- United States

- /

- Biotech

- /

- NasdaqGM:ARDX

How Real-World IBSRELA Data at Ardelyx (ARDX) May Shift the Investment Narrative

Reviewed by Sasha Jovanovic

- Earlier this week, Ardelyx, Inc. presented new clinical and real-world data for IBSRELA® (tenapanor) at the American College of Gastroenterology’s Annual Scientific Meeting in Phoenix, emphasizing its efficacy for adults with irritable bowel syndrome with constipation (IBS-C).

- These findings not only highlight high patient satisfaction and meaningful improvements in IBS-C symptoms, but also indicate a potential reduction in healthcare resource utilization following IBSRELA initiation.

- We'll now explore how the real-world reductions in healthcare utilization may influence Ardelyx's investment narrative going forward.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

Ardelyx Investment Narrative Recap

At a high level, investors in Ardelyx must be confident in the company’s ability to expand its core IBSRELA franchise while mitigating the risks tied to a concentrated portfolio and uncertain market access. This week’s positive real-world data on IBSRELA’s impact on symptom management and potential reduction in healthcare utilization could provide added support for ongoing adoption efforts, but it does not materially change the company’s most immediate catalysts or risks, namely, access and reimbursement dynamics, especially for XPHOZAH, and the path to profitability.

Among recent announcements, Ardelyx’s raised 2025 net sales guidance for IBSRELA (US$250 million to US$260 million) stands out in context. The new effectiveness and utilization data presented could help underpin those growth targets, linking real-world outcomes with market opportunity as the company approaches its next earnings update and continues to manage portfolio concentration and operational spending.

However, in contrast, one major risk that investors should keep top of mind is Ardelyx’s heavy reliance on favorable reimbursement decisions and access for both IBSRELA and XPHOZAH, particularly as...

Read the full narrative on Ardelyx (it's free!)

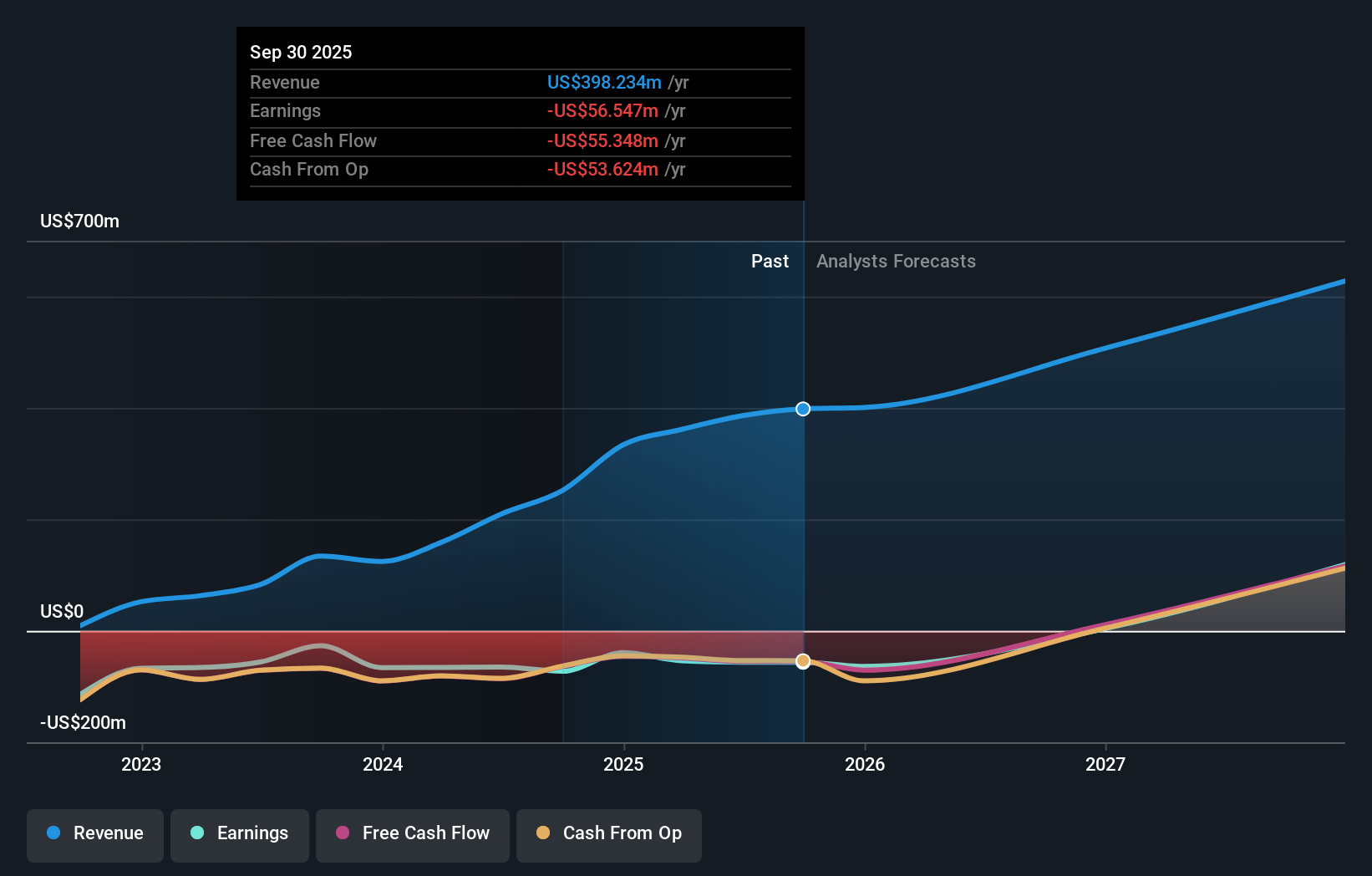

Ardelyx's narrative projects $704.6 million revenue and $178.8 million earnings by 2028. This requires 22.2% yearly revenue growth and a $235.2 million earnings increase from -$56.4 million today.

Uncover how Ardelyx's forecasts yield a $11.36 fair value, a 129% upside to its current price.

Exploring Other Perspectives

Thirteen private investors in the Simply Wall St Community estimated fair values for Ardelyx ranging from US$8 to US$57.65 per share. With such a broad spread of opinions, it is clear that reliance on a limited product portfolio and shifting reimbursement could have far-reaching effects on future performance.

Explore 13 other fair value estimates on Ardelyx - why the stock might be a potential multi-bagger!

Build Your Own Ardelyx Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ardelyx research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Ardelyx research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ardelyx's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ARDX

Ardelyx

Ardelyx, Inc. discovers, develops, and commercializes medicines to treat unmet medical needs in the United States and internationally.

Undervalued with high growth potential.

Market Insights

Community Narratives