- United States

- /

- Media

- /

- NYSE:MNTN

Exploring 3 High Growth Tech Stocks In The US Market

Reviewed by Simply Wall St

The United States market has recently experienced mixed performances, with the Dow Jones Industrial Average declining for two consecutive days while technology shares have shown signs of rebounding. Amidst these fluctuations, investors are paying close attention to high-growth tech stocks, which can offer potential opportunities due to their innovative capabilities and adaptability in a rapidly evolving economic landscape.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| ADMA Biologics | 20.01% | 24.80% | ★★★★★☆ |

| Exelixis | 10.68% | 20.92% | ★★★★★☆ |

| Palantir Technologies | 26.87% | 29.45% | ★★★★★★ |

| Workday | 11.19% | 32.11% | ★★★★★☆ |

| Circle Internet Group | 26.50% | 88.24% | ★★★★★☆ |

| RenovoRx | 65.52% | 68.63% | ★★★★★☆ |

| Gorilla Technology Group | 32.75% | 122.61% | ★★★★★☆ |

| OS Therapies | 56.64% | 68.61% | ★★★★★☆ |

| Zscaler | 15.72% | 40.94% | ★★★★★☆ |

| Procore Technologies | 11.61% | 114.49% | ★★★★★☆ |

Click here to see the full list of 73 stocks from our US High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Allot (ALLT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Allot Ltd. is a company that develops, sells, and markets network intelligence and security solutions across various regions including Israel, Europe, Asia, Oceania, the Americas, the Middle East, and Africa with a market cap of $426.44 million.

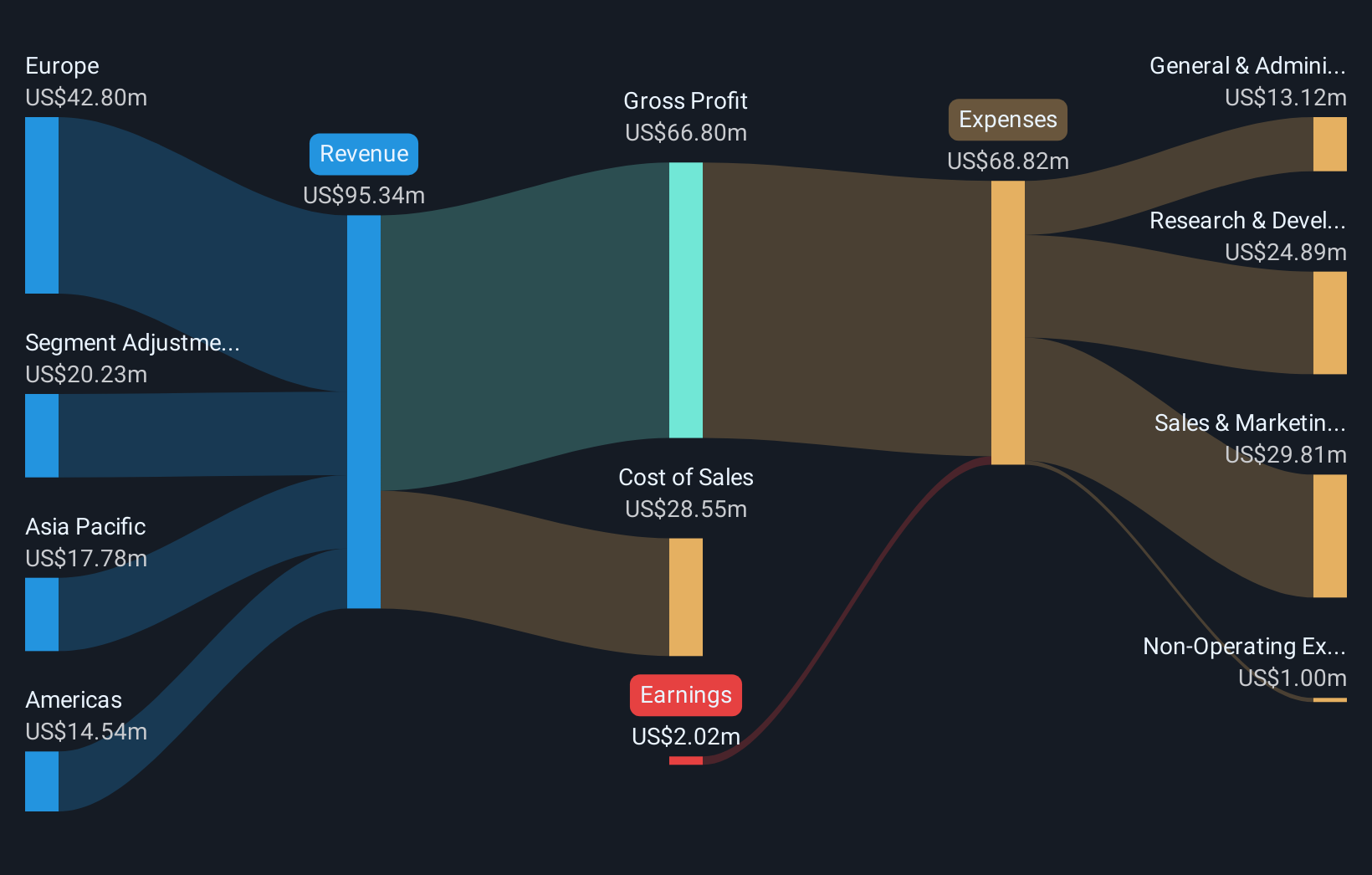

Operations: The company generates revenue primarily from its optical networking equipment segment, amounting to $95.34 million. With a market cap of $426.44 million, it operates across multiple regions including Israel, Europe, Asia, and the Americas.

Allot's recent strategic moves, including a significant shift in its board structure and proactive revenue guidance for 2025, signal a robust alignment towards streamlined governance and financial clarity. With an expected annual revenue growth rate of 11.1%, slightly above the US market average of 10.4%, Allot is positioning itself as a competitive player in the tech sector despite current unprofitability. The company's R&D focus, crucial for innovation in tech, remains aggressive with plans to turn profitable within three years, underpinned by an earnings forecast growth of 56.15% per year. These developments suggest Allot is navigating its challenges with strategic foresight, aiming to leverage its enhanced corporate structure and market adaptations for future profitability.

- Delve into the full analysis health report here for a deeper understanding of Allot.

Assess Allot's past performance with our detailed historical performance reports.

Annexon (ANNX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Annexon, Inc. is a clinical-stage biopharmaceutical company focused on discovering and developing medicines for treating inflammatory-related diseases, with a market cap of $339.76 million.

Operations: Annexon, Inc. engages in the discovery and development of treatments for inflammatory-related diseases as a clinical-stage biopharmaceutical entity. The company currently does not report any revenue streams, indicating its focus remains on research and development activities rather than commercial sales at this stage.

Amidst a challenging landscape, Annexon stands out with its aggressive pursuit of growth, evidenced by a projected revenue increase of 73% annually. This figure notably surpasses the U.S. market average growth rate of 10.4%. Despite current unprofitability, the company's strategic initiatives, including recent follow-on equity offerings raising nearly $75 million, underscore its commitment to scaling operations and fueling its R&D endeavors. With earnings expected to grow by 54.14% per year, Annexon is strategically positioning itself for profitability within the next three years, aligning with industry expectations for significant advancements in biotech innovation and therapeutic development.

- Dive into the specifics of Annexon here with our thorough health report.

Gain insights into Annexon's historical performance by reviewing our past performance report.

MNTN (MNTN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MNTN, Inc. operates a technology platform focused on performance marketing for Connected TV and has a market cap of $1.04 billion.

