- United States

- /

- Biotech

- /

- NasdaqGS:ANIK

Strong week for Anika Therapeutics (NASDAQ:ANIK) shareholders doesn't alleviate pain of five-year loss

Anika Therapeutics, Inc. (NASDAQ:ANIK) shareholders should be happy to see the share price up 14% in the last month. But that doesn't change the fact that the returns over the last five years have been less than pleasing. After all, the share price is down 41% in that time, significantly under-performing the market.

Although the past week has been more reassuring for shareholders, they're still in the red over the last five years, so let's see if the underlying business has been responsible for the decline.

See our latest analysis for Anika Therapeutics

Given that Anika Therapeutics didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over five years, Anika Therapeutics grew its revenue at 9.4% per year. That's a pretty good rate for a long time period. Shareholders have seen the share price fall at 7% per year, for five years: a poor performance. Clearly, the expectations from back then have not been satisfied. The lesson is that if you buy shares in a money losing company you could end up losing money.

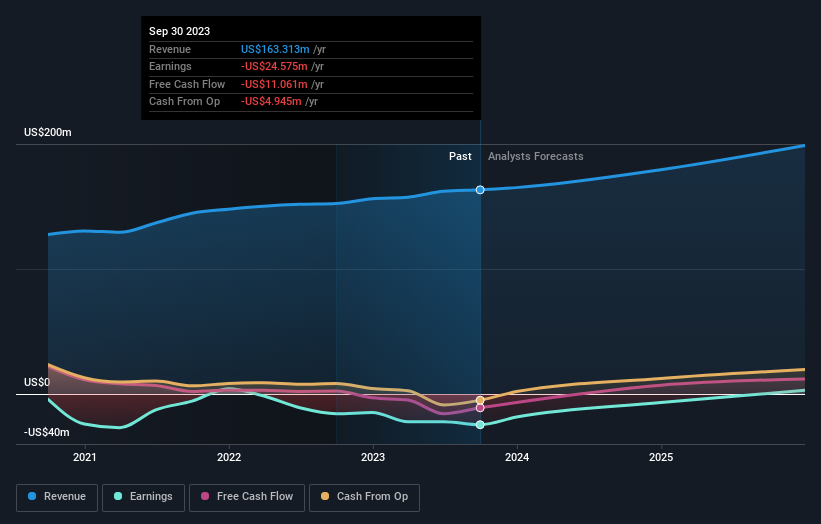

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

While the broader market gained around 16% in the last year, Anika Therapeutics shareholders lost 28%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 7% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ANIK

Anika Therapeutics

A joint preservation company, creates and delivers advancements in early intervention orthopedic care in the areas of osteoarthritis (OA) pain management, regenerative solutions, sports medicine, and arthrosurface joint solutions in the United States, Europe, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives