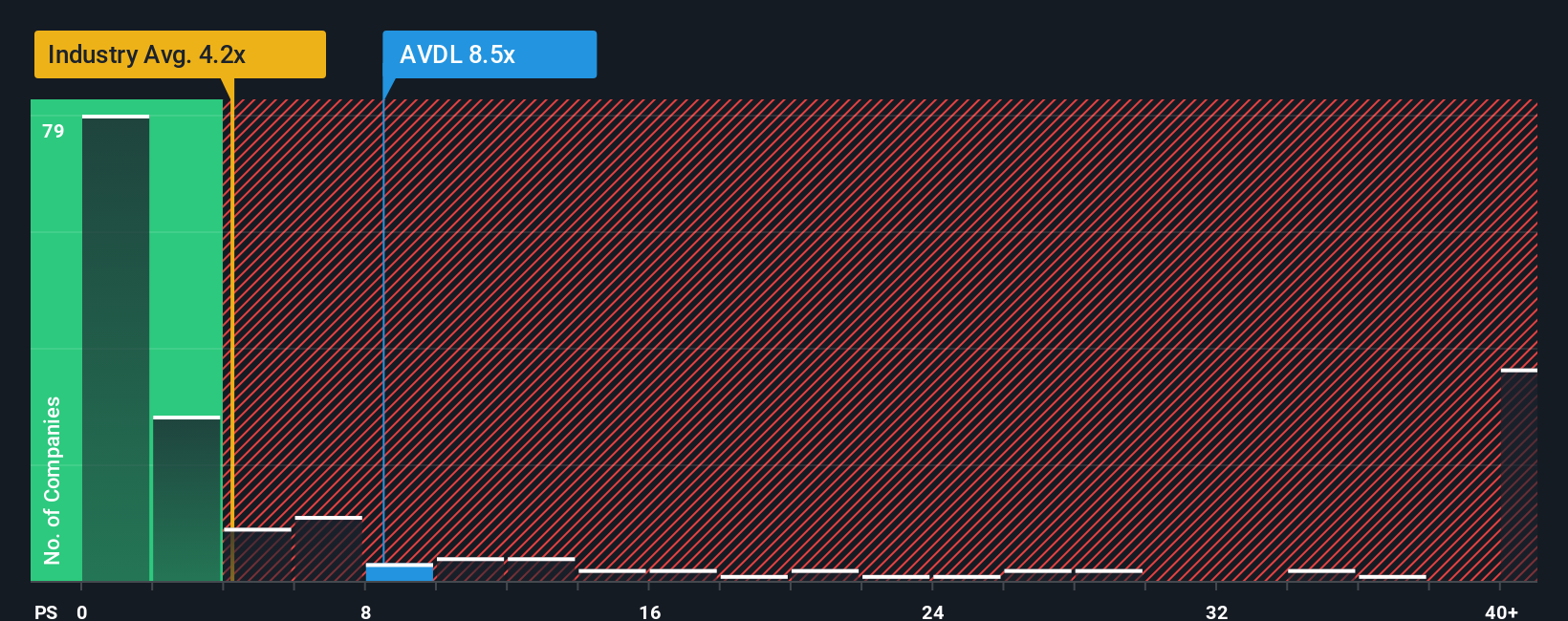

The Price-to-Sales (P/S) ratio is a commonly used metric to value companies that are not yet profitable but show revenue growth, such as Avadel Pharmaceuticals. Since the company is reinvesting for future growth rather than producing steady profits today, a sales-based multiple provides a better sense of what investors are willing to pay for each dollar of revenue.

Market enthusiasm and risk tolerance often influence what is considered a “normal” P/S multiple in the sector. Highly optimistic growth expectations can increase this ratio, while a higher perceived risk tends to lower it. Comparing Avadel’s P/S to those of its industry and peers provides important context, but does not capture company-specific dynamics.

Avadel currently trades at an 8.4x P/S, which is almost double the Pharmaceuticals industry average of 4.2x, but well below the peer average of 29.1x. However, relying solely on these benchmarks can be misleading because they overlook company-specific variables such as growth rate, risk profile, profit margins, and market capitalization. Simply Wall St’s proprietary "Fair Ratio" adjusts the expected multiple in light of these more nuanced factors, creating a more realistic picture.

For Avadel, the Fair Ratio is set at 8.2x, which closely matches its current P/S ratio. The small difference suggests that Avadel’s shares are priced about right, considering its growth outlook, risks, and competitive position.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1438 companies where insiders are betting big on explosive growth.

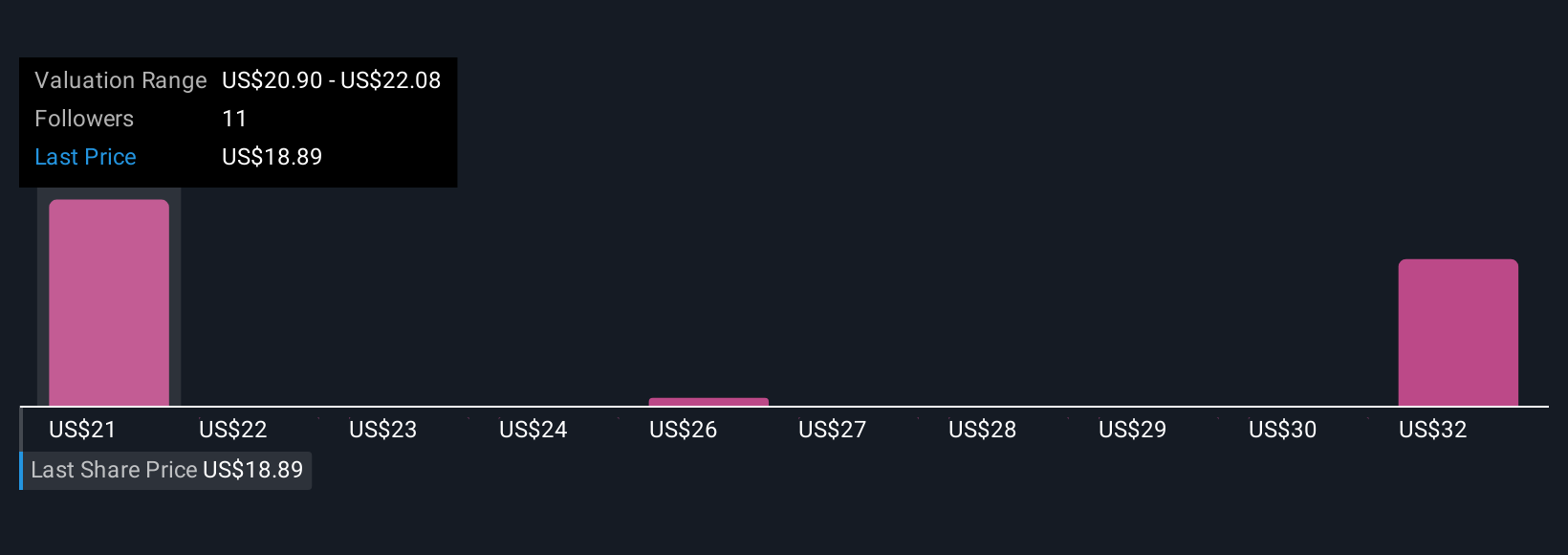

Upgrade Your Decision Making: Choose your Avadel Pharmaceuticals Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is the story and perspective you put behind the numbers, allowing you to frame your own expectations for Avadel Pharmaceuticals’ future, from revenue growth to profit margins, and see how those beliefs translate into fair value.

Unlike traditional valuation models, Narratives connect a company’s underlying story with your financial forecasts, so you can see how new developments, risks, or opportunities might change what the stock is really worth. This tool is available within the Community page on Simply Wall St, where millions of investors build, share, and discuss Narratives for every listed company.

Narratives empower you to make buy and sell decisions by easily comparing your calculated Fair Value with the latest market price, and they stay up to date as news, earnings, or events roll in. For example, one Narrative might assume Avadel grows revenue by 27% a year and deserves a $24 per share target, while a more cautious view might peg growth at 16% and a $16 per share target. No matter your stance, Narratives let you invest with clarity and conviction, constantly adapting as the story unfolds.

Do you think there's more to the story for Avadel Pharmaceuticals? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:AVDL

Avadel Pharmaceuticals

Operates as a biopharmaceutical company in the United States.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.