- United States

- /

- Biotech

- /

- NasdaqGS:ASND

Should Investors Consider Ascendis Pharma After FDA Nod for Next-Gen Hormone Therapy in 2025?

Reviewed by Bailey Pemberton

If you’re looking at Ascendis Pharma right now and wondering whether it’s time to buy, sell, or simply keep watching, you’re not alone. The biotech stock has caught plenty of attention, especially after an impressive YTD climb of 50.0% and a mammoth 63.5% jump over the past year. While the past week was a touch softer with a dip of 3.6%, the one-month gain of 5.0% hints that upbeat sentiment hasn’t faded. Looking at the bigger picture, even the three-year rise of 94.0% and nearly 30% over five years suggest this company has been no stranger to long-term growth stories in the fast-evolving pharma sector.

Part of what’s fueling discussion lately is how investors are viewing risk and reward with ongoing developments in the biotech landscape. Shifts in the market’s appetite for growth stocks have no doubt helped push Ascendis Pharma higher, but there has also been renewed optimism about pipeline progress across the industry. While not all news has dramatic short-term impacts, it is clear that investors are recalibrating what fair value looks like for companies like Ascendis.

Interestingly, when we break down Ascendis Pharma’s value through six different valuation checks, it stands out as undervalued in four of them, earning a solid valuation score of 4 out of 6. That raises a key question for anyone sizing up their next move: do traditional metrics tell the whole story, or is there a smarter way to judge whether Ascendis is a bargain? Here is how the stock measures up on several popular valuation approaches and what could be the most insightful perspective at the end.

Approach 1: Ascendis Pharma Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's true worth by projecting how much cash it will generate in the future and then discounting those figures back to today’s euros. In essence, it asks what those future cash flows are really worth if you had them now. This reflects the time value of money and the risks involved.

Ascendis Pharma currently reports a last-twelve-month Free Cash Flow (FCF) of approximately €-173.38 Million. Analysts expect substantial improvement in the years ahead, with FCF forecasted to reach €1.24 Billion by 2029. Only the next five years of cash flows come from analyst estimates. Projections for the following half decade are extrapolated from these estimates. These forward-looking figures suggest strong anticipated growth as Ascendis moves closer to consistent profitability.

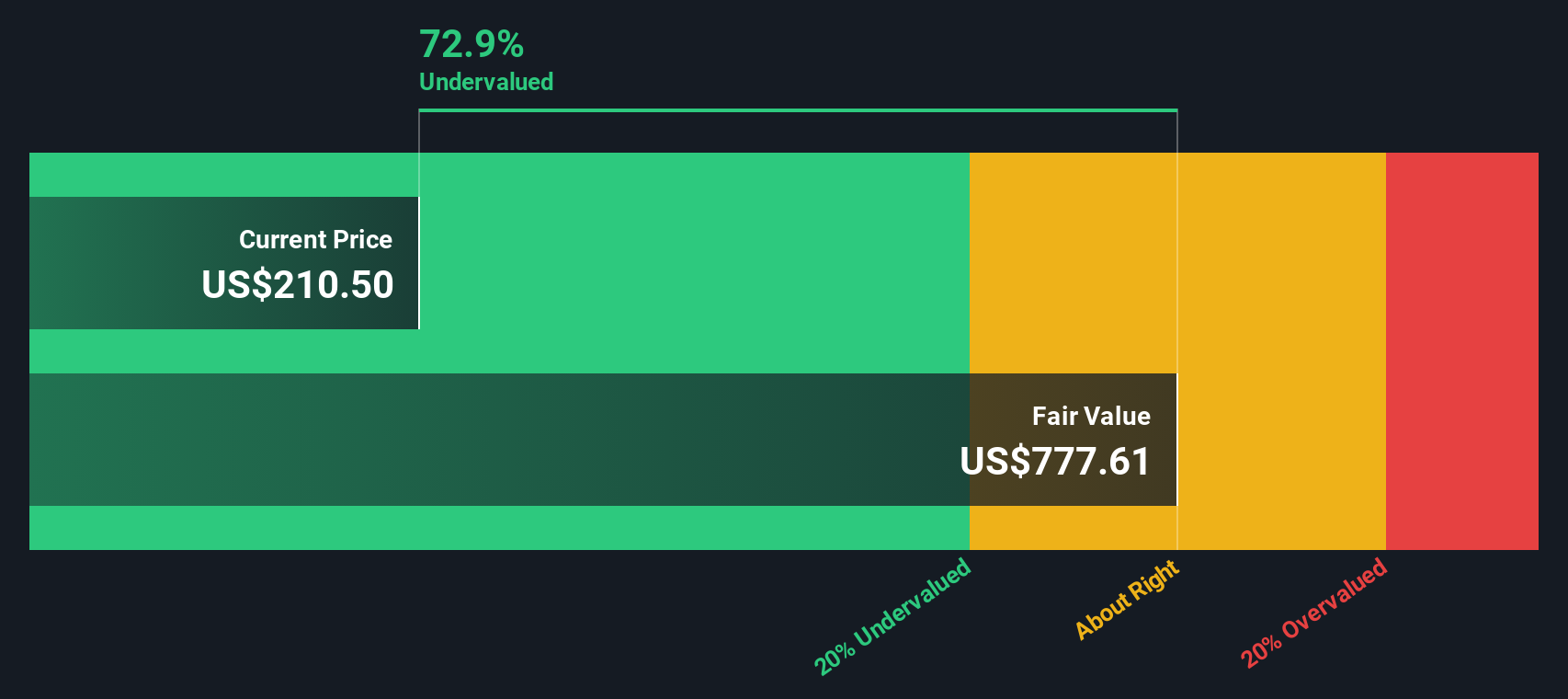

With all these future cash flows discounted to present value, the DCF model arrives at an intrinsic value of €781.27 per share. This result signals that the stock is trading at a significant discount, with the analysis implying it is around 73.5% undervalued compared to its current market price in dollars.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Ascendis Pharma is undervalued by 73.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Ascendis Pharma Price vs Sales

For companies like Ascendis Pharma, which are not yet consistently profitable, the Price-to-Sales (P/S) multiple is often the most meaningful valuation tool. P/S is especially useful in the biotech space, where many promising firms are in growth stages and do not have steady earnings, but are rapidly generating sales growth or expect to soon.

Typically, higher sales growth and lower risk justify a higher “normal” or “fair” P/S ratio, since investors are paying more for today’s revenue in expectation of stronger future profits. In contrast, slower-growing or riskier firms tend to trade at lower multiples. That is why industry averages and peer comparisons are still valuable reference points.

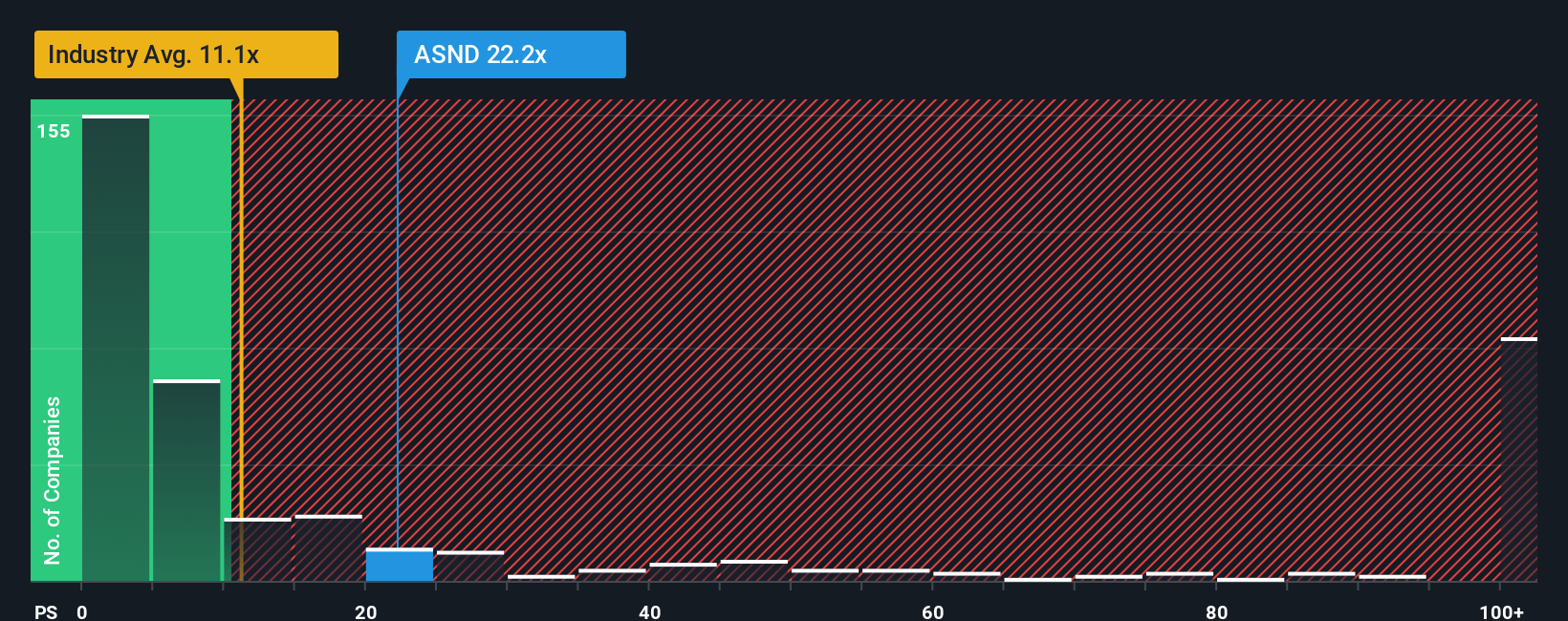

At present, Ascendis Pharma trades at a P/S multiple of 22.0x. This is notably higher than the biotech industry average of 11.3x and below the average for comparable peers at 30.5x. More importantly, Simply Wall St’s proprietary "Fair Ratio," which takes into account metrics like expected growth, profit margins, market cap, and sector-specific risks, estimates that a multiple of 16.7x best reflects the company's fair value. Unlike simple benchmarks, the Fair Ratio dynamically adjusts for each company’s specific outlook and risk profile, creating a more precise assessment than just comparing it to the industry or peers.

Comparing Ascendis Pharma’s current P/S of 22.0x to its Fair Ratio of 16.7x, the stock appears overvalued based on this metric.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Ascendis Pharma Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. This approach goes beyond financial ratios by connecting your view of a company's story to forecasts and fair value.

A Narrative is simply your perspective on a business, built from the story you believe about its future. With Narratives, you outline your expectations for things like future revenue, profit margins, and industry changes, and see how these assumptions translate into a fair value for the stock.

This method lets you tie numbers to the reasons behind them, making the investment process more personal, logical, and actionable. Narratives are easy to create and update on Simply Wall St’s Community page, where millions of investors weigh in with their own views. This allows you to compare, learn, and adjust as new information emerges.

By linking the company’s journey directly to a financial forecast, Narratives help you decide when you think the stock is under- or over-valued, because your fair value can be compared with the latest share price in real time.

Narratives are dynamic too; when earnings, news, or competitive updates come in, your Narrative automatically updates, ensuring your decisions always reflect the latest facts and sentiment.

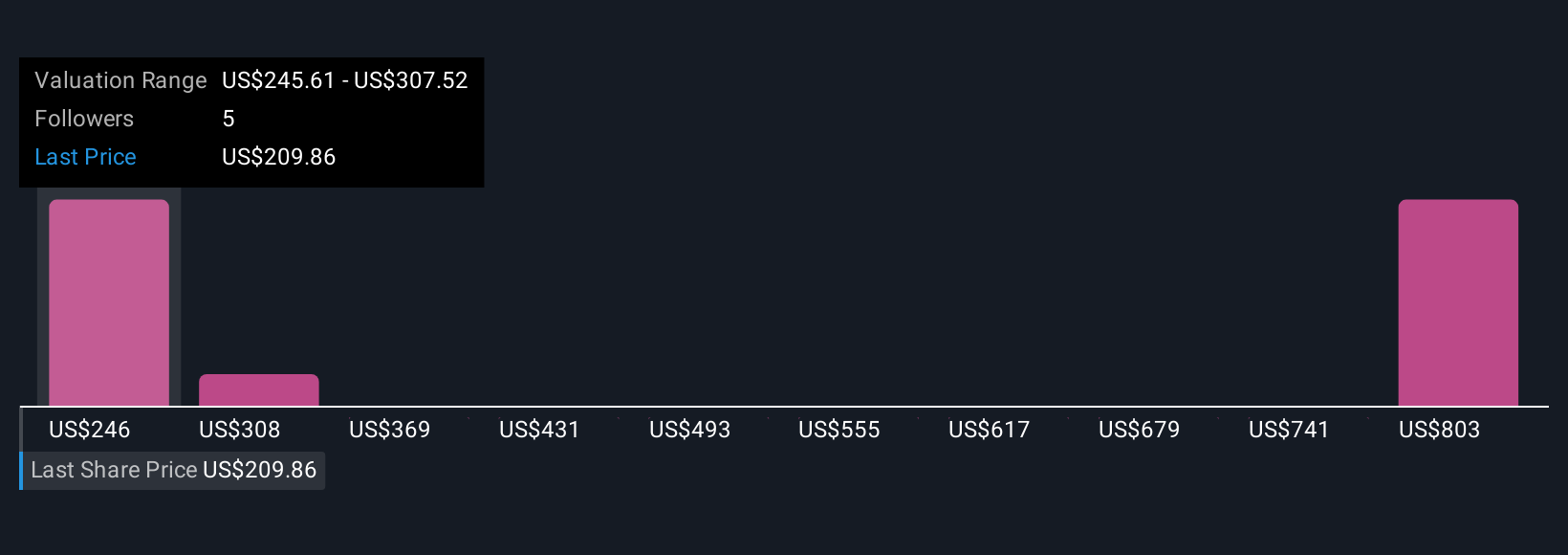

For example, some investors in the Community give Ascendis Pharma a fair value as high as $307, expecting blockbuster success from its pipeline, while the most cautious see fair value closer to $203 due to competitive or regulatory risks.

Do you think there's more to the story for Ascendis Pharma? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ASND

Ascendis Pharma

Operates as a biopharmaceutical company that focuses on developing TransCon-based therapies for unmet medical needs in Denmark, rest of Europe, North America, and internationally.

Exceptional growth potential and good value.

Market Insights

Community Narratives