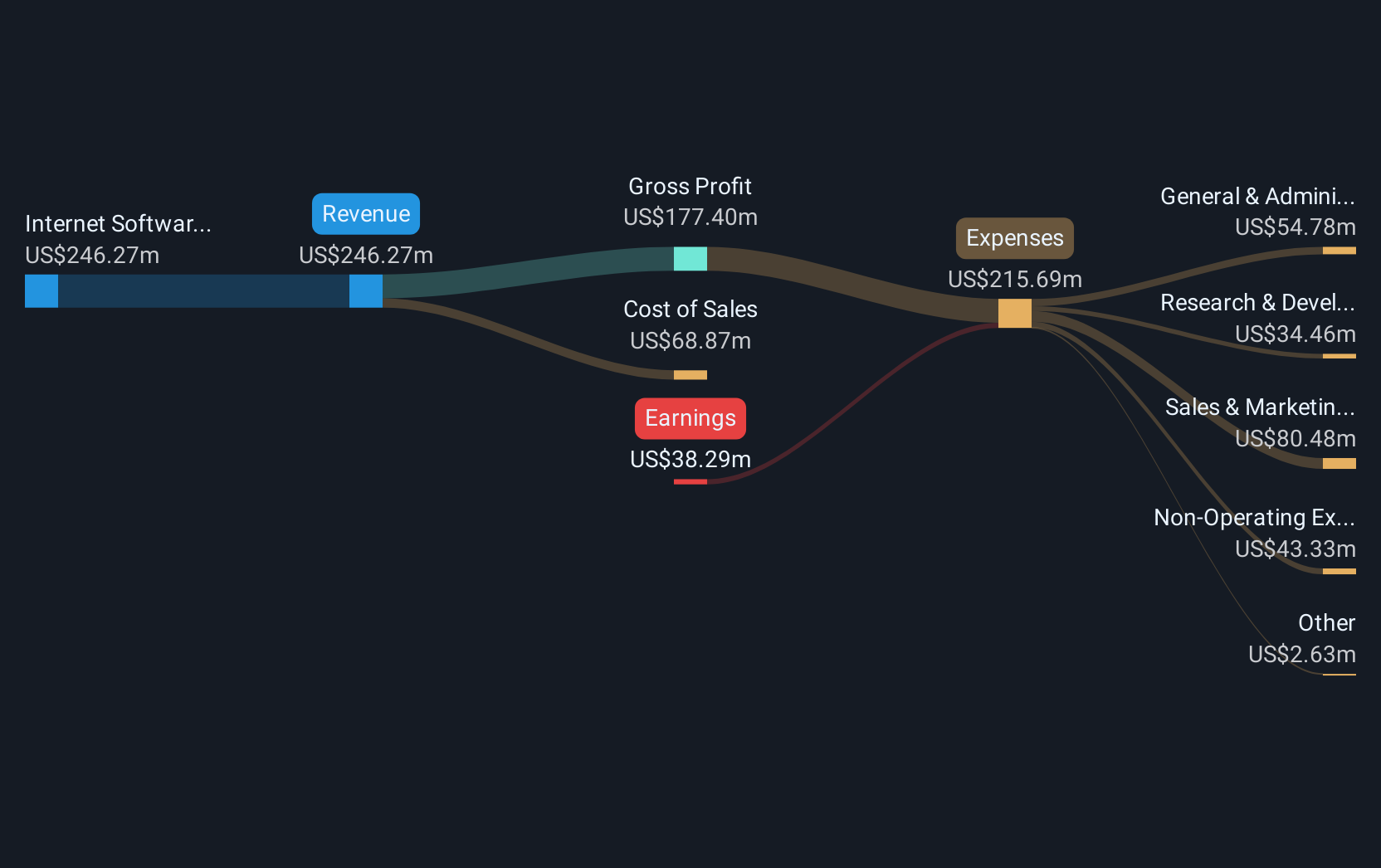

Operations: The company generates revenue of $272.81 million from its Internet Software & Services segment. It focuses on leveraging technology to enhance performance marketing within the Connected TV space.

MNTN's recent performance showcases a significant turnaround with Q3 sales jumping to $70.02 million from $57.13 million the previous year, and a shift from a net loss to a profit of $6.44 million. This pivot is underscored by their innovative QuickFrame AI, which revolutionizes ad creation by integrating advanced AI technologies for rapid, studio-quality production, enhancing MNTN's appeal in the competitive advertising technology sector. Moreover, strategic partnerships like those with Haus and PubMatic are expanding MNTN’s footprint in Connected TV (CTV), promising further market penetration and revenue streams as evidenced by projected Q4 revenues up to $86.5 million—a 34% increase year-over-year at midpoint estimates excluding divestitures—highlighting its potential amidst rising CTV demand expected to reach $36.87 billion this year alone.

- Unlock comprehensive insights into our analysis of MNTN stock in this health report.

Explore historical data to track MNTN's performance over time in our Past section.

Taking Advantage

- Navigate through the entire inventory of 73 US High Growth Tech and AI Stocks here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MNTN

MNTN

Operates a technology platform that brings performance marketing to Connected TV.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives