- United States

- /

- Biotech

- /

- NasdaqGS:AUTL

Can Autolus Therapeutics' (AUTL) Expanding Obe-cel Reach Bolster Its Position in Cell Therapy?

Reviewed by Sasha Jovanovic

- Autolus Therapeutics recently reported its third quarter results, showing a reduction in net loss to US$79.12 million versus US$82.09 million a year ago, and announced operational advances including broad US market access for Obe-cel with 60 authorized treatment centers and a manufacturing success rate above 90%.

- The company is also progressing with clinical programs in pediatric ALL, lupus nephritis, and progressive multiple sclerosis, and announced leadership changes as it prepares for key data presentations at the upcoming ASH conference.

- With accelerating uptake of Obe-cel and expanded clinical activity, we'll examine how these developments influence Autolus's investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 28 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Autolus Therapeutics Investment Narrative Recap

To own Autolus Therapeutics, one has to believe in its capacity to turn rapid US uptake of Obe-cel and pipeline expansion into lasting growth, while overcoming persistent operational losses and heavy reliance on a single geography. The latest Q3 results, highlighting reduced net loss and continued US commercial momentum, reinforce the company’s short-term catalyst, robust Obe-cel adoption, yet do little to lessen the major risk of unprofitable operations if manufacturing efficiency and market expansion do not keep pace.

Among the recent announcements, the appointment of Patrick McIlvenny as Chief Accounting Officer stands out, given the company’s ongoing need to improve cost discipline and operational efficiency. A seasoned finance executive, McIlvenny’s arrival aligns with Autolus’s efforts to address high cost of goods sold, a core issue impacting both net losses and the sustainability of the Obe-cel rollout.

In contrast, investors should be aware that despite steady clinical and operational progress, Autolus’s path to profitability still depends on...

Read the full narrative on Autolus Therapeutics (it's free!)

Autolus Therapeutics' outlook anticipates $354.3 million in revenue and $56.9 million in earnings by 2028. This scenario relies on 127.9% annual revenue growth and a $284.7 million increase in earnings from the current level of -$227.8 million.

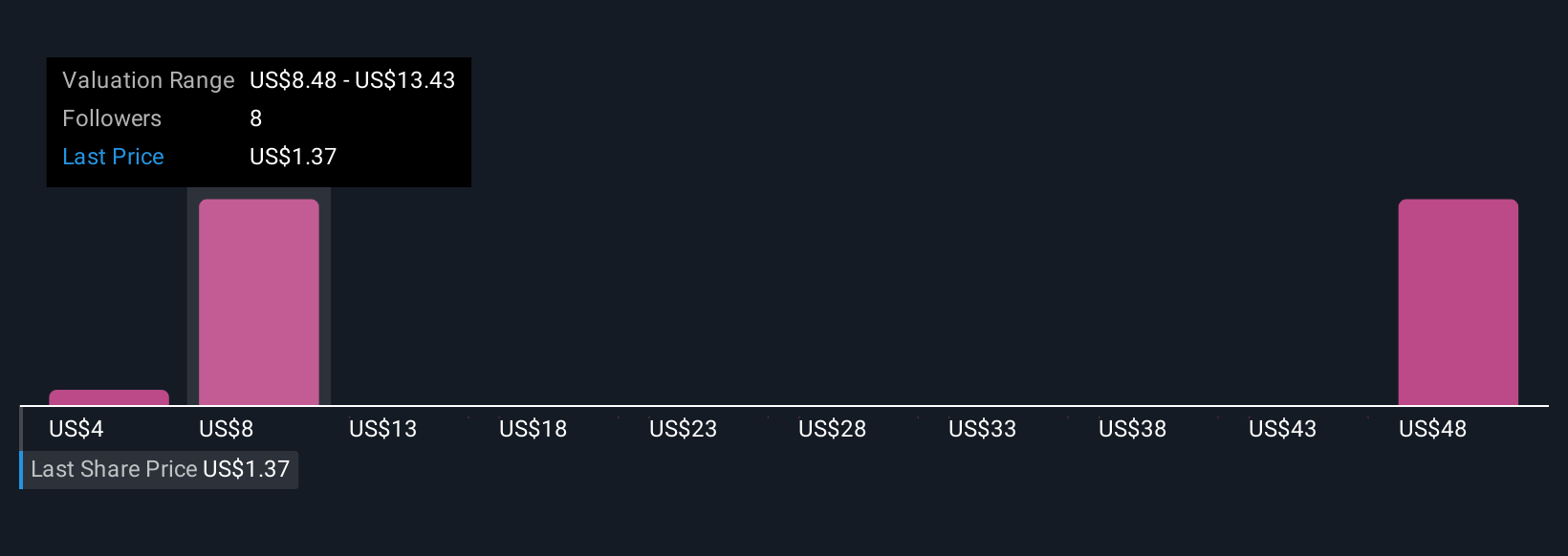

Uncover how Autolus Therapeutics' forecasts yield a $9.62 fair value, a 652% upside to its current price.

Exploring Other Perspectives

Six Simply Wall St Community members provided fair value estimates for Autolus ranging from US$3.53 to US$34.54 per share. While opinions vary widely, sustained high operating costs remain a key concern for those watching the company’s move toward commercial scale.

Explore 6 other fair value estimates on Autolus Therapeutics - why the stock might be worth just $3.53!

Build Your Own Autolus Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Autolus Therapeutics research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Autolus Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Autolus Therapeutics' overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AUTL

Autolus Therapeutics

A clinical-stage biopharmaceutical company, develops T cell therapies for the treatment of cancer and autoimmune diseases in United Kingdom and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives