- United States

- /

- Pharma

- /

- NasdaqGM:AQST

Aquestive Therapeutics, Inc.'s (NASDAQ:AQST) Shares Climb 30% But Its Business Is Yet to Catch Up

Aquestive Therapeutics, Inc. (NASDAQ:AQST) shares have continued their recent momentum with a 30% gain in the last month alone. The last 30 days were the cherry on top of the stock's 316% gain in the last year, which is nothing short of spectacular.

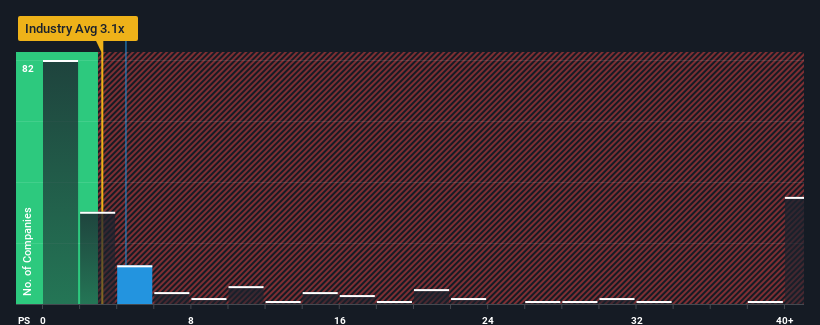

After such a large jump in price, Aquestive Therapeutics may be sending bearish signals at the moment with its price-to-sales (or "P/S") ratio of 4.4x, since almost half of all companies in the Pharmaceuticals in the United States have P/S ratios under 3.1x and even P/S lower than 0.6x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for Aquestive Therapeutics

What Does Aquestive Therapeutics' P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Aquestive Therapeutics' revenue has gone into reverse gear, which is not great. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Aquestive Therapeutics will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Aquestive Therapeutics?

In order to justify its P/S ratio, Aquestive Therapeutics would need to produce impressive growth in excess of the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 13% drop in revenue. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 15% per annum during the coming three years according to the six analysts following the company. That's shaping up to be materially lower than the 49% per year growth forecast for the broader industry.

In light of this, it's alarming that Aquestive Therapeutics' P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

The large bounce in Aquestive Therapeutics' shares has lifted the company's P/S handsomely. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Aquestive Therapeutics, this doesn't appear to be impacting the P/S in the slightest. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. At these price levels, investors should remain cautious, particularly if things don't improve.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Aquestive Therapeutics (of which 1 is a bit unpleasant!) you should know about.

If these risks are making you reconsider your opinion on Aquestive Therapeutics, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Aquestive Therapeutics, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:AQST

Aquestive Therapeutics

Operates as a pharmaceutical company in the United States and internationally.

Good value with limited growth.

Similar Companies

Market Insights

Community Narratives