- United States

- /

- Biotech

- /

- NasdaqGM:ARCT

Arcturus Therapeutics Holdings Inc.'s (NASDAQ:ARCT) Share Price Boosted 45% But Its Business Prospects Need A Lift Too

Arcturus Therapeutics Holdings Inc. (NASDAQ:ARCT) shareholders are no doubt pleased to see that the share price has bounced 45% in the last month, although it is still struggling to make up recently lost ground. Looking back a bit further, it's encouraging to see the stock is up 44% in the last year.

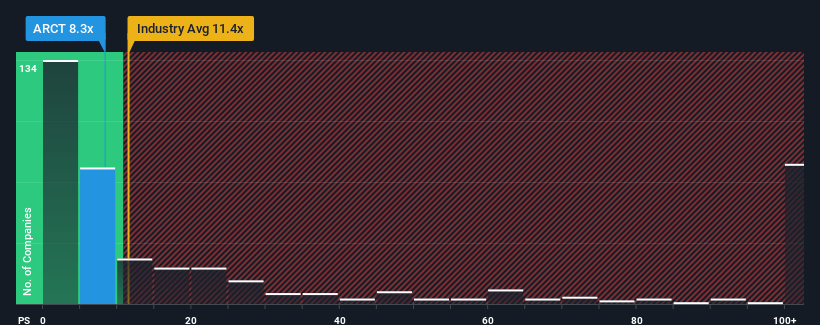

In spite of the firm bounce in price, Arcturus Therapeutics Holdings may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 8.3x, considering almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 11.4x and even P/S higher than 65x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Arcturus Therapeutics Holdings

How Has Arcturus Therapeutics Holdings Performed Recently?

Arcturus Therapeutics Holdings could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Arcturus Therapeutics Holdings.What Are Revenue Growth Metrics Telling Us About The Low P/S?

Arcturus Therapeutics Holdings' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 56%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, despite the drawbacks experienced in the last 12 months. So while the company has done a great job in the past, it's somewhat concerning to see revenue growth decline so harshly.

Shifting to the future, estimates from the nine analysts covering the company suggest revenue should grow by 51% each year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 209% per annum, which is noticeably more attractive.

With this in consideration, its clear as to why Arcturus Therapeutics Holdings' P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

Despite Arcturus Therapeutics Holdings' share price climbing recently, its P/S still lags most other companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Arcturus Therapeutics Holdings maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Arcturus Therapeutics Holdings that you should be aware of.

If these risks are making you reconsider your opinion on Arcturus Therapeutics Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:ARCT

Arcturus Therapeutics Holdings

Engages in the development of infectious disease vaccines and other products within liver and respiratory rare diseases.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives