- United States

- /

- Biotech

- /

- NasdaqGM:ARDX

Why Investors Shouldn't Be Surprised By Ardelyx, Inc.'s (NASDAQ:ARDX) 25% Share Price Plunge

The Ardelyx, Inc. (NASDAQ:ARDX) share price has fared very poorly over the last month, falling by a substantial 25%. Still, a bad month hasn't completely ruined the past year with the stock gaining 57%, which is great even in a bull market.

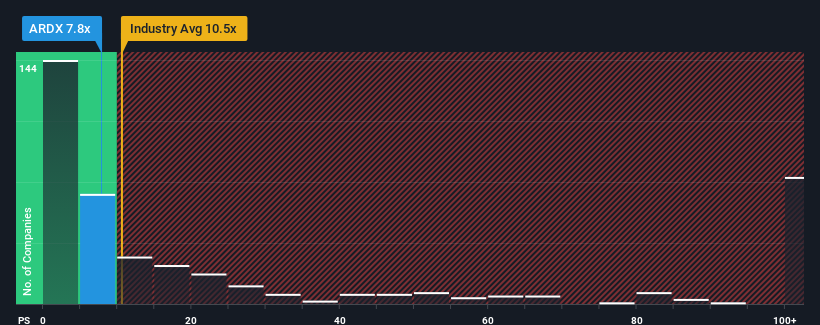

Since its price has dipped substantially, Ardelyx's price-to-sales (or "P/S") ratio of 7.8x might make it look like a buy right now compared to the Biotechs industry in the United States, where around half of the companies have P/S ratios above 10.5x and even P/S above 63x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Ardelyx

How Has Ardelyx Performed Recently?

With revenue growth that's superior to most other companies of late, Ardelyx has been doing relatively well. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Ardelyx will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Ardelyx?

Ardelyx's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 152%. This great performance means it was also able to deliver immense revenue growth over the last three years. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 50% per annum as estimated by the ten analysts watching the company. That's shaping up to be materially lower than the 209% per year growth forecast for the broader industry.

With this information, we can see why Ardelyx is trading at a P/S lower than the industry. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

The southerly movements of Ardelyx's shares means its P/S is now sitting at a pretty low level. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Ardelyx's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

Plus, you should also learn about these 3 warning signs we've spotted with Ardelyx.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ARDX

Ardelyx

Ardelyx, Inc. discovers, develops, and commercializes medicines to treat unmet medical needs in the United States and internationally.

Undervalued with high growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026