- United States

- /

- Biotech

- /

- NasdaqGM:ARCT

Arcturus Therapeutics (ARCT): Evaluating Valuation After Cystic Fibrosis Trial Setback and Heightened Regulatory Scrutiny

Reviewed by Simply Wall St

Arcturus Therapeutics Holdings (ARCT) drew intense investor attention after it released interim results from a Phase 2 trial for its cystic fibrosis treatment, ARCT-032. The report showed no substantial lung function improvement, which triggered sharp share declines and analyst downgrades.

See our latest analysis for Arcturus Therapeutics Holdings.

It has been a turbulent year for Arcturus Therapeutics. Shares have dropped sharply after underwhelming trial news and legal scrutiny, leading to a 1-year total shareholder return of -40.8%. Momentum has faded, and the 1-month share price return stands at -45.1%. This reflects a loss of investor confidence in the near term as markets reassess future growth prospects and risk.

If you’re weighing your next move, consider exploring opportunities among other healthcare innovators with our See the full list for free..

With shares hitting multiyear lows and analyst targets slashed, investors may wonder whether Arcturus is now trading at a meaningful discount or if markets are fairly reflecting the company’s risks and prospects for future growth.

Most Popular Narrative: 83% Undervalued

Arcturus Therapeutics Holdings' most popular narrative assigns a fair value of $65.88, significantly above its last close at $11.22. This gap creates a valuation story built on bold growth forecasts and ambitious expectations for the pipeline's success.

Progression of late-stage clinical programs, particularly the ARCT-810 (OTC deficiency) and ARCT-032 (Cystic Fibrosis) trials, offers the potential to unlock significant rare disease markets with high pricing power and strong net margins if positive Phase II/III results lead to regulatory approval and commercialization.

What is driving this sky-high fair value? The answer is extraordinary projections for revenue, profit margins, and future earnings multiples rarely seen at this stage. Want to unravel the optimism at the heart of this narrative? Check out the full story for the details behind these aggressive assumptions.

Result: Fair Value of $65.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on a narrow late-stage pipeline and ongoing regulatory uncertainties could quickly undermine the bullish outlook for Arcturus shares.

Find out about the key risks to this Arcturus Therapeutics Holdings narrative.

Another View: Market Multiples Suggest a Cautious Reading

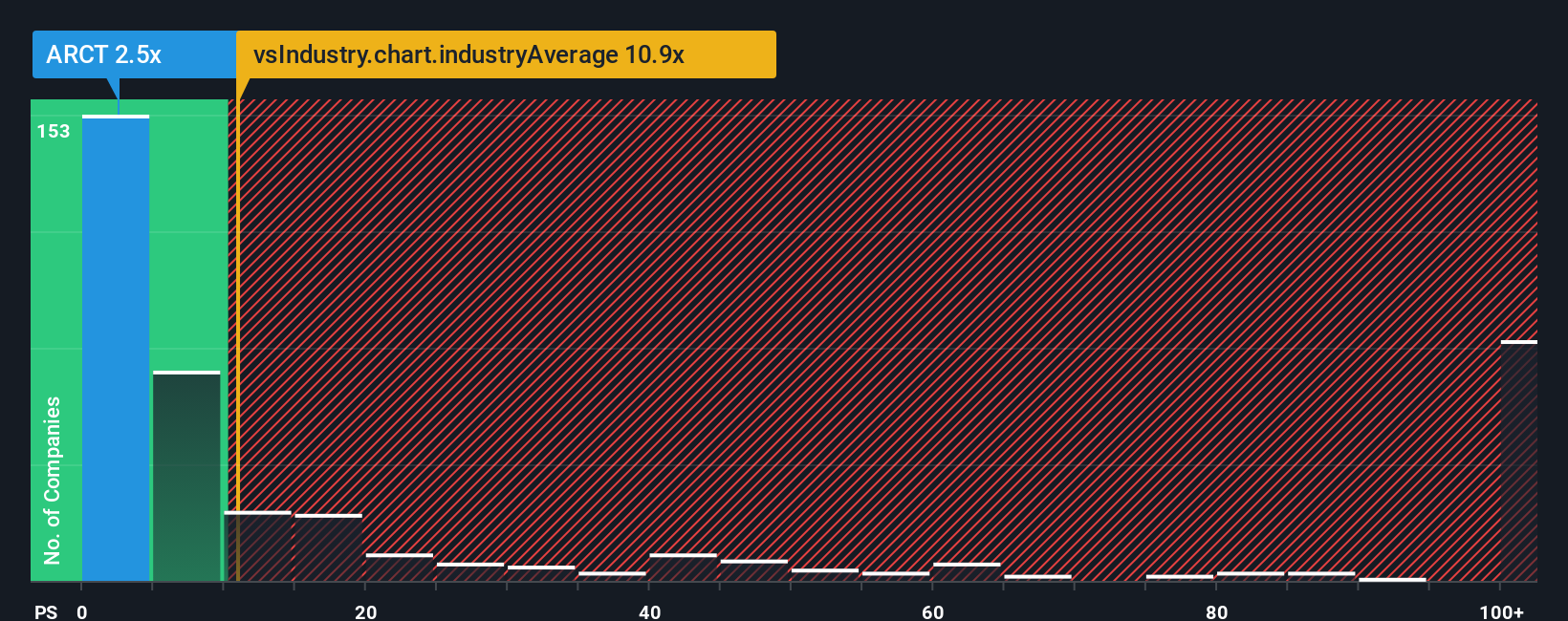

Looking beyond narrative-driven forecasts, Arcturus trades at a price-to-sales ratio of 2.5x. This is well below the US Biotechs industry average of 10.8x and the peer average of 21x. However, it remains above its own fair ratio of 1.4x. This might signal value compared to peers, yet the gap over the fair ratio highlights real valuation risks if growth does not materialize as anticipated. Is the market offering a bargain opportunity or just reflecting the challenges ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Arcturus Therapeutics Holdings Narrative

If you'd like to dig deeper or have your own perspective, it only takes a few minutes to explore the data and shape your own view. Do it your way.

A great starting point for your Arcturus Therapeutics Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Unlock the next level of your portfolio. The market’s best opportunities are just waiting for you. Don’t let them pass by while others take action.

- Capture growth potential by targeting these 880 undervalued stocks based on cash flows that stand out for their compelling financials and future upside others overlook.

- Claim your stake in tomorrow’s breakthroughs with these 27 AI penny stocks, where artificial intelligence is reshaping industry limits right now.

- Accelerate your search for steady income streams with these 17 dividend stocks with yields > 3% that reward investors with attractive high yields and solid payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ARCT

Arcturus Therapeutics Holdings

Engages in the development of infectious disease vaccines and other products within liver and respiratory rare diseases.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives