- United States

- /

- Biotech

- /

- NasdaqGM:ARDX

Does Real-World XPHOZAH Data Reveal a New Innovation Edge for Ardelyx (ARDX)?

Reviewed by Sasha Jovanovic

- Ardelyx, Inc. recently presented results from the first real-world study of XPHOZAH, its FDA-approved phosphate absorption inhibitor for adults with chronic kidney disease on dialysis, at the American Society of Nephrology's Kidney Week in Houston.

- This announcement shines a light on XPHOZAH’s unique mechanism of action and its role as the only phosphate absorption inhibitor in its class, potentially broadening treatment options for patients who do not respond to standard phosphate binders.

- We’ll examine how the first real-world data for XPHOZAH may reinforce Ardelyx’s focus on product innovation in its investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 28 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Ardelyx Investment Narrative Recap

To be a shareholder in Ardelyx, you need confidence in the company's ability to expand its presence in the kidney and gastrointestinal therapeutics market, notably by leveraging first-mover advantages and ongoing product innovation. The latest real-world XPHOZAH study presentation solidifies Ardelyx's scientific credentials but does not materially shift the biggest near-term catalyst or the largest risk, which continues to be market access and reimbursement, particularly Medicare coverage for XPHOZAH, amid regulatory and payer uncertainty.

Among recent developments, Ardelyx’s follow-on equity offering of US$100 million stands out as the most relevant to this news event, given its timing just before the new clinical data release for XPHOZAH. Access to additional capital is critical as the company pushes for broader adoption of its therapies and manages the operational expenses tied to commercialization, while waiting for greater clarity on reimbursement catalysts.

Yet, alongside product momentum, the ongoing reimbursement risk, especially with Medicare, remains something investors should absolutely keep in mind...

Read the full narrative on Ardelyx (it's free!)

Ardelyx's narrative projects $704.6 million in revenue and $178.8 million in earnings by 2028. This requires 22.2% yearly revenue growth and a $235.2 million increase in earnings from the current $-56.4 million.

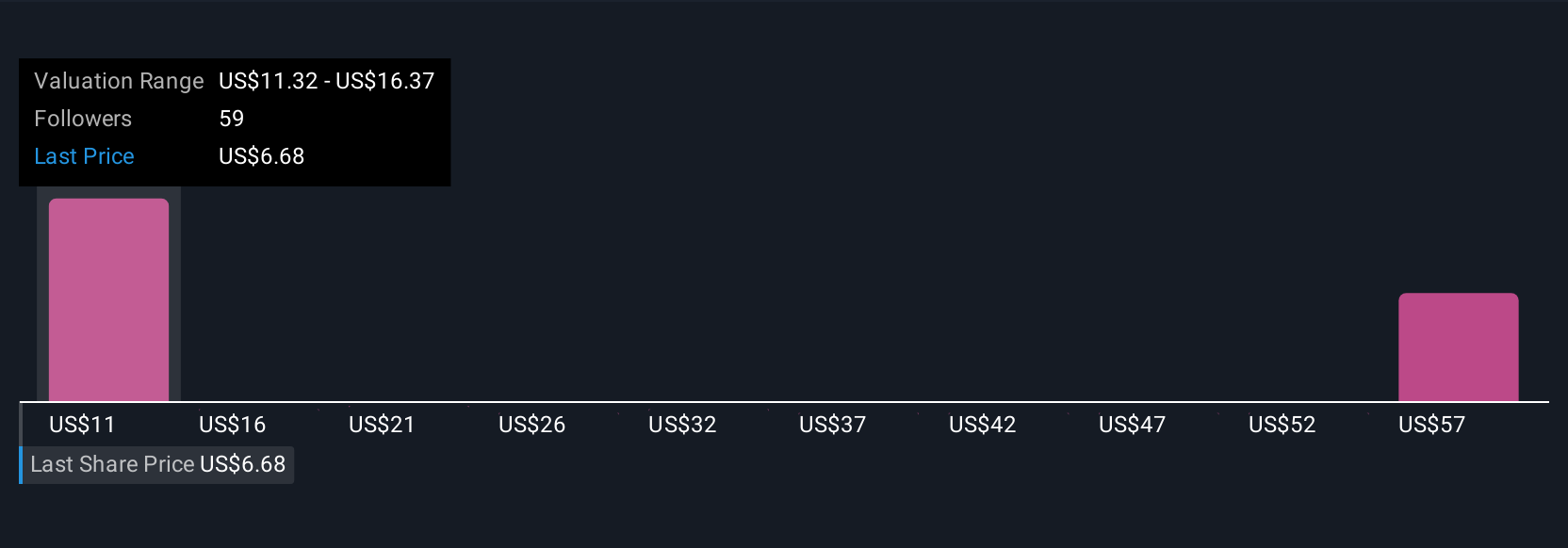

Uncover how Ardelyx's forecasts yield a $11.73 fair value, a 101% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community posted 12 fair value estimates for Ardelyx, ranging widely from US$8 to US$57.72 per share. While those views reflect contrasting outlooks, focus stays on market access and payer decisions that could drive or derail future company performance.

Explore 12 other fair value estimates on Ardelyx - why the stock might be worth just $8.00!

Build Your Own Ardelyx Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ardelyx research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Ardelyx research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ardelyx's overall financial health at a glance.

No Opportunity In Ardelyx?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ARDX

Ardelyx

Ardelyx, Inc. discovers, develops, and commercializes medicines to treat unmet medical needs in the United States and internationally.

Undervalued with high growth potential.

Market Insights

Community Narratives