- United States

- /

- Pharma

- /

- NasdaqGM:AVDL

3 Prominent Stocks Estimated To Be Up To 35.1% Below Intrinsic Value

Reviewed by Simply Wall St

As the U.S. stock market shows signs of recovery with major indexes snapping recent losing streaks, investors are keeping a close watch on tech giants like Nvidia for insights into broader market trends. In this environment, identifying undervalued stocks can provide opportunities for growth, particularly when these equities are trading significantly below their intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| TowneBank (TOWN) | $32.29 | $62.85 | 48.6% |

| Perfect (PERF) | $1.74 | $3.45 | 49.6% |

| Northwest Bancshares (NWBI) | $11.34 | $22.10 | 48.7% |

| Horizon Bancorp (HBNC) | $15.74 | $30.81 | 48.9% |

| Hasbro (HAS) | $76.47 | $150.20 | 49.1% |

| Crocs (CROX) | $79.17 | $155.89 | 49.2% |

| Caris Life Sciences (CAI) | $23.90 | $46.82 | 49% |

| BILL Holdings (BILL) | $48.52 | $94.27 | 48.5% |

| Beacon Financial (BBT) | $24.64 | $48.61 | 49.3% |

| BCB Bancorp (BCBP) | $7.53 | $14.72 | 48.8% |

Below we spotlight a couple of our favorites from our exclusive screener.

Avadel Pharmaceuticals (AVDL)

Overview: Avadel Pharmaceuticals plc is a biopharmaceutical company operating in the United States with a market cap of approximately $2.24 billion.

Operations: The company's revenue is primarily derived from the development and commercialization of pharmaceutical products, totaling $248.52 million.

Estimated Discount To Fair Value: 28.9%

Avadel Pharmaceuticals is trading at US$23.10, below its estimated fair value of US$32.47, indicating potential undervaluation based on cash flows. The company is expected to achieve profitability within three years with earnings projected to grow significantly annually. Recent earnings show a turnaround from losses to a modest net income. A proposed acquisition by H. Lundbeck A/S for up to US$23 per share could impact future valuations and strategic direction, pending shareholder approval and regulatory review.

- Insights from our recent growth report point to a promising forecast for Avadel Pharmaceuticals' business outlook.

- Click here to discover the nuances of Avadel Pharmaceuticals with our detailed financial health report.

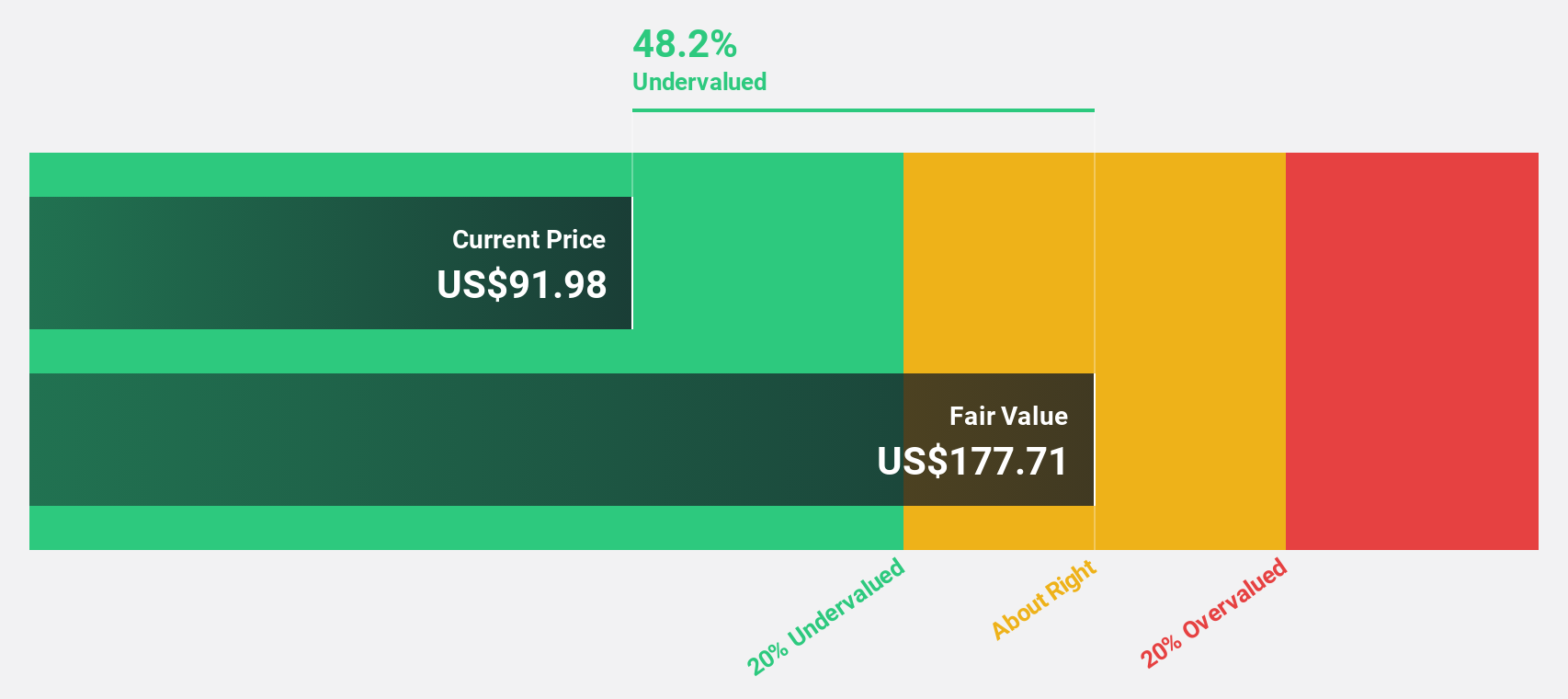

Rhythm Pharmaceuticals (RYTM)

Overview: Rhythm Pharmaceuticals, Inc. is a commercial-stage biopharmaceutical company specializing in treatments for rare neuroendocrine diseases, with a market cap of approximately $6.71 billion.

Operations: The company's revenue primarily comes from its pharmaceuticals segment, which generated $174.33 million.

Estimated Discount To Fair Value: 35.1%

Rhythm Pharmaceuticals is trading at US$103.15, significantly below its estimated fair value of US$158.83, highlighting potential undervaluation based on cash flows. The company is expected to become profitable within three years with revenue projected to grow 45.9% annually, outpacing the broader market's growth rate. Despite a recent increase in quarterly revenue to US$51.3 million, the net loss widened due to ongoing investments in product development and regulatory processes for setmelanotide's expanded indications.

- In light of our recent growth report, it seems possible that Rhythm Pharmaceuticals' financial performance will exceed current levels.

- Dive into the specifics of Rhythm Pharmaceuticals here with our thorough financial health report.

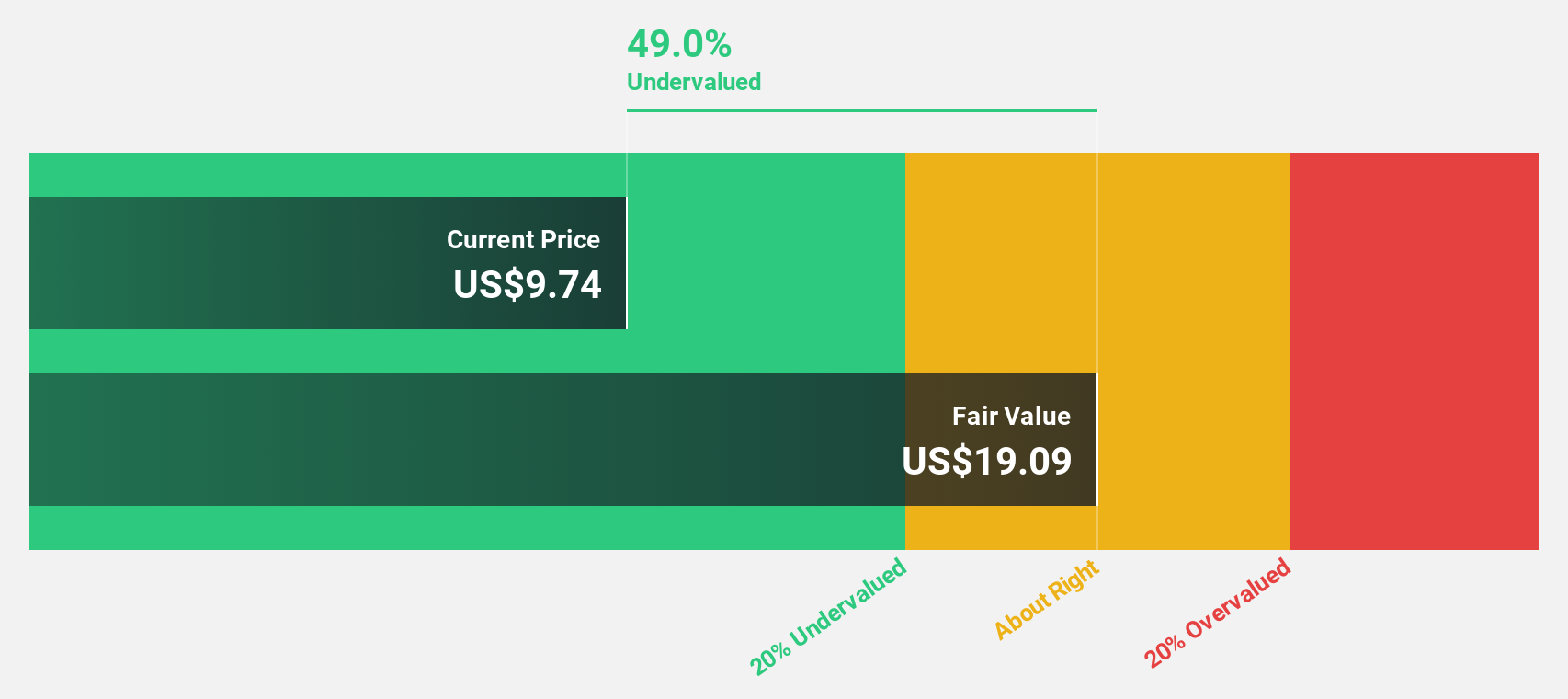

Semrush Holdings (SEMR)

Overview: Semrush Holdings, Inc. offers an online visibility management software-as-a-service platform globally and has a market cap of approximately $1.01 billion.

Operations: The company's revenue primarily comes from its Software & Programming segment, which generated $428.63 million.

Estimated Discount To Fair Value: 16.7%

Semrush Holdings is trading at US$11.76, slightly below its estimated fair value of US$14.12, suggesting potential undervaluation based on cash flows. Adobe's acquisition offer of US$2 billion underscores market confidence despite recent quarterly losses and slower revenue growth forecasts compared to peers. The company's innovative AI-driven products like Semrush One aim to enhance visibility and performance in the evolving digital landscape, potentially supporting future profitability expected within three years.

- The analysis detailed in our Semrush Holdings growth report hints at robust future financial performance.

- Get an in-depth perspective on Semrush Holdings' balance sheet by reading our health report here.

Summing It All Up

- Gain an insight into the universe of 207 Undervalued US Stocks Based On Cash Flows by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:AVDL

Avadel Pharmaceuticals

Operates as a biopharmaceutical company in the United States.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives