- United States

- /

- Biotech

- /

- NasdaqGS:ANIK

Companies Like Anika Therapeutics (NASDAQ:ANIK) Can Afford To Invest In Growth

Just because a business does not make any money, does not mean that the stock will go down. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

So should Anika Therapeutics (NASDAQ:ANIK) shareholders be worried about its cash burn? For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

See our latest analysis for Anika Therapeutics

When Might Anika Therapeutics Run Out Of Money?

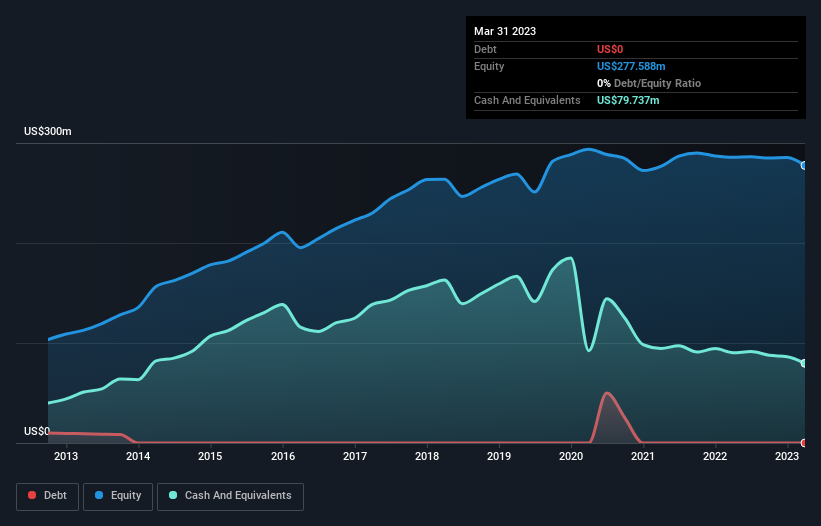

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. As at March 2023, Anika Therapeutics had cash of US$80m and no debt. Importantly, its cash burn was US$4.9m over the trailing twelve months. That means it had a cash runway of very many years as of March 2023. Importantly, though, analysts think that Anika Therapeutics will reach cashflow breakeven before then. In that case, it may never reach the end of its cash runway. The image below shows how its cash balance has been changing over the last few years.

Is Anika Therapeutics' Revenue Growing?

We're hesitant to extrapolate on the recent trend to assess its cash burn, because Anika Therapeutics actually had positive free cash flow last year, so operating revenue growth is probably our best bet to measure, right now. Although it's hardly brilliant growth, it's good to see the company grew revenue by 4.8% in the last year. While the past is always worth studying, it is the future that matters most of all. So you might want to take a peek at how much the company is expected to grow in the next few years.

How Easily Can Anika Therapeutics Raise Cash?

While Anika Therapeutics is showing solid revenue growth, it's still worth considering how easily it could raise more cash, even just to fuel faster growth. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Commonly, a business will sell new shares in itself to raise cash and drive growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Anika Therapeutics has a market capitalisation of US$330m and burnt through US$4.9m last year, which is 1.5% of the company's market value. That means it could easily issue a few shares to fund more growth, and might well be in a position to borrow cheaply.

So, Should We Worry About Anika Therapeutics' Cash Burn?

It may already be apparent to you that we're relatively comfortable with the way Anika Therapeutics is burning through its cash. For example, we think its cash runway suggests that the company is on a good path. On this analysis its revenue growth was its weakest feature, but we are not concerned about it. There's no doubt that shareholders can take a lot of heart from the fact that analysts are forecasting it will reach breakeven before too long. After considering a range of factors in this article, we're pretty relaxed about its cash burn, since the company seems to be in a good position to continue to fund its growth. While we always like to monitor cash burn for early stage companies, qualitative factors such as the CEO pay can also shed light on the situation. Click here to see free what the Anika Therapeutics CEO is paid..

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

If you're looking to trade Anika Therapeutics, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ANIK

Anika Therapeutics

A joint preservation company, creates and delivers advancements in early intervention orthopedic care in the areas of osteoarthritis (OA) pain management, regenerative solutions, sports medicine, and arthrosurface joint solutions in the United States, Europe, and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives