- United States

- /

- Biotech

- /

- NasdaqGS:ARWR

Is Arrowhead a Bargain After Clinical Trial Progress Fuels 168% Jump in 2025?

Reviewed by Bailey Pemberton

- If you have ever wondered whether Arrowhead Pharmaceuticals is truly a bargain or just looks like one, you are in the right place. Let’s dig into what the numbers really say about its value.

- The stock has soared recently, climbing 30.3% in the past week, 24.6% over the past month, and an astonishing 168.2% year-to-date. This suggests that investor optimism and perhaps risk perceptions have shifted quickly.

- Much of this excitement comes after Arrowhead announced promising clinical trial progress on its lead drug candidates and formed a new strategic collaboration with a major pharma partner. Both developments sparked investor confidence and renewed attention from analysts.

- Despite these recent moves, Arrowhead scores a 3 out of 6 on our valuation checks. This indicates there is more to the value story than headline numbers alone. We will break down the approaches soon, plus share a new way to spot value that investors often overlook.

Approach 1: Arrowhead Pharmaceuticals Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today's dollars. The goal is to determine what Arrowhead Pharmaceuticals is truly worth based on its ability to generate cash over time.

Currently, Arrowhead's Free Cash Flow (FCF) stands at -$83.8 Million, reflecting ongoing investment and development. Analysts provide detailed projections for the next five years, which indicate that while cash flows are expected to remain negative in the short term, significant improvement is forecasted from 2030 onward. By that year, Arrowhead is anticipated to reach $189.2 Million in FCF due to its progressing pipeline and growth strategy. Forecasts beyond the analyst horizon are extrapolated, and by 2035 the company's FCF could exceed $586 Million.

Applying the DCF model, the estimated intrinsic value per share is $58.64. Compared to the current share price, this represents a 10.1% discount, suggesting the stock is modestly undervalued according to these cash flow projections.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Arrowhead Pharmaceuticals is undervalued by 10.1%. Track this in your watchlist or portfolio, or discover 919 more undervalued stocks based on cash flows.

Approach 2: Arrowhead Pharmaceuticals Price vs Sales

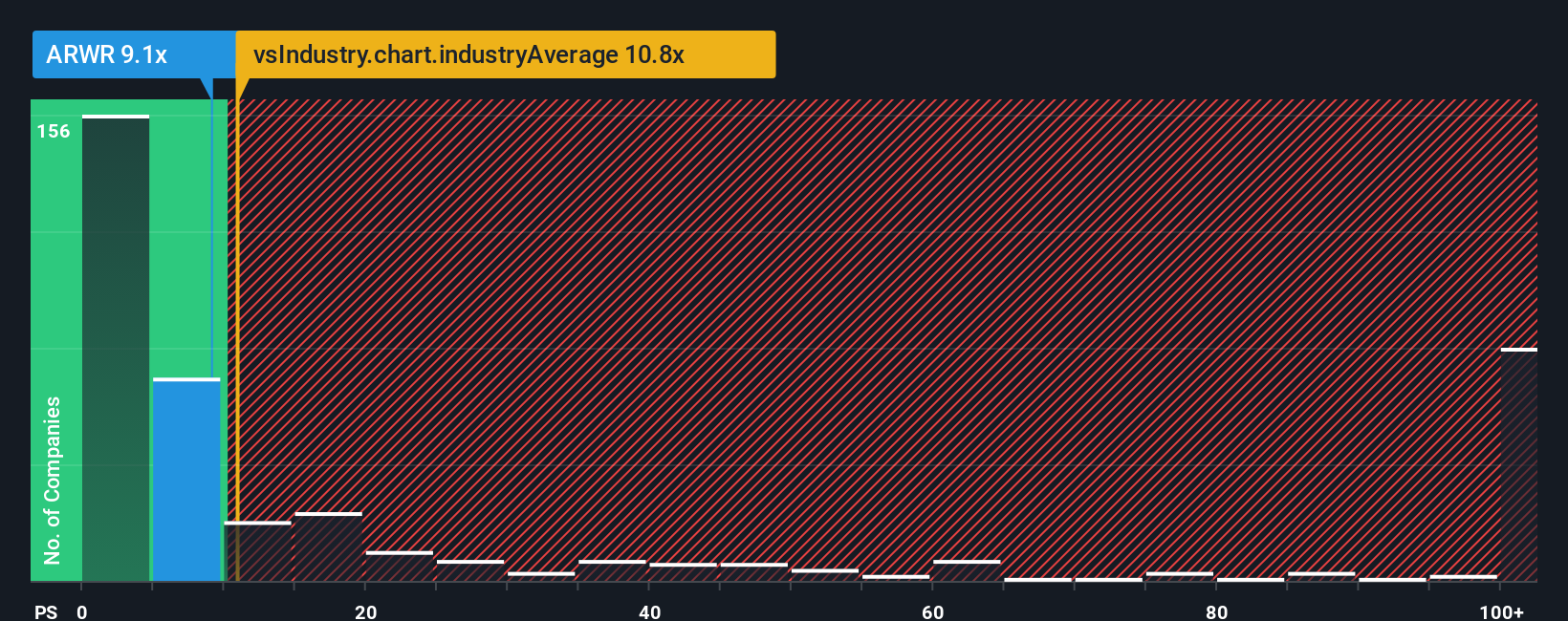

The Price-to-Sales (P/S) ratio is a widely used valuation metric, especially for companies that are not yet profitable but are generating growing revenue streams. For innovative biotech firms like Arrowhead Pharmaceuticals, the P/S ratio is particularly relevant since profits may be several years away and sales figures serve as a key measure of progress.

Growth expectations and company-specific risks play a pivotal role in determining what qualifies as a normal or fair P/S ratio. Higher growth prospects typically justify higher multiples, while elevated risks or uncertain pathways to profitability warrant lower ratios. Comparing Arrowhead’s current P/S multiple of 8.63x to the Biotechs industry average of 12.85x and a peer average of 6.48x shows that the company trades at a moderate premium relative to its peers but at a discount to the broader industry.

Simply Wall St’s proprietary “Fair Ratio” for Arrowhead is 10.68x. This tailored benchmark considers unique factors such as earnings growth, industry dynamics, profit margins, company size, and risk profile, providing a holistic view of the stock’s value. By factoring in more than just simple peer or industry multiples, the Fair Ratio gives a sharper perspective on what a reasonable valuation should be in context.

With Arrowhead’s current P/S ratio sitting about 2 points below the Fair Ratio, the stock appears moderately undervalued on this metric and points to potential upside if operational momentum continues.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1439 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Arrowhead Pharmaceuticals Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives are the stories behind the numbers, a way for you to express your perspective about Arrowhead Pharmaceuticals by combining your expectations for its future revenue, earnings, and profit margins to estimate what you believe is a fair value for the company.

A Narrative links the company's real-world story to a financial forecast and a fair value, empowering investors to visualize scenarios, whether that is success, stagnation, or something in between. On Simply Wall St’s Community page, millions of investors already use Narratives to easily build and share their own “storylines,” directly comparing their fair value estimates with the current market price to spot clear buy or sell opportunities.

Narratives are dynamic, automatically kept up to date as new information like earnings results or major news emerges, so your thesis evolves as the facts change. For example, one investor’s optimistic Narrative for Arrowhead Pharmaceuticals, based on rapid commercial expansion and new partnership revenue, might set a fair value as high as $80 per share, while another with concerns about regulatory setbacks and rising costs may land closer to $17. This makes it easy to see where you stand and make decisions with confidence.

Do you think there's more to the story for Arrowhead Pharmaceuticals? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ARWR

Arrowhead Pharmaceuticals

Develops medicines for the treatment of intractable diseases in the United States.

Excellent balance sheet and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026