- United States

- /

- Biotech

- /

- NasdaqGS:ARQT

Exploring 3 High Growth Tech Stocks In The US Market

Reviewed by Simply Wall St

The United States market has remained flat over the past week but has shown a 10.0% increase over the past year, with earnings projected to grow by 15% annually. In this context, identifying high-growth tech stocks involves focusing on companies that demonstrate strong potential for revenue expansion and innovation in line with these optimistic earnings forecasts.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 26.38% | 39.09% | ★★★★★★ |

| Mereo BioPharma Group | 53.63% | 66.57% | ★★★★★★ |

| Ardelyx | 21.03% | 60.42% | ★★★★★★ |

| TG Therapeutics | 26.46% | 38.75% | ★★★★★★ |

| AVITA Medical | 27.42% | 61.05% | ★★★★★★ |

| Blueprint Medicines | 21.12% | 60.77% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.63% | 60.61% | ★★★★★★ |

| Alkami Technology | 20.53% | 76.67% | ★★★★★★ |

| Ascendis Pharma | 35.07% | 59.92% | ★★★★★★ |

| Lumentum Holdings | 22.99% | 103.97% | ★★★★★★ |

Click here to see the full list of 227 stocks from our US High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Akebia Therapeutics (AKBA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Akebia Therapeutics, Inc. is a biopharmaceutical company dedicated to developing and commercializing therapeutics for kidney disease patients, with a market cap of $966.50 million.

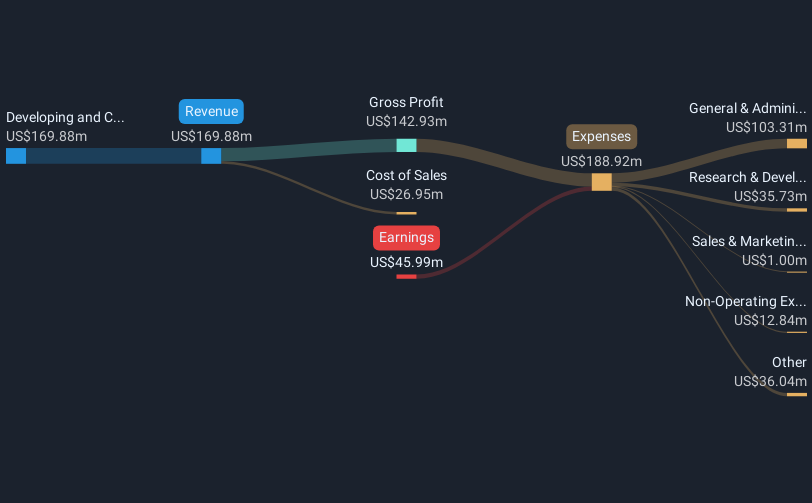

Operations: Akebia focuses on developing and commercializing therapeutics for kidney disease, generating $184.91 million in revenue from its innovative products.

Akebia Therapeutics, with its recent FDA approval for Vafseo and positive outcomes from phase 3 clinical trials, is navigating a transformative phase. Despite being unprofitable currently, the company's revenue surged to $57.34 million in Q1 2025 from $32.61 million the previous year, marking a significant growth trajectory. This performance is bolstered by an annual revenue growth forecast of 19.8%, outpacing the US market's 8.7%. Moreover, earnings are expected to grow robustly at an annual rate of 63.52%, reflecting potential profitability within three years and indicating resilience in its operational strategy amidst competitive pressures in biotech innovation for chronic kidney disease treatments.

- Take a closer look at Akebia Therapeutics' potential here in our health report.

Examine Akebia Therapeutics' past performance report to understand how it has performed in the past.

TG Therapeutics (TGTX)

Simply Wall St Growth Rating: ★★★★★★

Overview: TG Therapeutics, Inc. is a commercial stage biopharmaceutical company dedicated to acquiring, developing, and commercializing innovative treatments for B-cell mediated diseases globally, with a market cap of $5.25 billion.

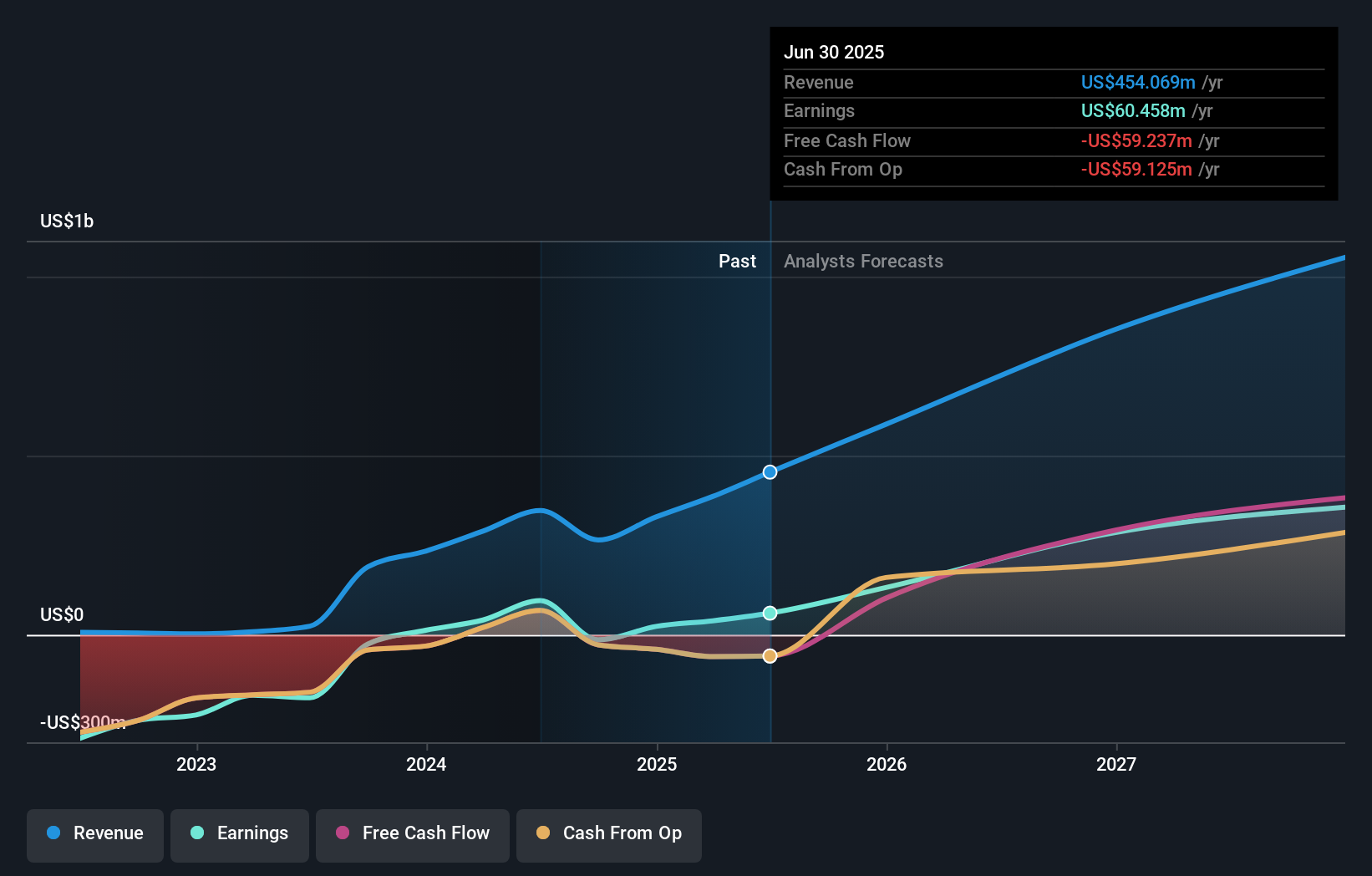

Operations: TG Therapeutics focuses on developing and commercializing treatments for B-cell mediated diseases, generating revenue primarily from its biotechnology segment, which accounted for $386.39 million.

TG Therapeutics has demonstrated a robust growth trajectory, with revenue soaring by 26.5% annually and earnings expected to surge by 38.8% each year, significantly outpacing the US market average of 14.6%. This growth is underpinned by substantial R&D investments which have fueled innovations in treatments for multiple sclerosis, as evidenced by their recent positive data presentations and increased revenue forecasts for BRIUMVI®. The company's strategic focus on expanding its product portfolio through rigorous research initiatives not only enhances its competitive edge but also aligns with broader industry trends towards specialized healthcare solutions. With a forward-looking approach marked by recent upward revisions in financial guidance and active participation in major healthcare conferences, TG Therapeutics is well-positioned to capitalize on emerging opportunities within the biotech sector.

- Delve into the full analysis health report here for a deeper understanding of TG Therapeutics.

Gain insights into TG Therapeutics' past trends and performance with our Past report.

Arcutis Biotherapeutics (ARQT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Arcutis Biotherapeutics, Inc. is a biopharmaceutical company dedicated to the development and commercialization of treatments for dermatological diseases, with a market cap of approximately $1.65 billion.

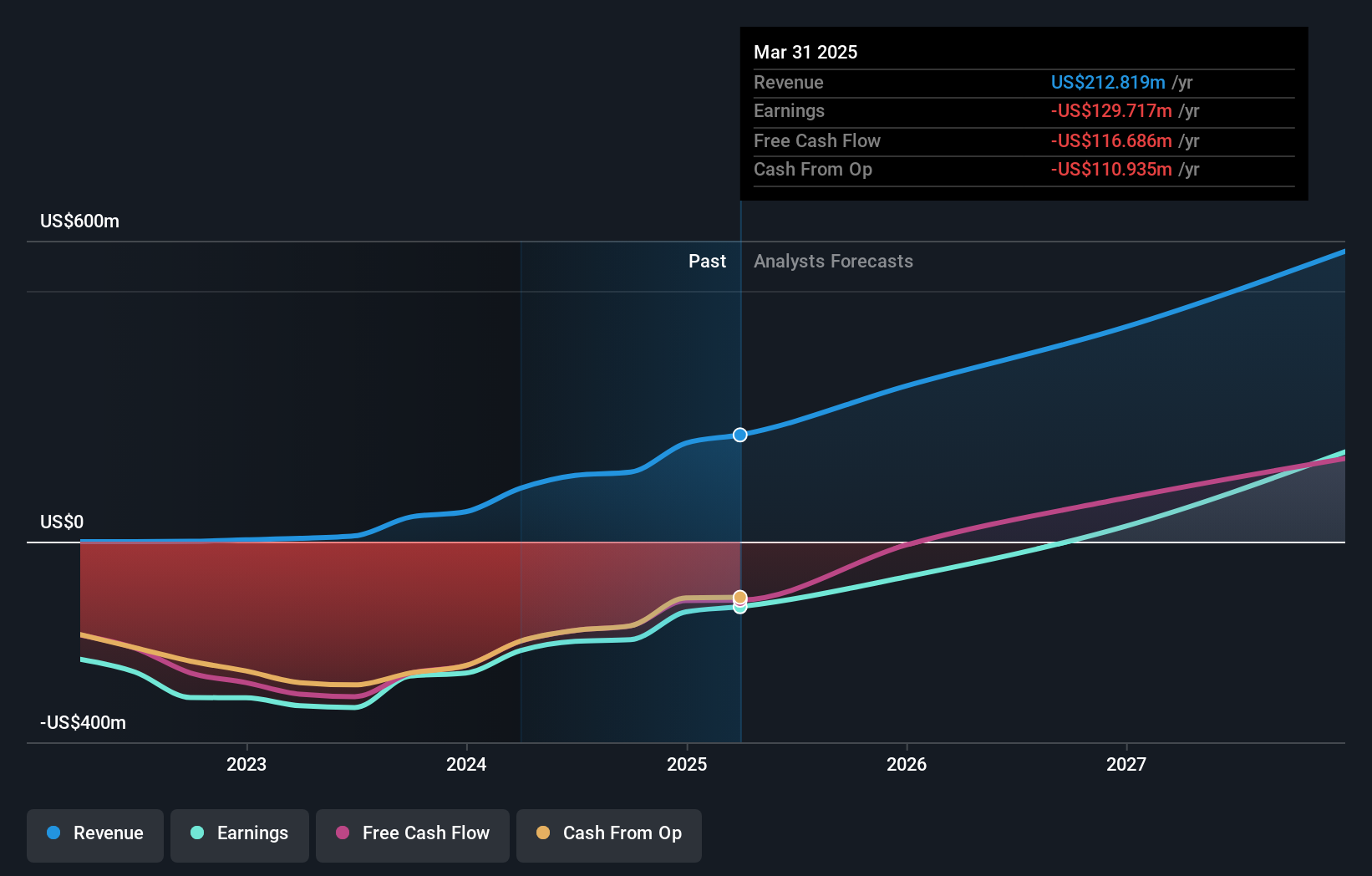

Operations: Arcutis Biotherapeutics generates revenue primarily from the development and commercialization of treatments for dermatological diseases, amounting to $212.82 million.

Arcutis Biotherapeutics has been at the forefront of dermatological innovation, particularly with its recent FDA approvals and clinical trial advancements. The company's focus on phosphodiesterase-4 (PDE4) inhibitors for conditions like plaque psoriasis and atopic dermatitis underlines its commitment to addressing unmet medical needs. Recent data from the INTEGUMENT-Ole study highlighted long-term benefits of ZORYVE cream in managing symptoms effectively, marking a significant step in chronic skin condition management. With a revenue increase to $65.85 million from $49.57 million year-over-year and a reduced net loss, Arcutis is strategically poised to leverage its R&D breakthroughs for sustained growth, especially with upcoming PDUFA dates promising further market expansions.

Seize The Opportunity

- Explore the 227 names from our US High Growth Tech and AI Stocks screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ARQT

Arcutis Biotherapeutics

A biopharmaceutical company, focuses on developing and commercializing treatments for dermatological diseases.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives