- United States

- /

- Biotech

- /

- NasdaqGS:ARQT

Does Arcutis Biotherapeutics (NASDAQ:ARQT) Have A Healthy Balance Sheet?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Arcutis Biotherapeutics, Inc. (NASDAQ:ARQT) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Arcutis Biotherapeutics

How Much Debt Does Arcutis Biotherapeutics Carry?

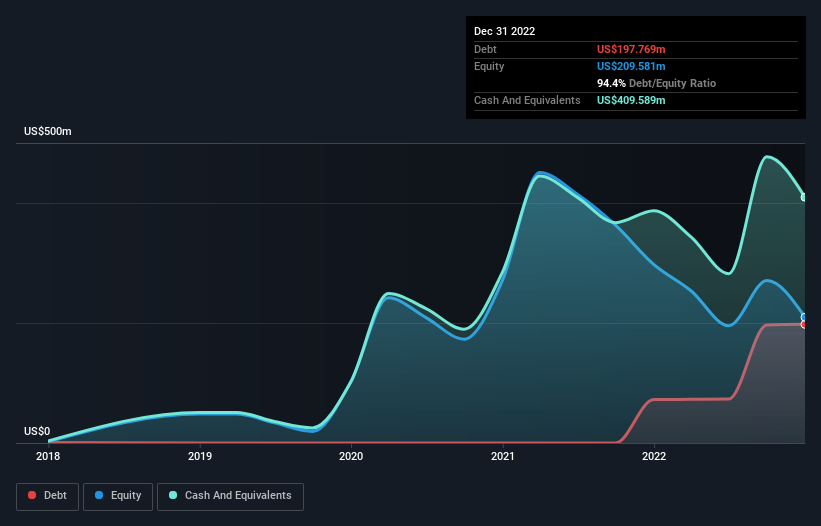

You can click the graphic below for the historical numbers, but it shows that as of December 2022 Arcutis Biotherapeutics had US$197.8m of debt, an increase on US$72.4m, over one year. But it also has US$409.6m in cash to offset that, meaning it has US$211.8m net cash.

A Look At Arcutis Biotherapeutics' Liabilities

The latest balance sheet data shows that Arcutis Biotherapeutics had liabilities of US$37.8m due within a year, and liabilities of US$201.9m falling due after that. Offsetting this, it had US$409.6m in cash and US$8.46m in receivables that were due within 12 months. So it actually has US$178.4m more liquid assets than total liabilities.

This surplus suggests that Arcutis Biotherapeutics is using debt in a way that is appears to be both safe and conservative. Due to its strong net asset position, it is not likely to face issues with its lenders. Succinctly put, Arcutis Biotherapeutics boasts net cash, so it's fair to say it does not have a heavy debt load! When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Arcutis Biotherapeutics can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year Arcutis Biotherapeutics managed to produce its first revenue as a listed company, but given the lack of profit, shareholders will no doubt be hoping to see some strong increases.

So How Risky Is Arcutis Biotherapeutics?

We have no doubt that loss making companies are, in general, riskier than profitable ones. And in the last year Arcutis Biotherapeutics had an earnings before interest and tax (EBIT) loss, truth be told. And over the same period it saw negative free cash outflow of US$281m and booked a US$311m accounting loss. But the saving grace is the US$211.8m on the balance sheet. That kitty means the company can keep spending for growth for at least two years, at current rates. Even though its balance sheet seems sufficiently liquid, debt always makes us a little nervous if a company doesn't produce free cash flow regularly. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. We've identified 3 warning signs with Arcutis Biotherapeutics , and understanding them should be part of your investment process.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ARQT

Arcutis Biotherapeutics

A biopharmaceutical company, focuses on developing and commercializing treatments for dermatological diseases.

High growth potential and good value.